Soon after the initial pandemic disruption, the tech sector became the most preferred dance floor for party animals within the investment community. Unlike past global recessions, which pulled down the sector along with the broader economy, the recession of 2020 gave a strong impetus to the sector as clients globally realised that a thrust on digitisation spending was an imperative to deal with the challenges posed. Indian IT services companies were big beneficiaries of this structural trend and this played out well for investors. A V-shaped global recovery further accelerated the momentum.

Since the March 2020 lows, the S&P BSE IT index had returned (in absolute terms) around 230 per cent by March 31, 2022, nicely outperforming the broader Sensex’s 125 per cent returns. However, in recent weeks, the mood amongst investors has been getting a bit sombre, reflected in the IT index underperforming Sensex by 9 per cent in the last month. A two-day rout in the Infosys stock post Q4 results and collateral damage amongst peer stocks has made some investors wonder, ‘is the party over?’

While the answer to this will be confirmed only in hindsight, here we discuss four aspects that indicate it is time to sober up, if you haven’t already by now.

Global growth

With five of the top seven IT companies having reported results for Q4 so far, and none of them expressing concerns on growth, why should this be a worry?

While things look hunky-dory for now, it merits attention that the Russia-Ukraine crisis and multi-decade high inflation in developed markets are the sword of Damocles hanging over the head of global growth. Add to this, Covid-related lockdowns in China, which have further accentuated supply-chain disruptions. Last week, the World Bank reduced its global growth forecast for CY22 to 3.2 per cent from the prior 4.1 per cent due to stress to economies created by the war and the inflationary spiral because of supply disruptions. Also, a few weeks back, yields on US 10 and 2-year treasury bonds inverted. This, traditionally considered a harbinger of recession (although the inversion lasted only for days and more clarity is required), broadly reflects bond investors’ concerns on the long-term economic outlook.

None of these considerations appear to be reflecting in the stock prices of some of the IT services companies (even after recent correction) or in growth outlook for the next year or two.

The high priority that IT spending has amongst clients’ budgets reflects in Indian IT companies not having felt the impact of current global events in their outlook. However, given the uncertainties, it would be prudent to factor for impact to growth a few quarters down the line. A lot will depend on the course of the war. Also, to what extent global central banks, especially the US Fed, will extend their aggressive monetary tightening stand to rein in inflation, will also determine how growth actually trends for the year. Probabilities of a recession in the US in the next year or so have been increasing in the forecast book of economists.

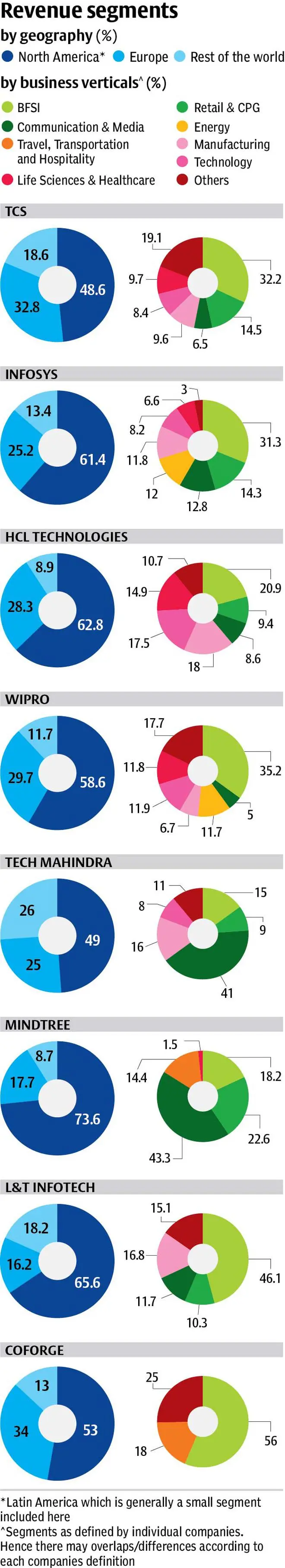

With IT services being primarily an export-oriented industry, the correlation to global growth is strong. The extent to which India’s growth is decoupled from the rest of the world (if at all decoupling really exists) will have no bearing on the IT services sector . Another important factor to note is that the exposure of most companies to cyclical sectors (mainly BFSI) is heavy and hence vulnerable to impact in case of any worse-than-expected slowdown.

Investors’ share of pie shrinking

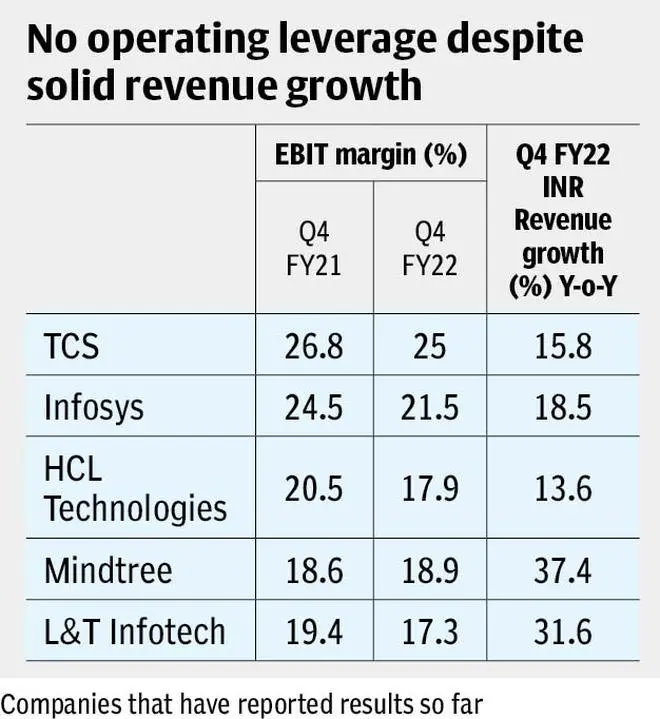

In our Reality Check column in last week’s Portfolio edition ( https://tinyurl.com/ITstocks2022 (), we highlighted how operating leverage has been completely absent despite robust topline growth reported by TCS and Infosys , and that has largely played out in companies that have released results since then as well.

Every unit of revenue in the profit and loss account largely gets split among – one, employees (variable/input and operating costs); two, suppliers/vendors (other costs); three, government/society (taxes); and four, shareholders (profits). Operating leverage is when investors’ share of the pie increases with revenue growth. However, this time, investors’ share of the pie has been reducing, with margins contracting due to higher variable costs.

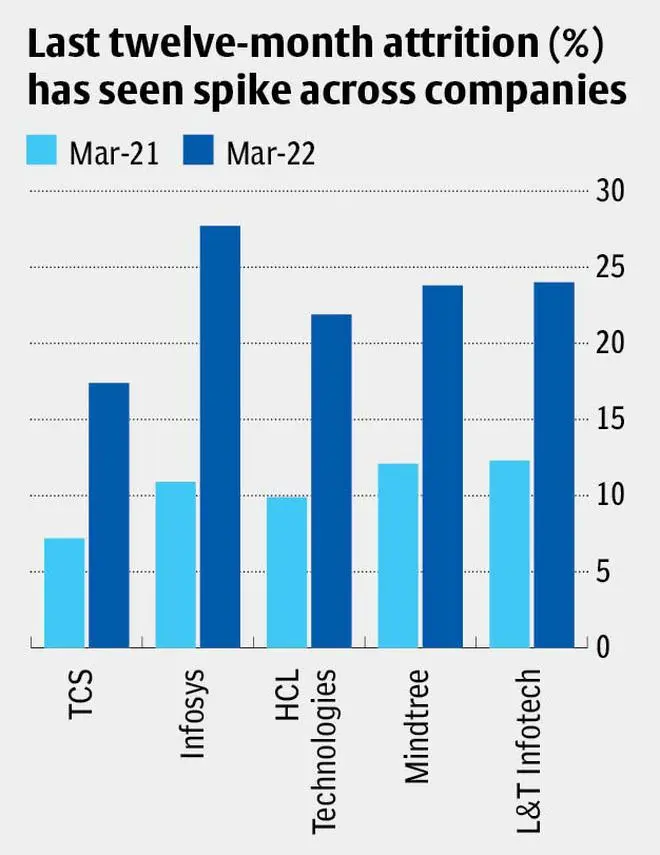

Based on the margin guidance given by the companies so far, there isn’t much of operating leverage expected to play out in FY23 as well. Cost pressures driven by higher employee and subcontracting costs to meet demand are likely to remain entrenched for a while. The dynamics in favour of employees is evident in the huge spikes in attrition numbers of companies, year on year (see table). Thus while earnings is growing, that it is growing at slower pace than revenue is a dampener for stocks and, ideally, should be so for investor sentiment as well. Since Infosys’ results, there have actually been downward earnings revisions for companies in the sector.

How this trend progresses will also be a key determinant of stock performance. Talent shortage has resulted in higher bargaining power for employees and substantially high attrition than what it was a year back. Further, some of the benefits that played out during lockdowns – like lower travel, marketing and promotion costs, etc – are now normalising to pre-Covid levels and are also doing their bit in denting margins.

Companies that can get their employee pyramid structure right (more employees with less experience and thereby costing less) without impacting quality of delivery to clients are likely to perform better. Clarity on this may emerge in the next few quarters.

Red ocean strategy

According to a recent Nasscom review, India’s technology industry’s dollar revenue grew at around 15.5 per cent in FY22. As against this, within the IT services segment and amongst the companies that have reported results so far, TCS has grown revenue at around 15.5 per cent, Infosys at 20 per cent, HCL Technologies at around 13 per cent, Mindtree at 33 per cent and L&T Infotech at 26 per cent. It is clearly evident some are gaining market share and some aren’t.

One trend that has distinctly emerged since the Covid disruption is stronger competition from the tier-2 IT services companies (TCS, Infosys, HCL Tech and Wipro are considered tier-1). For example, besides the data mentioned above where smaller companies like Mindtree and L&T Infotech have outgrown industry leaders, a comparison of 2-year revenue CAGR for the periods FY18-20 and FY20-22 validates this structural change. During FY18-20, the combined growth of tier-1 companies was at a CAGR of 13 per cent and that of the next 4 largest companies (TechM, Mindtree, L&T Infotech and Coforge) was also the same at 13 per cent. However, between FY20 and FY22, while tier-1 revenue CAGR has reduced to 12 per cent, that of the next 4 has increased to 14 per cent.

The competition is heating up in the digital space. Intense competition is good in the long run as every player who survives, emerges stronger . But in the interim, there will be winners and losers and there may be periods when everyone loses as companies fight it out for market share at the expense of margins.

Part of the margin pressures/lack of operating leverage mentioned above are also a likely fallout of stronger competition. TCS, which has been fixated on maintaining its industry leading and well-above-peers margins, has fallen behind in growth. A point to ponder is, what would happen to competitive dynamics if TCS, for its size and scale, decides to go for growth over margins. The red ocean strategy could get more red.

Valuation

If you are a fundamental long-term investor, investment decisions have to be made on the fulcrum of fundamental analysis and valuation. A simple analysis largely indicates many of the IT companies are in the overvalued basket. For example, since pre-Covid (February 2020) level of around ₹2,200, the stock of TCS is up by around 65 per cent. During the same two-year period, its earnings have grown at just 20 per cent (absolute growth). Thus, the growth in shares of 65 per cent has come predominantly from multiple expansion. This is the trend across the board for many companies in the sector. The stock of Infosys is up over 100 per cent. During the same time its EPS is up by 35 per cent. In the case of Wipro, the stock is up by 120 per cent vs EPS up by 37 per cent. Thus what has largely played out over and above pick-up in business fundamentals is multiple expansion.

What has driven this multiple expansion from pre-Covid levels to now? Which investors were valuing these stocks right - the ones who bought the stocks pre-Covid or the ones buying it now?

Multiple expansions and contractions are a factor of fundamentals, liquidity and sentiment. Fundamental factors that can explain multiple expansion are – one, acceleration in revenue/earnings growth; two, margin expansion; three, higher long-term earnings visibility; and four, consistency in performance. While the companies have improved on points three and four, and shown reliable earnings power during recession, there has not been much of improvement on points one and two if one looks at 2-year performance. While the tier-2 companies have seen better acceleration in revenue, what needs to be tracked is how long it will sustain and how much the growth rates will taper post the initial digitisation thrust.

Fundamentals do not explain much of the multiple expansion beyond a certain level. Liquidity and sentiment have driven a more significant part of multiple expansion. Investors need to note one undeniable trend in stocks – that multiple expansions will be followed by multiple compressions as other factors that drove multiple expansion like liquidity and sentiment can reverse at short notice. Recent data indicates the IT sector was the second biggest loser of FPI funds in the previous fiscal. This trend can only increase as currently risk-free 2-year US treasury bonds trade at a yield of 2.7 per cent versus companies like TCS and Infosys trading at earnings yield (1/PE) of 3.2 and 3.7. These are completely unattractive valuations today from a foreign investor’s perspective.

Further, a simple illustration can explain the impact of multiples contraction. Based on its FY23 consensus EPS estimate, TCS is trading at a PE of 31 times. If it were to grow its EPS at 12 per cent CAGR (this could be considered generous given its last 5 years EPS growth was 10 per cent) for the next 5 years and the stock keeps pace with earnings growth, then an investor can expect 12 per cent CAGR returns in the stock as well (Not bad!). However if multiples were to contract to pre-Covid levels or 5-year average levels, investor returns would be a meagre 7 per cent (time to think, is the risk-reward favourable). Thus a lot depends on multiples not contracting, which is unlikely to be the case. A worse case scenario could be earning growth faring less than expected and multiples contracting below average levels (as an investor is this risk worth taking?).

Thus investors need to factor risk vs reward, margins of safety in reassessing their positions and expectations for stocks in the sector. At BL Portfolio, based on these factors, we have been getting cautious on some of the stocks in the sector since last year and have been shifting preference to companies that were under-appreciated by the markets (see box). For now, HCL Tech and Tech Mahindra remain relatively safer prospects for long-term investors amidst the current uncertainties. When better value emerges in other companies, either due to further stock price correction or more clarity on growth, margins, macro trends, etc, we will make further recommendations.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.