Term insurance is simple: Policyholder pays premiums; on death within the policy term, the nominee gets the sum assured and the dependants gain financial security. But the plan demands a committed relationship without expectations of return – if the insured survives the policy term, he or she or the family gets nothing. It is prudent to gather all relevant information beforehand on the background of the insurer, the factors that go into the pricing and the various riders associated with term plans, before committing.

1. Insurer’s background

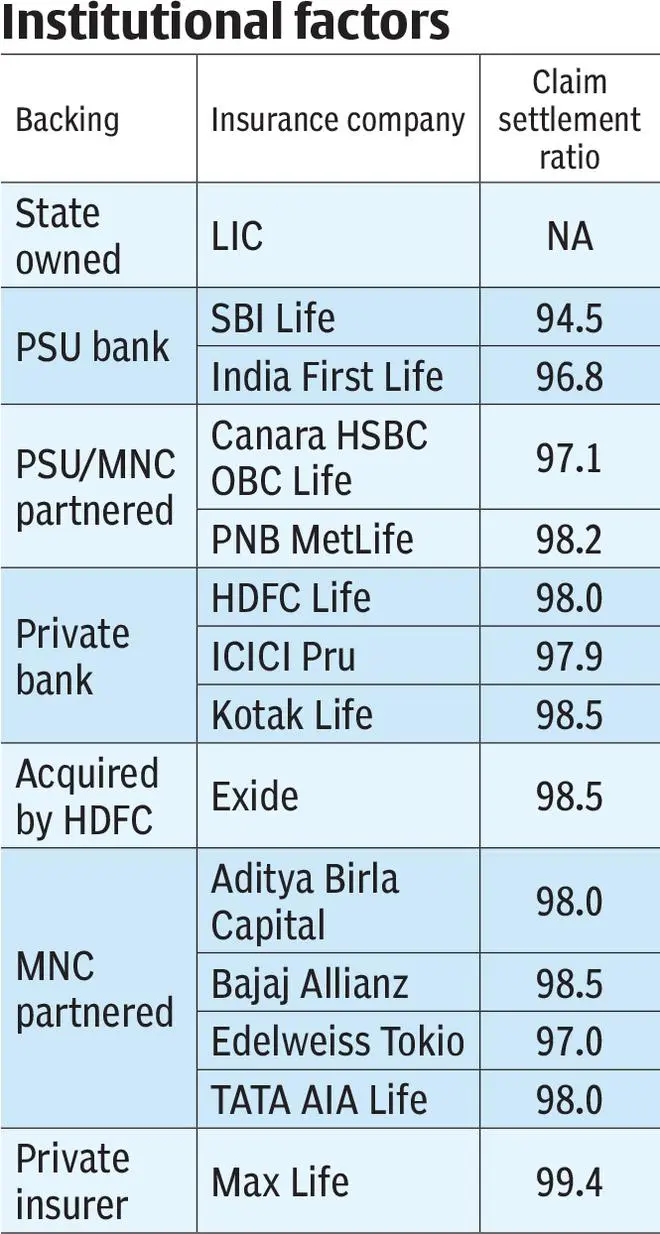

In insurance, scouting for a policy begins with which insurer to go with. The institution should have the wherewithal to process any claim/request many years into the future (1-25 years or more), including the big payout, with minimum risk and no hassles for the policyholder/nominee. However, any financial evaluation of the institution beyond two years, even by experts, is not easy. In such cases, historical institutional background and metrics should be assessed.

LIC is the state-owned insurer that supports a near-sovereign backing and long-term visibility. Insurers backed by public sector banks or public sector insurers such as SBI, PNB (PNB MetLife), India First (promoted by BoB and Union Bank) and Canara Bank (Canara HSBC Oriental) buttress concerns on longevity to an extent. They can draw critical skills of underwriting and risk control from their banking experience. Leading private sector players in life insurance, including HDFC, ICICI (ICICI Prudential) and Kotak Mahindra can also rely on their banking experience.

Indian conglomerates offering life insurance in partnership with multi-national insurers provide r the security of a local anchor and, at the same time, operating know-how of international partners. Aditya Birla with Canada’s Sun Life Financial, Tata with American AIA Group, Bajaj with Germany’s Allianz group, Reliance with Japan’s Nippon and Dabur with Aviva, the British player, are some examples.

However, the advantages that each enjoy can at best be perceptional. A sovereign guarantee doesn’t matter if the claim is rejected on other grounds. Superior underwriting skills cannot guarantee financial solvency and conglomerates can be subject to risks too. The key is that the policyholder should be comfortable with the entity to which he agrees to pay a premium to, for 25-30 years, especially since pricing seems uncorrelated to the group to which the entity belongs (see table).

Policyholder looking for only a (near) sovereign guarantee can look to state-backed units while policyholders interested in a range of evolving service options can look to entities with multinational partnerships.

2. Claim settlement ratio

Claims settlement ratio is the ratio of number of death claims settled against the total number of claims filed. Claim settlement ratios for all insurers start from 94 per cent and do not look bad per se. But at an individual level, the probability of rejection increasing from 0.6 per cent to 5.5 per cent across insurers implies up to 8 times higher chance of a rejection by one player over another. Claims ratio regularly submitted to the regulator IRDAI is very relevant to the policyholder.

With IRDAI tightening claim-processing standards during the Covid period, the average ratio improved from 2018-19 to 2021-21 period - from 97.8 per cent to 98.6 per cent for LIC and from 96.6 per cent to 97 per cent for private insurers.

Amongst the insurers, the claim processing does not have any correlation to either pricing or background grouping mentioned earlier. So, it is possible for a policyholder to exercise his choice based on claim settlement ratio, independent of pricing and other factors.

Claim settlement ratio apart, ease of claim settlement is another factor that has to be considered. Policyholder has to enquire amongst acquaintance, online reviews and other such forums for any legal or other hassles during claim settlement.

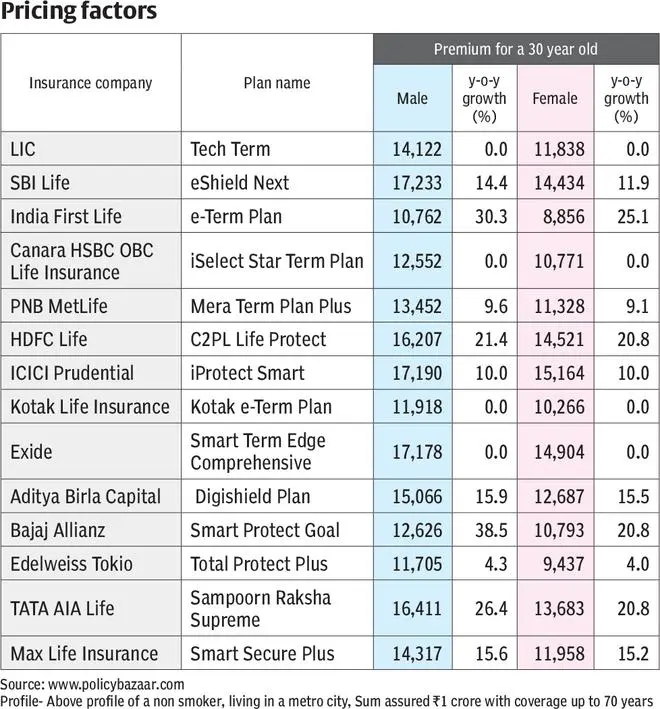

3. Factors influencing pricing

Term insurance is somewhat an undifferentiated service and pricing can be based on how aggressively the companies want to push their product. Reinsurers (insurer to the insurer who accepts a portion of the risk) have increased premiums in the last six months post-Covid and it can be observed that some insurers have passed on the higher prices, while some are still retaining it to increase penetration (see table). But from a customer perspective, pricing is also dependent on individual risk factors and the scope of coverage opted for.

Risk factors

Age and medical condition are the primary factors that can sway pricing. For every year that a policy is not taken, the premium increases by 4-5 per cent across policies. For instance, a term policy for a 30-year-old male, from ICICI Prudential, would cost ₹13,391 (30-year premium paying policy purchased online pre-GST) while the same would cost ₹16,388 for a 35-year-old, all else remaining constant. The biggest pricing impact in term insurance is from lifestyle habit of smoking which can increase the annual premium by 20 per cent. Factors such as education levels can also impact pricing by 3-4 per cent for most policies.

These factors affecting pricing cannot be managed but disclosures of health issues are of crucial importance so as not to face any surprises at the time of claims. Also, the often-repeated mantra in insurance - buy insurance at an early age - is quantifiably demonstrated here.

Scope of coverage

Pricing is also impacted by the scope of coverage chosen. Insurers’ standard offering prescribes the minimum age at which coverage can begin and the maximum age when coverage stops, and policy terminates. Any deviations from the standard offering can impact pricing and would have to be evaluated for the accruing benefit.

Increasing cover is a policy wherein the sum assured increases by 5 per cent every year and is suitable for policyholders who anticipate the need for a higher cover in later years. For instance, India First insurance offers a sum assured on death which starts from ₹1 crore and gradually increases every year to reach ₹2 crore by the end of term. The annual premiums are costlier by 50 per cent compared to non-increasing covers, but over the long term will be 33 per cent cheaper even at minimal 4 per cent inflation of premium. Assuming one opts for ₹1 crore insurance from India First at 30 and then again at 40 for another ₹1 crore (premium inflated by 4 per cent per year), the total of the premiums for the two would be 33 per cent higher compared to taking an increasing cover initially.

Return of premium and coverage up to 100 years of age are also available, but both dilute the essential nature of term insurance. Term insurance is a protection product with no real returns for the policyholder and pricing is reflective of the same. By adding an element of return (of premium), the pricing will increase by an average of 122 per cent across insurers. A simple math would indicate that buying normal term insurance for ₹14,000 and investing a similar amount in any instrument yielding even 4 per cent per year would return the same amount alongside death coverage. Max Life offers return of premium at the same cost if coverage up to age 70 or more is opted for. This could be a useful feature.

Term insurance is aimed at protecting earnings potential and this declines steeply beyond 70 years. Policies that provide coverage up to 100 years might be costlier by 40-80 per cent. The policy is expensive simply because the probability of a payout increases as age goes up, but is spent on providing cover for years when productivity declines.

4. Add-ons offered

Add-ons are purchasable options (for extra cost) that increase the functionality of term insurance by addressing different concerns arising in a policy payment period. Term insurance provides a payout on death, but on the policyholder being afflicted by critical illness during the policy term, certain insurers provide ₹5 lakh for treatment. This add-on costs around ₹2,000 per annum. This option lets your term plan double up as health insurance but is limited in scope. Policyholders must be aware of the list of critical illnesses covered (ranging around 30). A terminal illness is when the policyholder is incapacitated by the illness but ineligible for a payout. This is addressed by a full or a part payment of the complete sum assured which is provided as a free add-on by insurers such as ICICI Lombard, Max Life, PNB MetLife, Canara HSBC and a few others.

Accidental death is covered by the sum assured, but the hospitalisation expenses could eat into a large part of payout that is received later on, if health cover is absent or inadequate. Add-ons addressing this situation provide for an accidental death sum assured of ₹10 lakh, which is over and above the basic sum assured, and costs ₹500-1000 per year for the add-on. HDFC Life offers a comprehensive ₹1-crore additional accidental death benefit, which costs ₹5,841 per year Hospitalisation expenses for accidental disability are covered with a cover of ₹5-10 lakh and the add-on costs around ₹700 per year. Tata AIA covers this risk efficiently with a nominal charge of ₹50 for each accidental death (payout equal to sum assured) or accidental disability (payout of ₹1 lakh) and is suitable for high-risk occupations.

Securing spouse and child is also possible with add-ons. Bajaj Allianz, PNB MetLife and Canara HSBC provide child support benefit amount upon death of the policyholder in addition to the basic sum assured, which is intended to cover for child’s educational expenses. Based on the individual sum assured under this head, the additional cost is in the range of ₹500-2,500 per year. Joint life riders offered by Bajaj Allianz, PNB MetLife and Edelweiss let one provide a cover for the spouse in the same policy. But policyholder needs to clarify whether the sum assured is paid on both lives, first life, and are waivers of premium offered. In most cases, though, separate policy for the lives could be crucial to diversify payout risk.

Overall, policies with increasing cover alongside add-ons for terminal illness and accidental disability seem useful. This is assuming health insurance is covering all illnesses with no add-on covering for personal accident. Family objectives are part of Human Life Value and sum insured itself, but an extra cover may be useful for some.

Human Life Value

Human life value (HLV) is the basic assumption in term insurance and is based on estimating policyholders’ earnings potential and matching it with the policy’s sum assured. Most insurance portals estimate HLV for an individual, but it is also important to understand the process, to purchase the right cover. A person’s HLV is derived based on yearly maintenance requirement, which is net of annual income (expected to grow at a nominal growth rate) and expenses (expected to grow at inflation rate). The annual maintenance is then discounted at the market rate which is reflective of the investment reality. This amount is adjusted with existing liabilities, home or business loans, for instance, to arrive at the individual’s HLV. The HLV may be adjusted with already existing life covers, to estimate current policy needs. It is also important to note that an HLV is only a guide towards the minimum sum assured required. A higher inflation estimate and lower yield expectation will further inflate the HLV towards a conservative estimate.

All these variables undergo a significant change once in a few years, requiring a similar reassessment of term insurance. For instance, a critical point when policyholders re-consider term insurance is when the family grows, or home loans are added. A typical HLV may run into crores for any individual and term insurance is the apt vehicle to create such a cover. A rupee paid towards an average premium would provide death benefit cover of 23 times, compared to a measly 3-4 times in traditional life insurance policy. Term insurance scores in taxation as well, where premium payments qualify for Section 80 C benefits and payout is also tax-free for the nominee.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.