The growth of mutual funds is one of the most important developments in India’s financial market. During the last decade, mutual funds have become an important investment vehicle for investors, both individual as well as institutional investors like EPFO.

As financial savings in India are increasing, mutual funds appear to be a key beneficiary as well as a contributor to this phenomenon. As on March 2022, the assets under management (AUM) of mutual funds stood at ₹37,56,682.56 crore.

From the days of Unit Trust of India to the present times of dominance of bank-affiliated mutual funds, the industry structure of mutual funds has evolved significantly. From 1964 until late 1980s, UTI was the only player. From then on, banks, corporates, financial institutions and insurance companies entered the mutual fund space.

Mutual fund investing provides many benefits, the key one being diversification. The others include reduction in transaction costs and sharing of liquidity risk. On the surface, mutual funds appear to be a simple product. These financial intermediaries pool funds and invest them on behalf of the investors as per the objectives of the fund. Though simple in concept, the value chain of mutual fund comprises a cluster of services (see graphic).

All these activities are sources of value creation. Some of the activities are standardised and there is not much scope for differentiation. Securities selection, marketing and distribution are the areas where major scope for differentiation exists. A surface level investigation into the performances of the schemes and AUMs reveal that investors are not necessarily chasing funds with superior performance.

Funds with larger AUMs are not the ones beating the benchmarks at varying time horizons. Marketing and distribution appear to be a key component of the value chain. An enquiry into the manner investors choose mutual funds shows that mutual funds in India still remain a push product.

Mutual fund distribution network appears to crucial and influences the AUM in a big way. Many well-performing funds seem unable to garner large AUMs due to lack of distribution network. Distribution network has a significant fixed cost component, and bank-affiliated mutual funds appear to have a significant advantage over others.

Investment decisions

Investors base their decisions based on information arising from two sources — interpersonal and impersonal. Interpersonal information can be further be classified into informal sources like family, friends, peers, colleagues etc., and formal sources like distributors and advisors.

Impersonal sources include advertisement and direct reaching out by fund management companies. The primary channels of mutual fund product distribution in India are banks, local and national distributors and fund advisors.

In the case of formal interpersonal sources like distributors, bank-affiliated mutual funds appear to be at an advantage. These funds have access to the wide branch networks of banks. The brand recall of bank-affiliated funds is stronger. These advantages are quite visible in the growth of AUM of bank-affiliated funds. In the last two decades, there has been a clear shift towards the dominance of bank-affiliated mutual funds.

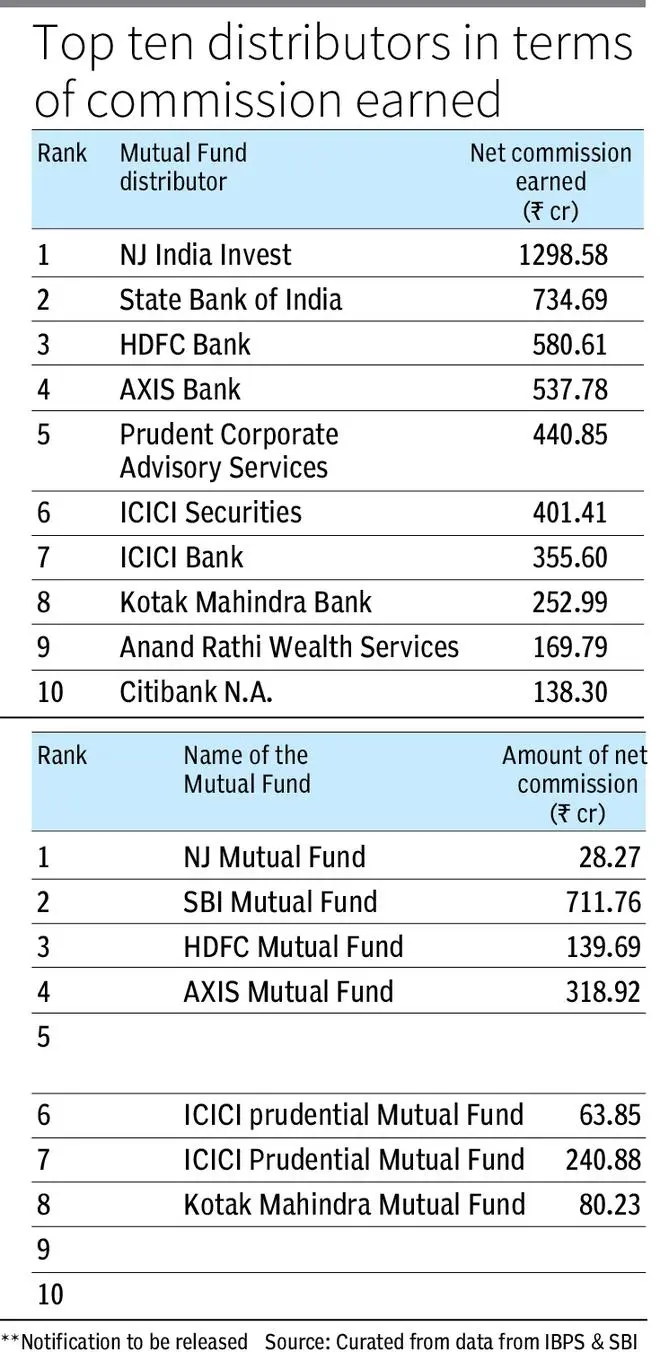

The Table shows the top 10 distributors in terms of commission earned and the name of the mutual fund paying those commissions. The largest mutual fund by AUM, SBI Mutual Fund, has paid ₹1,371.83 crore by way of net commission to its distributors. The biggest beneficiary of the same is SBI. These inherent incentives are possibly influencing the way and the kind of mutual fund products sold to investors.

It is quite possible that if you are buying funds from your bank, you are sold products of the mutual fund your bank has affiliation with.

The writer is Professor and Dean (Academics), National Institute of Securities Markets

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.