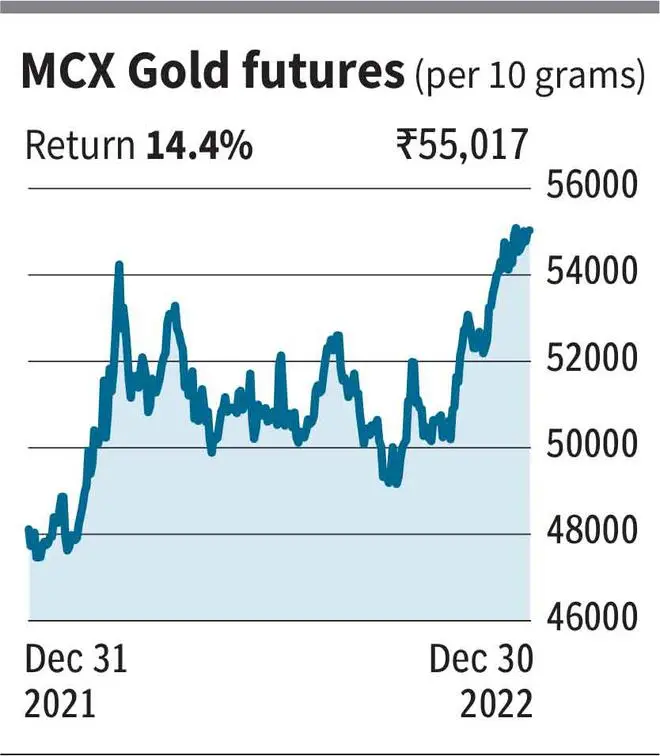

Gold has delivered a diverse performance in 2022. In terms of dollar, the precious metal was largely flat whereas in rupee terms it gained nearly 14 per cent, producing a double-digit gain in three of the last four years. The outperformance in the domestic market was due to depreciation in the rupee against the dollar —the Indian currency lost 11.3 per cent versus the dollar last year.

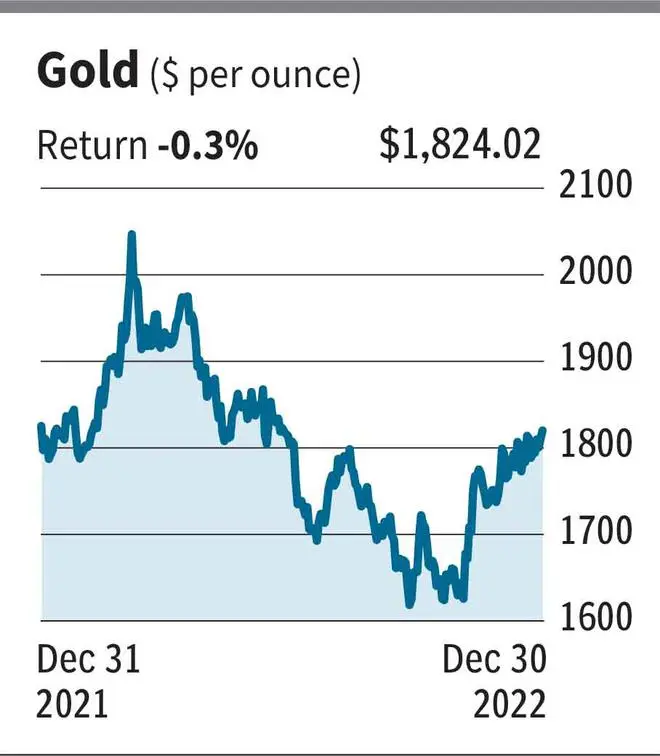

In the international spot market, the yellow metal ended the year at $1824 per ounce. In the domestic market, the gold futures on the Multi Commodity Exchange (MCX) has closed at ₹55,017 per 10 gram.

Related Stories

2023 Equities Outlook: Play it like a test match with a rest day in between

Be wary of scope for multiple compression in valuationsIn our outlook for 2022, we forecast gold to touch $2,075 and ₹56,000 in global and local markets, respectively. These targets were almost achieved in the first quarter itself. In terms of dollar, gold marked a high of $2,070 whereas on the MCX, gold futures (continuous contract) made a high of ₹55,558 in March.

Related Stories

Debt outlook for 2023

Where should fixed-income investors park their money in 2023?Here, we look at the factors that moved gold in 2022 and what is there on the plate for the yellow metal in 2023.

Fed actions held sway

Early last year, gold surged due to the Russia-Ukraine conflict. However, prices did not stay elevated for long and made a U-turn for a couple of reasons.

One, central banks, especially the US Federal Reserve, started hiking rates in March and the pace was more than expected. In 2022, the Fed lifted rates from near zero to 4.5 per cent through the year. This led to the dollar strengthening and a rise in the US Treasury yields.

Two, the global gold ETFs (Exchange Traded Funds) have seen a net outflow of nearly 100 tonnes as on December 16 as per the data from the World Gold Council (WGC).

In addition to this, speculators reduced their net long positions on COMEX from 913 tonnes in March to 236 tonnes in September. However, the net long positions have improved of late, and it stands at 443 tonnes as on December 19.

The negative effect of the above factors outweighed the positive impact from physical demand for the precious metal. The WGC data shows that the total gold demand in the first three quarters (calendar year) of 2022 stood at 3,387 tonnes — the highest for the corresponding period since 2016.

What’s ahead for gold

Positives

Rate hike from the US Fed is set to peak in 2023. According to the latest ‘Economic Projections’ by the Fed, the rate hikes are likely to be capped between 5 and 5.25 per cent in 2023. Thereafter, it is likely to see a downward path. This can weigh on the US dollar and keep it subdued, a positive for gold.

A possible global economic slowdown can push other major central banks as well to ponder cutting rates. In the latest World Economic Outlook by the International Monetary Fund, released in October, the global growth expectations have been revised down to 2.7 per cent, down from 2.9 and 3.6 per cent forecast in July and April respectively. Notably, this is before the Covid BF.7 scare. Such a slowdown might be the key to unleash the gold bulls, which appeared tamed last year despite elevated inflation.

Besides, should the global economy slip into a recession, the sentimental shift can nudge investors to start looking for safety. Historically, gold has done well during times of distress. This, coupled with a possible drop in treasury yields, will make gold very attractive.

Even the central banks stacked up gold on the back of economic uncertainties. They bought nearly 400 tonnes of gold in the third quarter of 2022 — the largest in over a decade. While a large chunk of that purchase is unknown, given their affinity towards the yellow metal, China and Russia are speculated to have bought significant levels. In December, China disclosed an addition of 32 tonnes in November, meaning their reserves have risen for the first time since September 2019.

For the global economy, which already faces risk on the economic front, geo-political tensions could be the other factors to keep the gold prices upbeat in 2023.

Negatives

The risks with respect to gold is inflation peaking, which can remove the necessity of a hedge against rising prices, and the global economy performs a soft landing by avoiding recession. For Indian investors, a depreciating dollar can lift the rupee, leading to less returns in rupee terms. However, over the long term, the rupee is a depreciating currency versus the dollar.

Overall, positive factors are expected to outweigh the negative ones, resulting in a rally in gold prices.

Technical

Gold found good support between $1,620 and $1,640 in October and rebounded to end the year at $1,824 an ounce. The yellow metal has managed to get past the $1,800-mark in spite of some selling pressure towards the end of the year.

The outlook is bullish. We expect gold to touch $2,000 in 2023 with intermediate corrections. If the momentum sustains and $2,000 is surpassed, retesting the all-time high of $2,075 should be easy. The RSI and the MACD on the weekly chart show that the momentum is good at this juncture and indicates more room for rally.

On the other hand, if there is a fall from here, $1,700 is expected to hold well. In the worst case, prices could retest the support band of $1,620-1,640. A fall below $1,620 is less likely in 2023.

In the domestic market, gold futures on the MCX are forecast to hit record highs. In 2023, we anticipate prices to rally past the ₹60,000-mark and potentially appreciate to ₹61,000.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.