There are reasons to believe that monetary policy formulation is based on theory, but divorced from an understanding of ground realities that impact growth. The authorities need to delve more deeply into why cash intensity in the economy has persisted despite policy efforts in recent times to promote less cash use(digitisation, formalisation through GST and demonetisation of high currency notes).

The RBI’s liquidity management function has gone awry, with its estimates of demand for cash not in sync with the emerging realities.

Currency demand

Income elasticity of currency demand is closer to unity across the RBI’s currency demand models. This is expected to decline with a surge in multi-channel digital payments (cashless online payments), digitisation of direct benefit transfers and demonetisation-led formalisation of high denomination notes (HDNs) via bank deposits and restrictions on cash transactions.

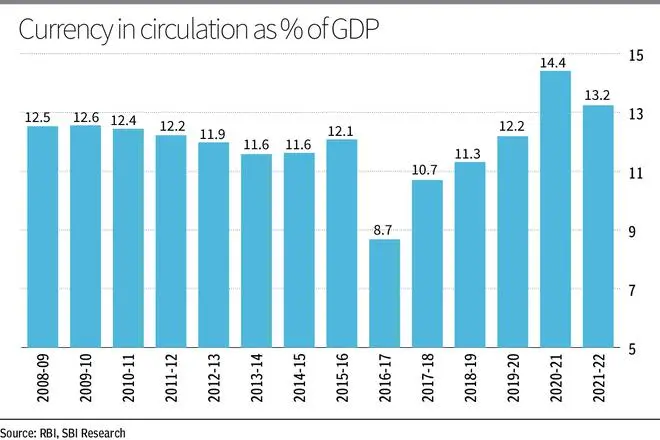

However, actual pace of expansion of currency with public (CwP) since mid-2000s, remains above the trend. The pace even got accelerated to record levels during the last four years ending FY2022 despite moderate nominal GDP growth and exponentially growing digital payments. Accelerated cash intensity is borne out by SBI’s November 3 Ecowrap, which shows an increase in currency in circulation (CwP plus cash held by banks) as a percentage of GDP post-demonetisation.

The incremental currency growth during these four years even surpassed the CwP stock at end-March 2014. The factors neutralising the drives to reduce the demand for cash include: under-invoiced and illicit Chinese imports plus higher cash holdback by businesses due to systemic disruptions in trade credit flows (TC) in the recent years.

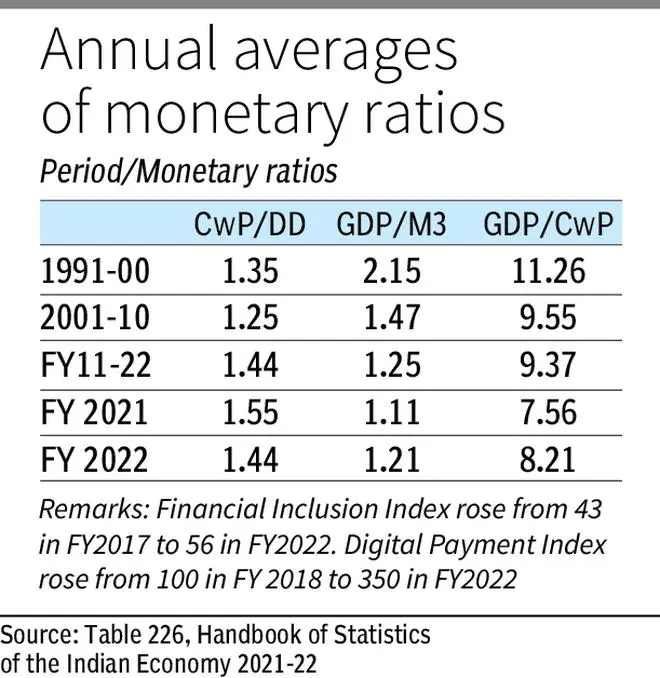

Rising cash intensity is reflected in a steady decline in decadal average income velocity of CwP and M3 (broad money) over the last two decades. GDP/CwP and GDP/M 3 ratios declined from 11.26 and 2.15 in 1990s, respectively, to 9.37 and 1.25 respectively during FY2011-22. These ratios touched a record low in FY 2021.

Further, higher CwP/demand deposit (DD) ratio during FY2011-22 compared to 2000s show rising cash holding by public. There is marginal improvement in these ratios during FY 2022 compared to FY 2021 as FY 2021 was abnormal year when GDP declined . Given the situation on the ground, it is unlikely, despite the growth in digital payments, that the demand for cash will fall as steeply as policymakers anticipate.

Missing variables

The rising demand for cash seems counter-intuitive. An analysis of the financing modes of millions of day-to-day business transactions show two distinct variables contributing to the abnormal high cash intensity. One is need for cash to finance under-invoiced or illicit portion of imports, mainly from China which rose steadily since mid-2000s.

Ample evidence to support this argument is found in various reports of Directorate of Revenue Intelligence, 145th Parliamentary Standing Committee on Commerce Report (Impact of Chinese Goods on Indian Industry, 2018), Global Financial Integrity, Washington and Special Investigation Report to the Supreme Court (2015). According to media reports, customs authorities have issued notices to 32 importers in September for alleged tax evasion of ₹16,000 crore through under-invoicing from April 2019 to December 2020.

This is just the tip of the iceberg. Discrepancies have been found between trade data sourced from the two countries, with invoiced imports being less than exports to India from China in the latter’s books.

The second variable is the negative trade credit (TC) conditions. This pushes-up higher liquidity holdback by firms and reduces TC flows and its average repayment speed. Lower TC velocity pushes-up cash-intensity. Liquidity is held back and velocity of money drops. TC crisis has been triggered by a string of events starting from demonetisation, followed by GST and Covid waves.

These led to trust and confidence contagion in the TC ecosystem which spur a strong preference for cash sales. History shows that the repayment behaviour, risk perception, business trust and liquidity conditions can change dramatically during period of volatility. RBI’s monetary analysis overlooks the two ground-level variables.

There was a sudden drop in repayment flows and consequent decline in millions of day-to-day TC-based transactions following demonetisation. Subsequently, teething issues in GST, loss of flexibility in mixed-use of informal and formal business funds and credit in financing business transactions reinforced disruptions in TC network. Before this fluid situation could stabilise, the Covid struck in repeated waves, hurting business operations. Fragility of TC was amplified with these chaotic developments.

These not only impacted the ability to repay but more crucially the willingness to repay in many cases. The weakening of business conventions have impacted payment behaviour. These drive more liquidity-holdback and strong preference for cash sales. Hence, the record low money velocity and rising cash-intensity in recent years.

Ground reality

Policies can go wrong when ground realities are ignored. An example is the demonetisation in FY2017. It was aimed at flushing out black money in the form of HDNs — ₹500 and ₹1,000. CAGR of HDNs was 24 per cent during FY2001-16. The key causal factor for this is the need for cash in financing of steadily growing under-invoiced and illicit imports.

A very large part of such cash circulation is thinly spread across household, trading-network and manufacturing units as the Chinese imports pervade our non-food consumption basket, trade and manufacturing structure. I

t was difficult to identify such thinly spread black money even as almost all HDNs were deposited in banks’ KYC compliant accounts during demonetisation.

Demonetisation resulted in high socio-economic cost, and was followed by a return to higher cash intensity. A better strategy would have been to check and control such imports at their entry point at ports. This could have worked better in curbing black money.

The writer is former DGM, SIDBI

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.