The past year saw the stock markets take a fundamental reality check, after the liquidity and sentiment-fuelled boom of 2020 and 2021. Some of the best performing stocks and sectors of 2021 turned out to be the worst performers of 2022. This includes information technology companies, new-age tech companies and low quality mid/small-cap companies.

The Nifty 50 ended the year up by 4 per cent. This may appear reasonable if one compares it with the rout in global markets. But the returns are disappointing when seen against the bullish expectations at the start of 2022 and the fact that low-risk, tension-free fixed income investments gave better returns. Overall, this year very much belonged to the tortoise, with the hare taking a nap.

Related Stories

Debt outlook for 2023

Where should fixed-income investors park their money in 2023?What lies ahead?

While the market adjustments of the past year may appear to have addressed valuation froth, this may not be entirely done yet. The changed dynamics indicate that investors must continue to remain cautious.

Scope for de-rating: The Nifty 50 defied all sceptics with its resilience amidst a spate of challenges that materialised last year. But the challenges have not wholly abated.

The trajectory of domestic as well as global inflation remains uncertain, some cooling in recent months notwithstanding. Domestic and global central banks continue to have a hawkish tilt, indicating that interest rates will remain higher for longer. As long as this headwind remains, equity valuations will continue to get tested.

At the start of 2022, the Nifty 50 was trading at a one-year forward PE of around 21 times. Fast forward by a year, and the Nifty 50 is trading at around the same levels — ie 21 times CY23 consensus EPS. While this might indicate valuation has been static, equity valuation is always a relative measure that has to be stacked up against returns on risk-free instruments. A year ago, the 10-year government bond in India, the lowest risk instrument, yielded 6.47 per cent — now the same bond can earn you a yield of 7.3 per cent. This sets a higher bar on equity returns, making a case for lower valuations. The risk-free yields in international markets have shot up even more, making emerging market stocks less attractive for foreign investors. For example, the US 10-year treasury now yields 3.87 per cent as against 1.51 per cent same time last year. The rise in yields has also made cost of capital more expensive and raising the hurdle return one expects from equity investments.

Related Stories

Big Story: Gold to hit $2,000

Positive factors are expected to outweigh the negative onesEconomic uncertainty too has shot up quite significantly. Developed market central banks seem to be on the warpath to keep interest rates high till inflation reduces substantially or unless something breaks in the economy. Recession in developed markets in 2023 and some spillover effects on the Indian economy are a distinct possibility. If this happens, earnings downgrades could follow in 2023. Thus, stocks may end up facing a double whammy of lower valuations and lower earnings growth.

Another factor to note is the consistent track record Indian sell side has had in terms of overestimating earnings. Analysis of data from Bloomberg indicates that, in the last 10 years, the sell side community has overestimated Nifty 50 earnings 8 of those times. This means 80 per cent of the times in the last 10 years, there have been earnings downgrades on an annual basis by 10 per cent or more, from the start to end of the year. This too is a factor to be cautious while assessing valuation based on forward expectations.

Mean reversion: Atime tested phenomenon in stock markets is that prolonged periods of multiple expansion (like in PE ratios) are always followed by multiple contractions. Unless earnings growth compensates for the multiple contraction, returns can be disappointing.

If there are any doubts, one must just look to the US tech stocks’ performance during 2022 after many years of higher valuation multiples and earnings growth. Learning from the pain of US investors, Indian investors may be able to spare themselves the suffering. Mean reversion can happen to valuation multiples as well as to earnings growth.

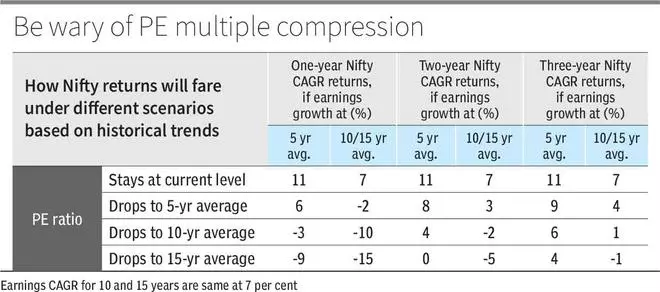

At current 21 times one-year forward PE, Nifty 50 is trading at 5 per cent premium to 5-year average, 15 per cent premium to 10-year average, and 23 per cent premium to its 15-year average. The current earnings growth estimates bake in around 14 per cent growth in CY23 and continuing double-digit growth for the next few years. As against this, data indicates Nifty earnings growth in the last 5, 10 and 15 years has been at a CAGR of 11, 7 and 7 per cent respectively. What will be the returns if these variables were to mean revert? The table provides some idea.

Investor playbook

In our 2022 equities outlook, we had recommended that investors shift their style to test match mode, from T20 mode. We think in 2023, investors must continue to stick to the test match mode, with a rest day in between, like the way test cricket used to be played till the mid 90s. Here is how to play it.

One, follow a conservative asset allocation strategy. Indian investors, irrespective of age group, can consider reducing equity allocations and increasing allocation to debt given the fact that low risk/risk free debt investments are offering decent yields today. Increasing allocation to gold/SGBs can also be considered, to hedge against stock market volatility and the possibility of sticky inflation.

Two, with a unidirectional market no longer a given, investors must be strongly fixated on risk versus reward. Many stocks that were considered good investments in end 2021 lost anywhere between 30 and 70 per cent in 2022. What went wrong there was a proper ‘risk versus reward’ analysis. Buying at high valuations makes the risk-reward unattractive, unless the growth trajectory is strong and discernible.

Three, investors can screen for opportunities in domestic facing industries less impacted by global spillovers (although they too are not immune). We believe reasonably valued financials/banks, agri-commodities, cement, infra and defence stocks still offer potential. Pharma stocks, which have been substantial underperformers in 2022, although they have export exposure, may offer opportunities.

Four, investors must start the year with some allocations to cash/easily deployable liquid investments so that they have dry powder. On a fundamental basis, high valuations and uncertainty indicate that 2023 may see more corrections. While there is no certainty on a correction, allocating some money for this possibility may pay rich dividends.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.