Russia invades Ukraine, again!

Now that Putin has gone on the offensive, sanctions are being imposed on Russia by many countries. It has now become very uncertain how the whole narrative is going to pan out.

Well, why do we or why does the entire world need to be concerned about this? That’s because, while a war is certainly bad on humanitarian grounds, there is another critical global economic angle to this saga – Oil.

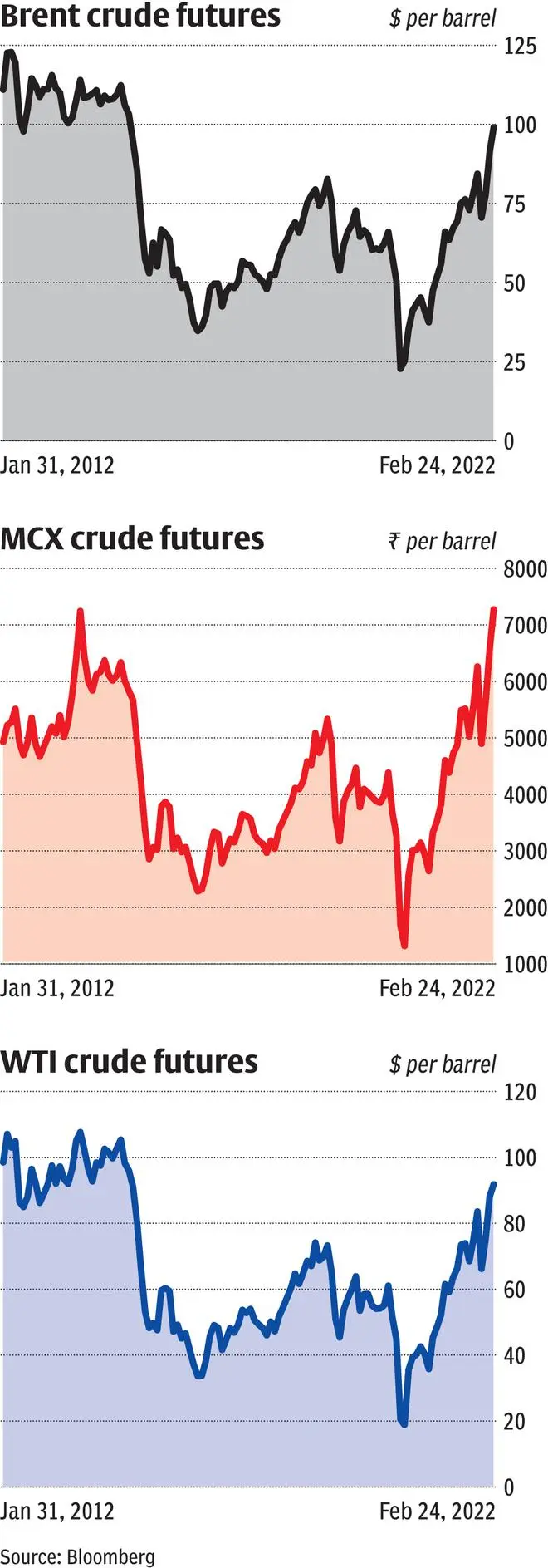

The price of crude oil has been on the rise, post the unprecedented fall triggered by the Covid outbreak, which saw global crude oil price (Brent) falling to as low as $16 a barrel in April 2020. Production cuts undertaken by major producers helped prices recover over the past two years. Already on an upward trajectory, prices got a boost because of the Russia-Ukraine tensions, which started to gain traction in December 2021.

Brent crude, which was at around $70 in November last year, saw a strong rally towards the end of 2021 and posted a gain of about 50 per cent for the year. Last week, Brent crude hit a high of $105.8 and is currently hovering around $100. Sanctions on Russia, the world’s second largest supplier, could be detrimental to the world and to India as well, with India being a big importer of this commodity.

What are the dynamics affecting crude oil prices now and what’s in store? Here’s a lowdown.

OPEC + moves

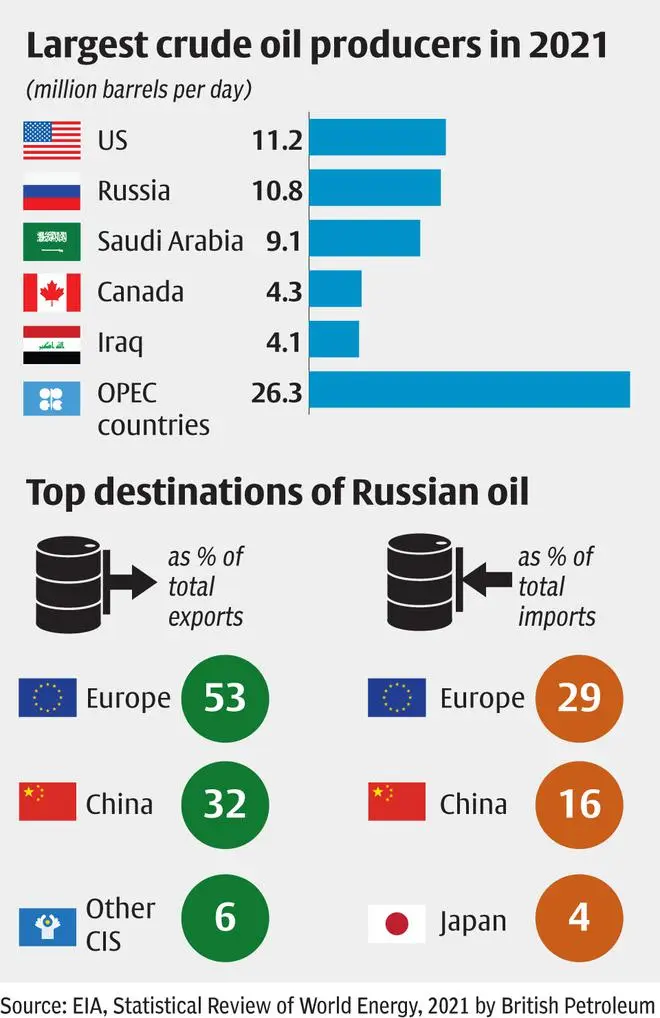

As per 2021 US EIA (Energy Information Administration) statistics, Russia is the second largest producer of crude oil with an output of 10.8 million barrels per day (MMbpd) following the US – the largest with an output over 11 MMbpd. Thus, Russia can significantly impact the supply of the energy commodity. With about 7.4 MMbpd of exports (according to Statistical Review of World Energy, 2021 by British Petroleum), Russia is one of the largest exporters of oil in the world. Europe (imports nearly 4 MMbpd) and China (imports 2 MMbpd) are its major customers.

On Thursday, the European Commission President, Ursula von der Leyen, announced curbs in exporting instruments that are important for oil refining, taking the first step towards targeting the energy sector of Russia. But will there be a blanket ban on Russian oil is still a question. If there is one, it can have a significant impact on the supply-demand dynamics as Europe depends on Russia for about 30 per cent of its requirement. To make up for this, it might have to import more from the US or OPEC+.

Russia’s closeness with the Middle East, especially Saudi Arabia, the third largest producer with an output of nearly 10 MMbpd, makes the matter more critical. The OPEC+ (Organisation of Petroleum Exporting Countries +), which includes OPEC members and several other countries, besides Russia, produces nearly half of the global output. Here, Russia and Saudi Arabia call the shots, providing the former a considerable amount of leverage over the global oil market. So, it is not a forgone conclusion that the OPEC+ will heed the demands of the US and Europe to increase supply to compensate for the possible vacuum created by any sanctions on Russia. At the same time, Saudi Arabia may not be able to resist the international community’s demands beyond a certain point.

Following the oil price crash because of the pandemic, OPEC+ initially announced a production cut of nearly 10 MMbpd in April 2020. While this was lowered to 5.8 MMbpd subsequently, its objective of pushing up the crude price was met. But in August 2021, OPEC+ decided to increase supply as demand started to show good recovery with the easing of lockdown restrictions across the globe. Despite upping the output, demand outstripped supply (by about 1.6 MMbpd) in 2021, the first time since 2017 when the supply deficit was at 0.95 MMbpd.

As it stands, the target now is to continue to increase supply by 4,00,000 barrels per day (bpd) and consequently, by September 2022, this is expected to result in the reversal of the production cut announced in 2020.

However, despite demands from the US to increase the production over and above 400,000 MMbpd, in the latest OPEC+ meet held in early February, it was decided that this level would be largely maintained. Thus, until now the belief among oil majors seems to be that the recent spike in oil prices can be transitory and once the Russia-Ukraine tensions ease, the price could correct considerably.

Iran oil and US shale as buffer

With events still unfolding on the Russia-Ukraine conflict and a lot of geo-political dynamics at play, it is still early days.

The EIA has projected the supply and demand in 2022 to be at 101.4 and 100.6 MMbpd, respectively, leaving a surplus of about 0.8 MMbpd. Considering that Russia exports 7.4 MMbpd, even if China continues to buy despite international sanctions, there can be significant disruptions which could lead to a massive supply deficit. This will have huge implications on the supply side of the equation and an eventual risk of price spiking further. The dynamics can worsen further in case demand overshoots the expected level. But these are extreme cases which no country in the world would want, particularly when inflation is already on the rise across regions. Therefore, the fear of huge supply scarcity, at its worst, can push the price upwards to the historical levels of $115-120.

What can help ease up prices to a certain extent in this scenario is improved supply from Iran as well as shale from the US.

In 2018, the Trump Administration exited from the 2015 nuclear deal, famously called JCPOA (Joint Comprehensive Plan of Action), involving Iran and the Western powers, and imposed sanctions on Iranian oil. This resulted in the production in Iran dropping to 1.96 MMbpd in 2019 compared to 3.82 MMbpd in 2017.

Nevertheless, the Biden Administration is trying to reinstall the 2015 deal and the recent talks, at least according to Iran, have progressed well. Should there be a breakthrough in arriving at a common ground, Iran will benefit as sanction on its oil, its lifeblood, will be lifted. But there is limited capacity in Iran above 2.4 MMbpd recorded in 2021 and therefore, Iran can only partially offset the potential supply cut from Russia. Then again, there are political factors that can drive the proceedings. For instance, the US may want Iran to increase production whereas the agreements with OPEC could prevent it from doing so beyond certain levels. This explains the complex politico-economic scenario around crude oil. In such a context, shale oil can provide a much needed buffer in supply.

Development of technologies like horizontal drilling and fracking made tapping oil from shale rocks a possibility for the Americans and gave them a dream-come-true moment. This drastically reduced the country’s dependence on imported oil. In fact, the US is now the largest producer of oil. Incidentally, shale was the major contributor to the 2014 oil crash. Oil prices crashed from about $112 in June 2014 to about $37 by the end of December 2015 because of the supply glut created by shale oil. In 2014 and 2015, the global surplus supply of oil stood at 0.8 and 1.8 MMbpd, respectively, due to excess supply of shale.

However, shale then had its own shortcomings. For one, it required huge technological investments and two, shale oil companies burned cash to gain market share. The good news is that the cost of extracting shale oil has come down over the years. The breakeven price for US producers has dropped from nearly $80 in 2014 to about $50 in 2021. So, shale companies might find the current crude prices more favourable.

Oil production in the US, about 70 per cent of which is shale, has been increasing. If we see the active oil rig count, it stood at 520 as on February 18 this year compared to 305 a year back, according to Baker Hughes, an energy technology company in the US. The US Tight have a strong rationale to increase the output if price sustains above $100 because of potential supply crunch.

Implications for India

India, which relies hugely on imports for crude oil, can find itself in a difficult position as international crude prices shoot up. Crude oil has already seen a rise in import in April-January of the current financial year to 175.9 million tonnes (costing $94.2 billion) compared to 163 million tonnes ($47.2 billion) in the corresponding period of the previous year. As the economy is on the path of a recovery, the imports can only go up from here, adding to the import bill of the country, which can depress the rupee (down by 1.3 per cent against the dollar year-to-date) and impact the current account deficit (CAD) negatively.

The current account balance in the first half of FY22 recorded a deficit of $3 billion as against a surplus of $34 billion in the corresponding period of FY21. Higher crude price can also increase inflation as the cost of production and transportation can go up, not to mention the impact on profitability of companies that use crude derivatives as their raw material.

With respect to India Inc., oil exploration companies like ONGC and Oil India can benefit from higher crude oil price. But on the other hand, there are few sectors which can be hit badly. For instance, fuel cost, at about 40 per cent, is the major expense for aviation. Similarly, for paint and tyre manufacturing companies, cost of crude and its derivatives account to about 50 per cent. Oil marketing companies too will face challenges as they will be caught between a deregulated oil pricing policy but at the same time government having a say in deciding duties. Besides these, the broader inflationary impact that crude price has in India will also impact business dynamics for India Inc.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.