Fundamentally, weak demand is expected to weigh on the prices. On the other hand, the charts too are bearish and there are no signs of a bullish reversal yet. In fact, price action hints at further downside.

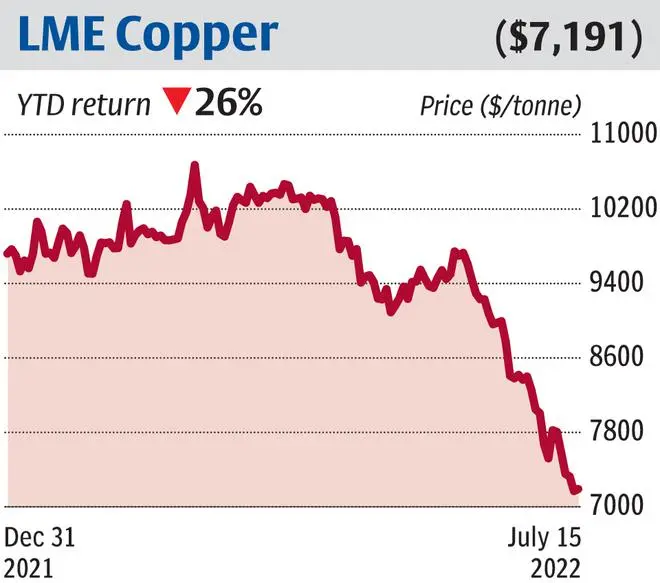

LME Copper ($7,190.5)

Post hitting a high of $10,845 in March, the three-month rolling forward contract of copper on the London Metal Exchange (LME) began falling. From the current level of $7,190.5, the contract is likely to fall further towards the nearest support at $6,850, where the 61.8 per cent Fibonacci retracement of the prior rally lies.

A breach of this can drag the contract to $6,250. If there is a recovery from here, it can be capped either at $8,400 or at $8,500 from where there could be a fresh fall. We might not see the contract rallying above $8,500 this year.

Support: $6,850 and $6,250

Resistance: $8,400 and $8,500

Also read

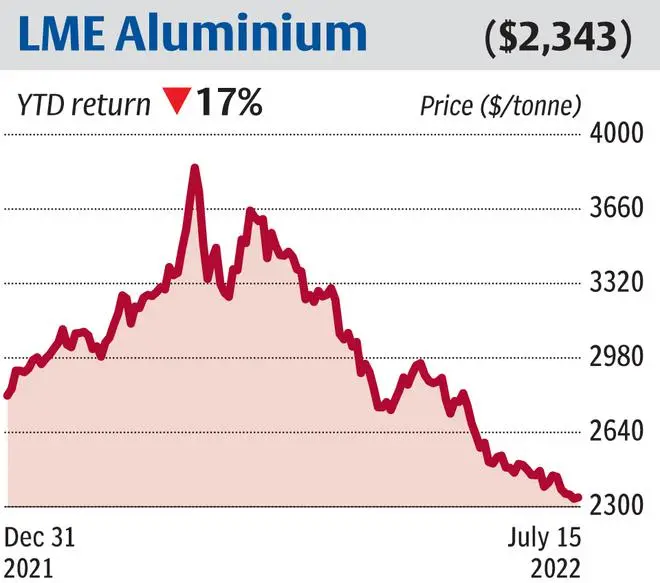

LME Aluminium ($2,343)

The three-month rolling forward contract of Aluminium on the LME hit a high of $4,073.5 before reversing lower. A month ago, it invalidated a crucial support at $2,750 and is currently trading at $2,343. There appears to be more on the downside. While $2,300 is a minor support, the contract is expected to gradually fall below this level and reach the support band of $2,000-2,100 before the end of this year.

If at all there is recovery, either from the current level or after declining to the $2,00-2,100 range, it will most likely be restricted to $2,750. That is, the contract is set to end the year below $2,750 in any case.

Support: $2,100 and $2,000

Resistance: $2,500 and $2,750

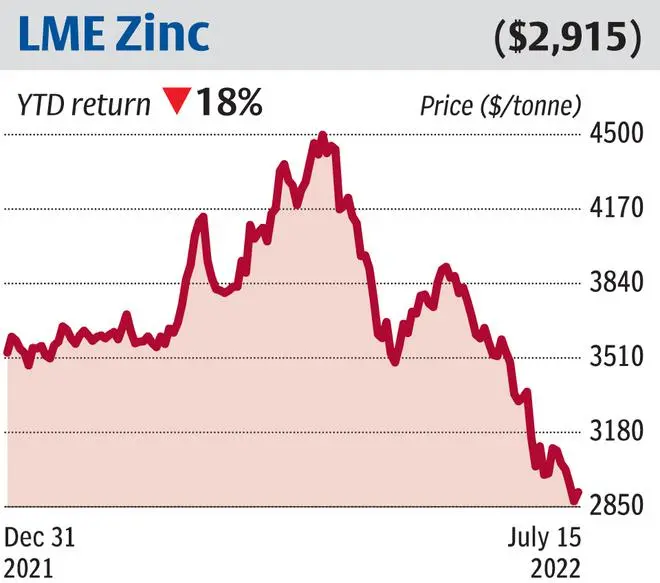

LME Zinc ($2,915)

The three-month rolling forward contract of zinc on the LME marked a record high of $4,896 in March. It then made a U-turn and tumbled. The contract extended the fall and last week it breached a key support at $2,950. This leaves the door open for another leg of a downswing from here and the nearest notable support is at $2,500.

Subsequent support is at $2,370 thus making the price area of $2,370-2,500 a support band. The contract is likely to fall to this region before the end of this year. If there is a rally from here, it can be capped at $3,130.

Support: $2,500 and $2,370

Resistance: $3,130 and $3,400

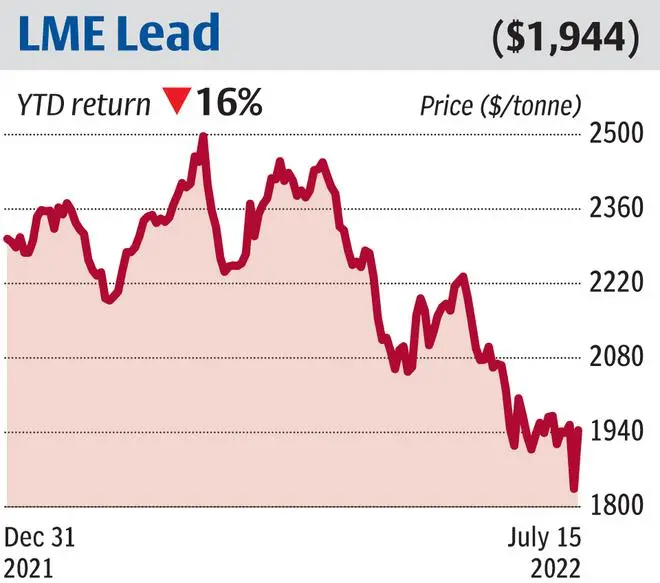

LME Lead ($1,944)

After largely staying in the range of $2,135-2,480 between June 2021 and mid-March this year, the three-month rolling forward contract of lead on the LME breached the support at $2,135 in March. This turned the outlook bearish for the contract. Yet, currently hovering around $1,944, the contract has been moving within the range of $1,880-2,000 for the past few weeks.

If it falls below $1,880 from here, it can fall to $1,750 before the end of this year. But, on the other hand, if it breaks out of $2,000, it can rally to $2,135, but not beyond that.

Support: $1,880 and $1,750

Resistance: $2,000 and $2,135

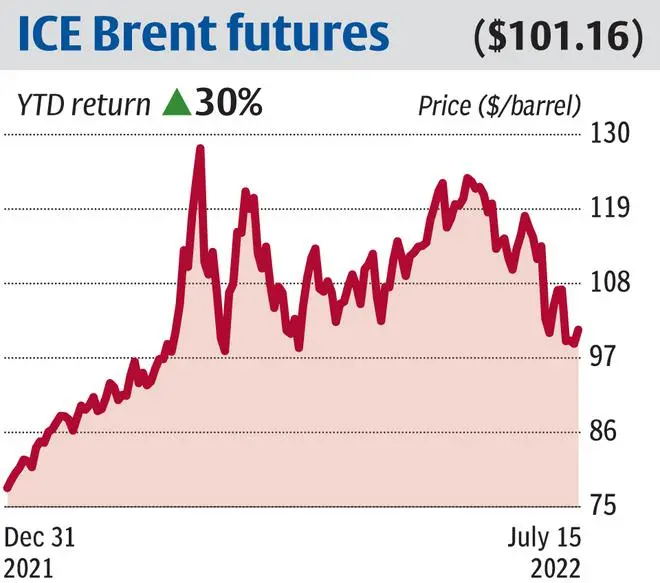

Brent crude futures ($101.16)

The Brent futures on the ICE (Intercontinental Exchange) hit a high of $139.4 in March. But then it lost momentum and has largely been oscillating between $98 and $124. The contract is currently testing the support at $98. A break downwards below this level can change the near-term trend to bearish and such a break will almost certainly drag the contract to the immediate notable support at $85.

Thereafter, it could stay within the $85-100 price region for some time. If Brent futures slip below $85, it could see a decline to $70. A fall below $70 in 2022 though can be a low-probability event.

Support: $98 and $85

Resistance: $115 and $124

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.