The government is stepping on the gas, and how!

The stocks of companies that produce and supply gas to industrial and individual customers have been on fire, over the last few days. City gas distribution companies — Indraprastha Gas, Adani Total Gas — have gained almost 5 per cent over the past week. Ditto with India’s largest oil producer, ONGC. This is thanks to the Government’s (Cabinet committee) decision to implement the domestic gas pricing policy guidelines as proposed by the Kirit Parikh Committee.

The new pricing guideline is believed to balance the interests of gas producers and consumers and also ensure long-term investment in the gas exploration space.

After the stupendous rally in energy prices — crude and natural gas — in 2022, prices have moderated a bit and are ruling steady now. In India too, the prices of domestic gas, which hit the roof in 2022, will moderate in 2023, due to the change in the pricing methodology. More importantly, this will bring stability to the revenues and earnings of gas producers. Until now, these numbers have been fluctuating due to volatile global prices as the price computation formula for domestic gas was linked to natural gas price and volume consumed in countries such as Europe, Russia, Canada, the US, etc.

New pricing contours

Under the new pricing mechanism, the domestic gas price is linked to the average price of Indian crude basket for the previous month. For instance, the gas price for May 2023 will be announced on April 30, 2023. It will be computed as 10 per cent of the average daily crude basket price for the period March 26 to April 25.

For gas from older fields, also called nominated fields, the price of gas will be capped at $6 per mmbtu and there will also be a floor price of $4.5 per mmbtu. The floor and cap price will remain for the next two years and will be increased by $0.25 per mmbtu every year, beginning FY26.

To encourage investment in new exploration, the Government has announced a premium of 20 per cent over APM (Administered Pricing Mechanism) gas price, for gas from new wells or well intervention in the nomination fields of ONGC and OIL, wherein the APM price floor and ceiling cap currently apply.

India being a gas deficient economy with significant dependency on imported gas, a stable pricing policy will encourage fresh investment in exploration and also increase production from existing wells. In 2022, India’s gas consumption stood at 45,661 million standard cubic metre, of which indigenous gas production was 25,868 million standard cubic metre, while the balance was met through re-gasification of imported liquified natural gas (LNG), according to data in Petroleum Planning & Analysis Cell (PPAC) website.

Benefits for upstream gas producers

Though the new pricing scheme will have a marginal negative impact in the short term due to cut in natural gas prices, it will be positive for oil exploration companies such as ONGC and OIL India in the medium term for three reasons.

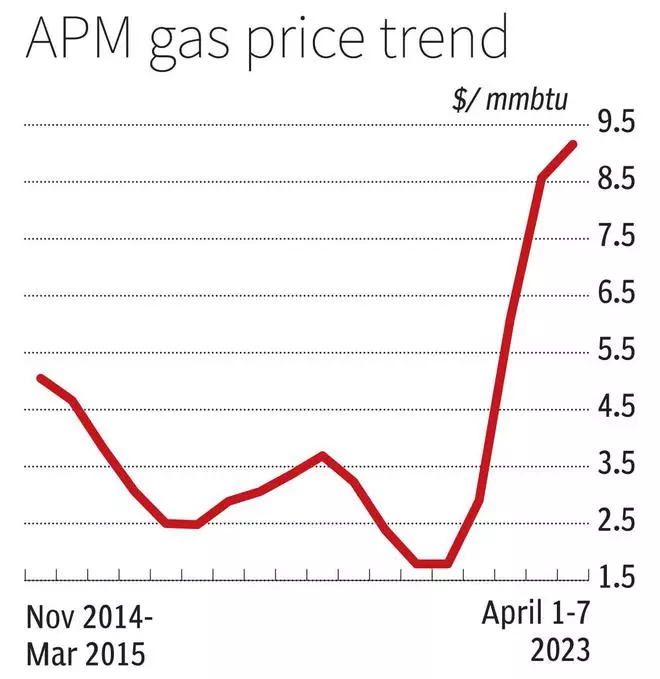

First, the new pricing guideline will bring stability to gas prices, which will help the performance of the gas division of exploration companies. The floor price of $4.5 per mmbtu for gas from nominated old fields is positive for ONGC and Oil India. This is because, gas price historically has largely remained in the range of $2-3 per mmbtu over the last eight years. Sample this: over the period October 2015 to March 2022, the average price of natural gas fixed by the Government was $2.8 per mmbtu. The natural gas price saw a meteoric rise to $6.1 per mmbtu in April 2022 and further increased to $8.57 per mmbtu in September 2022, thanks to the Russia-Ukraine war and the resultant energy crisis.

Barring the November 2014-September 2015 period, when the gas price was higher than $4.5 per mmbtu, the price range for natural gas has been under $4 per mmbtu. Thus, we believe that the floor price will help stable performance of the gas exploration division for the two PSU oil explorers ONGC and Oil India, and help boost their profitability over the next 2-3 years.

Second, though the ceiling price of $6 per mmbtu may seem to be restricting the upside for gas producers when energy prices rule high globally, given the low cost of operating nominated fields for ONGC and Oil India, the margins even at the cap price should remain attractive. We can understand this better looking at the performance of Oil India’s gas division. For instance, during the first two quarters of FY23, the average realisation of natural gas was $6.1 per mmbtu for Oil India. The operating profit margin for the company’s gas segment during this period was 32 per cent and 51 per cent, respectively. This compares with a loss during the first two quarters of FY22, when the average realisation was $1.79 per mmbtu.

Further, the increase in floor and ceiling beginning FY26 at $0.25 per mmbtu should also address any cost inflation in operating these fields.

Third, the move to offer a premium of 20 per cent over the APM gas price for newer fields will incentivise companies to pursue exploration activities and thus help overall volumes and also profit margins. More importantly, clarity on the pricing will help companies plan their capital expansion better. Also, the linkage to crude oil prices as compared to the erstwhile formula of volume-weighted price of gas in countries such as the US, Russia, Canada, Mexico, the European Union, and other countries, will help gas producers in the medium term, given that OPEC and other oil producers typically try to contain any downfall in oil price by altering production and supplies.

Positive for CGDs

For City Gas Distribution companies (CGD) such as Indraprastha Gas, Mahanagar Gas, Adani Total Gas and Gujarat Gas, we believe the move to have an immediate positive impact due to cut in APM gas prices with effect from April 2023. The 27 per cent cut in the price of APM gas from nominated fields should result in considerable cost savings for CGD companies. These companies have already reduced the price of LNG (liquified natural gas used for motor transport) and PNG (piped natural gas used for domestic and industrial purposes), soon after the approval of the new pricing scheme. For instance, Indraprastha Gas has already announced reduction in the price of CNG by ₹6 a kg in Delhi, to ₹73.59 a kg from ₹79.56 a kg earlier. Likewise, CNG prices have been cut by ₹6 a kg in Ghaziabad, Greater Noida, and Noida too.

We believe the new pricing guideline to be positive for CGD companies on two counts.

First, an immediate downward revision in the APM gas prices should ease the stress on the operating profit margins for CGD companies witnessed over the last two quarters, following the stupendous rise in oil and gas prices, globally.

Second, the availability of domestic gas should improve with clarity in the pricing mechanism and should encourage long-term capital commitment from exploration companies. Increased availability of domestic gas will help CGD companies increase their volume.

However, we believe that the cost of gas for CGD companies in the medium term will remain higher than in the recent past, given the linkage to global crude oil prices, now. This Is because the new floor price of $4.5/mmbtu for domestic gas is higher than the gas price range of $1.8 to $3.8 per mmbtu seen over the October 2015-March 2022 period. Ability of CGD companies to pass on the impact of price increases to end customers will be critical for sustainability of margins for these companies in the medium term.

Also, though the availability of additional gas from new fields will help improve volumes, the pricing for the new gas is going to be higher, which can have a bearing on the margin, in case these companies are not able to pass it on to their consumers. Further, inflation and macro-economic indicators may also have a role to play in the decision of CGDs — at least state-owned ones such as Indraprastha and Mahanagar Gas — to completely pass on price increases to consumers. Further, the Petroleum Planning and Analysis Cell has been mandated to build and maintain a dedicated portal for tracking PNG and LNG prices regularly, which will update the prices as and when changes happen.

Besides the new pricing mechanism, increasing investments in LNG globally can also have a positive rub-off on CGD companies. This is because, high LNG prices in 2022 have kindled investment interest in this space. In the European Union region, the re-gasification capacity is expected to increase by 25 per cent in 2023, thanks to expansion of existing re-gasification terminals and new floating storage regassification units. As overall LNG volumes increase, it should ease the pressure on LNG prices, which will also benefit CGD companies by way of lower raw material costs, as they bridge the gap in domestic gas supply through imported LNG.

Others

For gas utility companies such as GAIL, which is predominantly into natural gas trading and transmission, there will not be any significant impact on its margin on account of increase in gas prices. The company’s revenues are largely from monetisation of its transmission pipeline infrastructure. Though GAIL also has a small CGD component in its revenue, it is very negligible. Similarly, there will not be any impact of the new pricing mechanism on Petronet LNG, which primarily imports LNG, does re-gasification and distribution.

Outlook on stocks

Gas exploration companies ONGC and Oil India look interesting from a medium-term investment perspective, now with the new pricing guideline. Among the two PSU gas producers, Oil India seems attractively priced at 3 times its trailing twelve-month earnings. With an investment book of ₹29,728 crore and cash in the books of ₹4,362 crore as of September 2022, the company’s current market cap of ₹28,275 crore looks impressive. At bl. portfolio, we recently gave a ‘buy’ recommendation on this stock. ONGC, being the leader, trades at a slight premium to Oil India, at 5.1 times its trailing twelve-month earnings.

Mahanagar Gas also is expanding its wings beyond Maharashtra into Karnataka and is gearing for steady growth in the medium term. Indraprastha Gas currently trades at about 23 times its trailing twelve-month earnings, while Mahanagar Gas trades at 15 times its twelve-month trailing earnings.

We have an ‘accumulate’ recommendation on both Indraprastha Gas and Mahanagar Gas. Other stocks in the CGD space, including Adani Total Gas and Gujarat Gas which rank first and second in terms of highest number of geographical areas (GA), are at a premium to the above mentioned CGD companies. Adani Total Gas is trading at a steep premium to peers, at 201 times its trailing twelve-month earnings.Further, healthy balance sheet of both Indraprastha and Mahanagar Gas adds to the comfort, while Adani has debt totalling to about 0.5 time its shareholders’ funds in the books, given its aggressive expansion plans.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.