The optimism and bullishness that India Inc enjoyed on the bourses are set to be tested in the upcoming March quarter (Q4) results.

For the first time in almost two years, analysts are trimming their expectations on listed companies.

According to those polled on Bloomberg, Nifty50 earnings per share (EPS) for the Q4 FY22 results have been revised downwards by about once per cent and that for the June 2022 quarter (Q1FY23) by 8.9 per cent.

The downgrades primarily are on account of mounting input cost pressures, which is bound to hurt India Inc’s operating profits. This could well be a precursor for further cuts if the outlook on input costs projected by companies in the Q4 earnings commentary is worse than what has been factored in.

Dhananjay Sinha , Head of Research, JM Financial, believes there is a fairly high chance of an at least 20 per cent decline in earnings growth estimates over the next 12-24 months.

Sectors to be hit

Auto, consumer staples and durables, non-banking finance companies, cement and sectors where derivatives of crude oil find use such as paints and chemicals are bearing the brunt of EPS downgrades.

Operating margins hit a seven-quarter low 22.5 per cent (excluding financials, metals and oil and gas) in Q3 and the recent increase in metal and crude oil prices is set to further jack up the raw material cost by 300 to 500 basis points as per analyst estimates, which could imply a shrinkage in operating profit margins of these companies.

On the other hand, pockets such as banks, IT, healthcare, metals and oil and gas are poised for stronger EPS growth compared to a year-ago.

Being commodity players, metals and oil and gas space are is said to benefit from the steep increase in prices.

Currency volatility is a positive for the IT sector, while easing asset quality pressures should help banks, though one needs to watch out for the impact of the rising bond yields.

Brokerage action

Foreign portfolio investors remain net sellers of India stocks. However, just a handful of foreign brokerages have altered their stance on India (though not reduced their expectations significantly) post the Ukraine-Russia crisis.

Credit Suisse has tactically downgraded India from ‘outperform’ to ‘underperform’, due to concerns on higher oil prices and the impact of increased sensitivity to Fed rate hikes on the markets.

“If Brent crude remained at $120 a barrel, India’s current account would weaken by almost 3 per cent of GDP,” notes Neelkanth Mishra , India Strategist, Credit Suisse .

While he isn’t concerned about India’s traditionally expensive valuations, “India’s premium could magnify losses in a negative scenario,” he points out, adding that the EPS momentum is no longer a clear positive for India.

BofA Securities also has a similar outlook, though it believes that downgrade risk is high in mid- and small-cap stocks compared to stocks in Nifty basket.

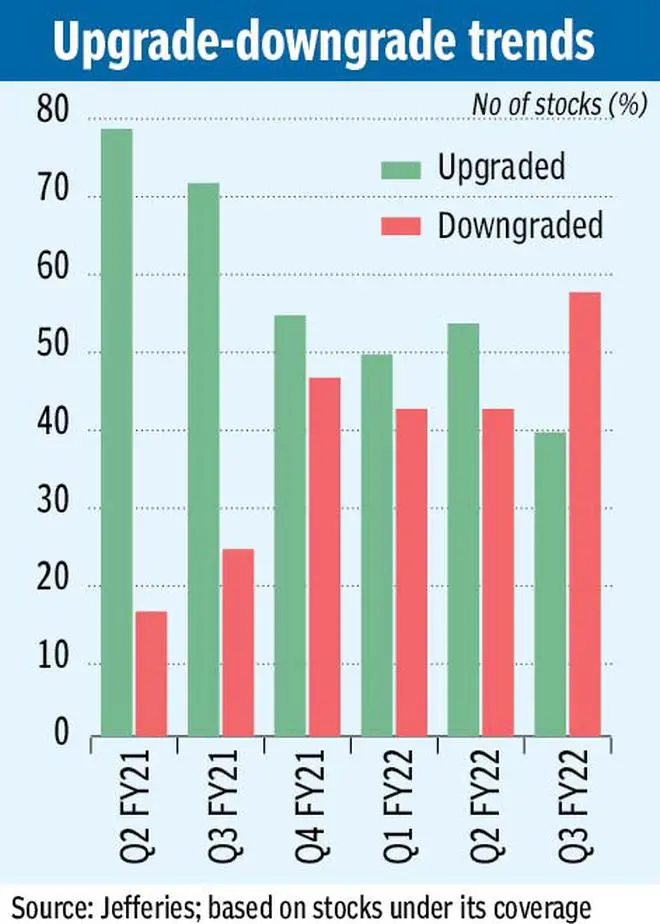

Jefferies notes that post Q3 results, 57 per cent of companies under its coverage saw earnings downgrade, which is the highest in seven quarters, while only 39 per cent companies saw an upgrade in expectations for FY22 – essentially suggesting that Q4 EPS growth may lag that of past quarters.

For now, Morgan Stanley is the only brokerage to trim its base case December 2022 Sensex target to 62,000 points from 70,000 points earlier, factoring for eight per cent reduction in FY23 EPS estimates.

It also expects the pace of earnings compounding to shrink from 24 per cent year-on-year seen previously to 22 per cent in the next two years. While these reductions may not alter the picture much, seen against the context that foreign brokerages had tall expectations from India Inc despite the pandemic, the current phase of downgrade may be interpreted as an indicator of waning optimism.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.