One theme that usually sees a lot of action in days preceding and following the Union Budget is Railways — specifically, the stocks of companies that derive business from Indian Railways. The reason, of course, is that any major proposals or announcements for Indian Railways are generally unveiled as part of the Budget.

However, of late, the ‘Defence’ sector seems to be on a faster track. Defence, the market darling in 2022, is likely be the dominant theme of Budget 2023. Defence is fast emerging as an industry vertical by itself, with several private sector companies focusing on supplies either to the Defence Ministry directly, or to defence PSUs or to foreign governments and foreign MNCs that cater to the defence needs of other countries.

The Indian defence industry has been in the spotlight in the last few years, particularly since 2020, with the stock prices of companies that supply products and services to this industry having grown multi-fold, on the back of robust order book expansion, healthy revenue, and profit growth. The stock of Hindustan Aeronautics Limited (HAL), which is into defence aircraft manufacturing and maintenance, has gained 110 per cent in the last 12 months. Likewise, the stock of Bharat Electronics, which is into design and manufacture of specialised electronic components, has seen 130 per cent jump since the start of 2022.

While the Indian’s government’s flagship Atmanirbhar Bharat programme — which has incentivised certain segments such as drone manufacturing, with schemes such as PLI (production-linked incentive) — has put more emphasis on strengthening the country’s indigenous manufacturing capabilities, intermittent border skirmishes with China and Pakistan and, more significantly, the Russia-Ukraine war crisis have led India to beef up its investment in the defence sector.

The investment is not just to acquire arms, ammunition, and equipment but also to strengthen the country’s capability to build its own defence systems and reduce dependence on other countries. With strategic independence as its key goal, the Indian defence industry is at an inflexion point and is poised for healthy growth in the medium term, for four reasons.

Achieving self-reliance

First, the focus of the Indian government to reduce dependency on Imports and achieve self-reliance by way of increasing domestic production is the biggest growth trigger for companies catering to the Indian defence Industry. Historically, India has been one of the world’s largest importers of arms and ammunition, accounting for almost 11 per cent of the total global arms market.

According to news reports quoting Lt General Shantanu Dayal, Deputy Chief of Army Staff (Capability Development and Sustenance), of the total capital acquisition contracts worth ₹90,000 crore in the last three financial years, about 83 per cent was awarded to Indian companies. The Ministry of Defence has released three positive indigenisation lists in the last two years, first one comprising 101 items notified in August 2020, second list of 108 items in June 2021 and the third one of 101 items in April 2022. These items will be procured only from domestic sources as per the provisions of the Defence Acquisition Procedure (DAP) 2020.

The latest list, released in April 2022, includes highly complex systems, sensors, weapons and ammunition such as like Light Weight Tanks, Mounted Arty Gun Systems and Next Generation Offshore Patrol Vessels (NGOPV). The Indian Army, according to public sources, has, in the last three years, processed 256 industry licences for supplying to the Indian Army, and 366 export licences, from companies looking to supply goods and services to the Indian armed forces.

Increasing capital spend

The second reason for being sanguine on the sector is the significant increase in defence spend by the Government, over the last few years. According to data compiled by the World Bank, India’s total defence spend has increased from $47.2 billion in 2012 to $76.6 billion in 2021, implying an annualised growth of 5.5 per cent. USD depreciation over this period is about 4.6 per cent. This translates into an over 10 per cent annual increase in spend in rupee terms. And In 2021, India, with $76.6 billion, ranked third in terms of its absolute defence spend and accounted for 3.6 per cent of the global spend. The US ($801 billion) ranked first, followed by China ($293 billion), making up 38 per cent and 14 per cent of the global defence expenditure, respectively.

The defence capital outlay has increased from ₹0.95 lakh crore in FY19 to ₹1.39 lakh crore by FY22, implying an impressive 13 per cent annual increase over the last three years. Of this, the Indian Army, Navy, and Air Force accounted for 88 per cent of the total capital outlay in 2022. This has grown at an annualised 12 per cent since FY19, outpacing the overall defence spend.

Ramping up exports

Third, India not only aims to achieve self-sufficiency in defence manufacturing but also looks to capitalise on the large export opportunity available in neighbouring countries, South Asia, West Asia and a few European countries. The Government has an export target of $5 billion in defence by 2025, from about $1.6 billion in 2021-22, driven largely by private players and also micro, small, and medium enterprises.

About 50 companies are currently licensed for defence exports. Major markets for Indian exporters include Italy, Maldives, SriLanka, Russia, France, Nepal, Israel, Mauritius, Egypt, Bhutan, Ethiopia, and the UAE, to name a few.

Several small and mid-sized companies are already catering to the defence needs of other countries. For instance, Paras Defence and Space Technologies, which designs and manufactures critical imaging components such as large space optics and diffractive gratings, serves not only Indian defence PSUs but also multinationals such as Rafael Advanced Defense Systems Ltd and Israel Aeronautics Industries. Several such listed companies are exporting defence goods.

Besides private players, defence PSUs have also been stepping up exports. For instance, Garden Reach Shipbuilders and Engineers, who have largely focussed on Indian Navy business, are eyeing export opportunities as well.

PPP for execution

The fourth reason for our optimism is that defence PSUs have been forging private-public partnerships to ensure speedier execution and also enhance the synergies from the indigenous capabilities. This will help the defence Industry as a whole. It will also be a big positive for companies in this space and will foster stronger partnerships. For instance, In August 2021, Solar Industries’ group company, Economic Explosives Limited manufactured and delivered multi-mode hand grenades, under technology transfer arrangement with Terminal Ballistic Research Lab of DRDO.

The Defence Ministry is fostering innovation and making available technologies such as AI, blockchain and quantum computing, which will aid military decision-making and enhance combat efficiency. For instance, autonomous weapon systems can augment defence strength while data from these systems can be translated into actionable intelligence. The Defence forces — Army, for instance — is collaborating with academia in top-tier institutes such as IIT to develop and deploy new technologies.

While all this bodes well for the country as a whole, what does this mean for Indian companies?

Well, for one, higher indigenisation will help companies in the defence space by way of higher order inflows, which will eventually translate into stronger revenue and profit growth. FY23 saw several defence PSUs report record order book. Hindustan Aeronautics Limited tops the list with a whopping ₹83,858 crore as of September 2022. This is 3.4 times the company’s FY22 reported revenue of ₹24,620 crore. Bharat Electronics Limited (BEL) and Mazagon Dock Shipbuilders with order book of ₹52,795 crore and ₹42,000 crore, share the second and third spot. BEL and Mazagon reported sales of ₹15,368 crore and ₹5733 crore in FY22. The current order book is about 3.4 times and 7.3 times their respective FY22 sales.

But even as order book is impressive and instils confidence on the growth visibility for these companies, the real game is execution that translates into revenues and profits. The pace of execution will have to increase now, given the Government’s vision to make India a global manufacturing hub for defence.

To achieve this, several PSUs have already embarked on partnerships with private players to outsource the non-critical portion of the work. Garden Reach Ship builders and Engineers (GRSE), for instance, with a record order book of over ₹22,930 crore, outsources some basic construction such as ship hull to L&T Shipyard.

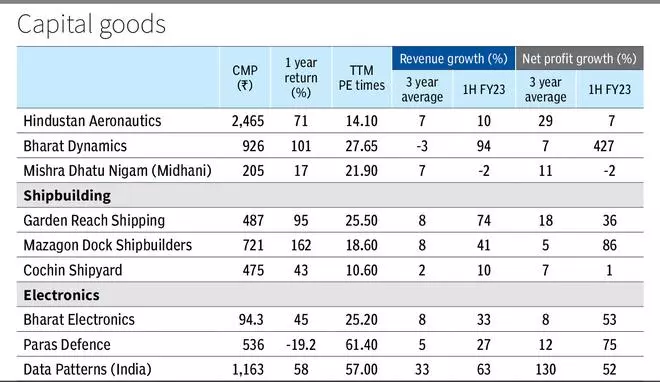

The improved execution track record of these companies is also evident from their financial performance in the current year. The accompanying table highlights how sales and profit growth have accelerated in the first half of FY23, compared to the average growth of the past three years. But for Mishra Dhatu Nigam Limited, all other companies listed in the table have seen their revenue in 1HFY23 surpass the average growth rate in the last three years. In the PSU space, Bharat Dynamics, GRSE and Mazagon posted strong revenue growth of 94 per cent, 74 per cent and 41 per cent year-on-year in the 1HFY23 period. In the private sector, companies such as Zen Technologies (174 per cent) and Data Patterns (India) (63 per cent) have also posted healthy growth.

On the profit front, PSU companies such as Bharat Dynamics, Mazagon and GRSE recorded higher profit growth in the first half of FY23.

Hindustan Aeronautics (HAL) and Midhani have been outliers, posting slower profit growth compared to the last three years, largely due to increased costs. For HAL particularly, the large orders are in mobilisation stage and will translate into revenue beginning FY24.

In the private sector, Zen Technologies, Paras Defence, and Data Patterns (India) have reported exceptional growth in the April-September 2022 period with profit growth of 1,698 per cent, 75 per cent and 52 per cent, respectively.

Outlook

The growth visibility remains strong for companies in this space with double-digit sales and profit. HAL, though it has the highest order book, has seen a moderation in the revenue growth pace this year, as large orders were already executed. However, with several large orders expected to conclude over the next few months, management expects 10-12 per cent annualised growth to continue over the next two years. .

Bharat Dynamics, which is into manufacturing of missiles, is expected to grow revenue and profit by over 20 per cent over the next two years. Similarly, shipyard companies such as Mazagon, GRSE and Cochin Shipyard, with a healthy order book, are expected to sustain healthy double-digit profit and revenue growth over the next two years. There is also significant room for margin improvement for Mazagon and GRSE, given the large order book and good visibility, and depressed margins in the past.

In the current high interest rate regime, defence PSU companies with strong balance sheet, negligible debt and improved cash flow generation as executiongains pace, are well-positioned to further boost their return ratios. This will add to the attractiveness of these businesses from an investment perspective. Also, the working capital cycle, which may be currently higher largely due to inventory, will improve as the execution gets better and the turnaround time comes down.

Overall, we believe defence companies to be on a strong footing with good growth visibility. However, execution and ability to sustainably improve turnaround time need to be watched. It may pay to keep tabs on the performance of shipyard companies such as Mazagaon Dock, GRSE and PSUs such as Bharat Electronics and Bharat Dynamics and private players like Data Patterns

Budget expectation

As India seeks to carve a niche for itself as a self-reliant country and as a reliable export partner, there is need to invest more in defence, not just for manufacturing but also to improve research capabilities. In addition to the usual 12-15 per cent higher allocation for defence expenditure, a higher capital outlay and, more importantly, long-term incentive to invest capital into strengthening technological capabilities is the need of the hour. Spurring investment in R&D will help the country develop its proprietary technology platforms, in turn reducing import dependence and saving on forex outgo. It will help realise our vision to become the preferred defence partner for countries across the globe. Also, there is an expectation to bring more defence-related capital goods under PLI scheme as that will spur capex investments on the manufacturing front.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.