Indian generics manufacturers have had strong structural factors to bank on in the last decade. The two main end-markets — India and emerging countries, on one side, supported low double-digit growth in revenues, and US, which is the single-largest market, provided higher adoption of generics brought in volume growth. The industry players also developed competent regulatory, product development and launch capabilities, tapping every market and exporting to over 100 countries, both big and small, earning the sobriquet ‘Pharmacy of the World’. However, the narrative and stock performance are not on the same page. Measured by Nifty Pharma index, which returned 3.3 per cent CAGR in the last five years, the sector’s returns has significantly underperformed the broader Nifty-50 index by close to 800 bps.

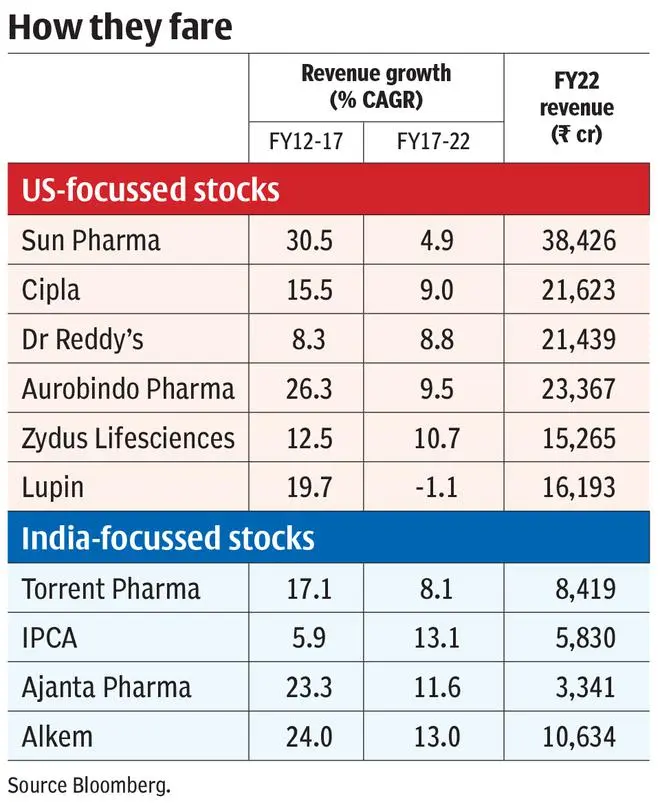

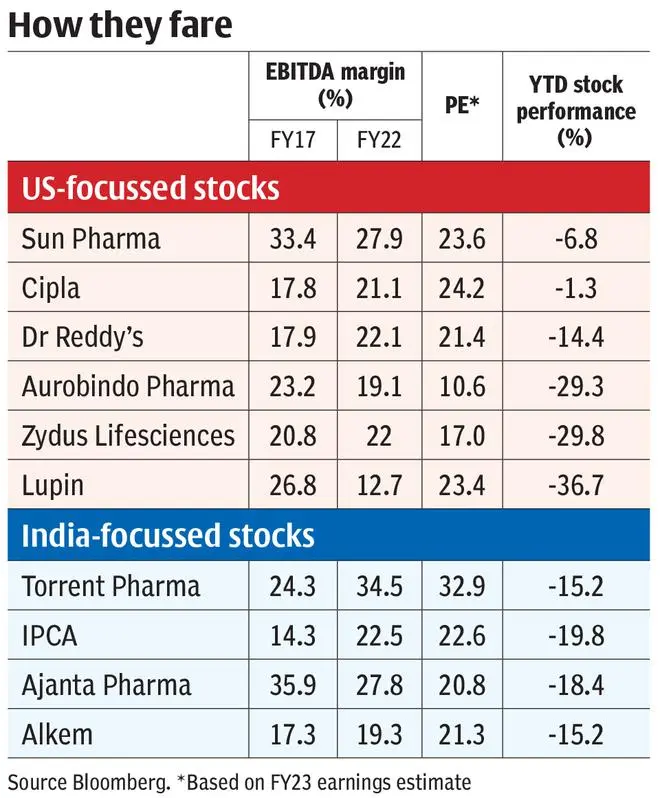

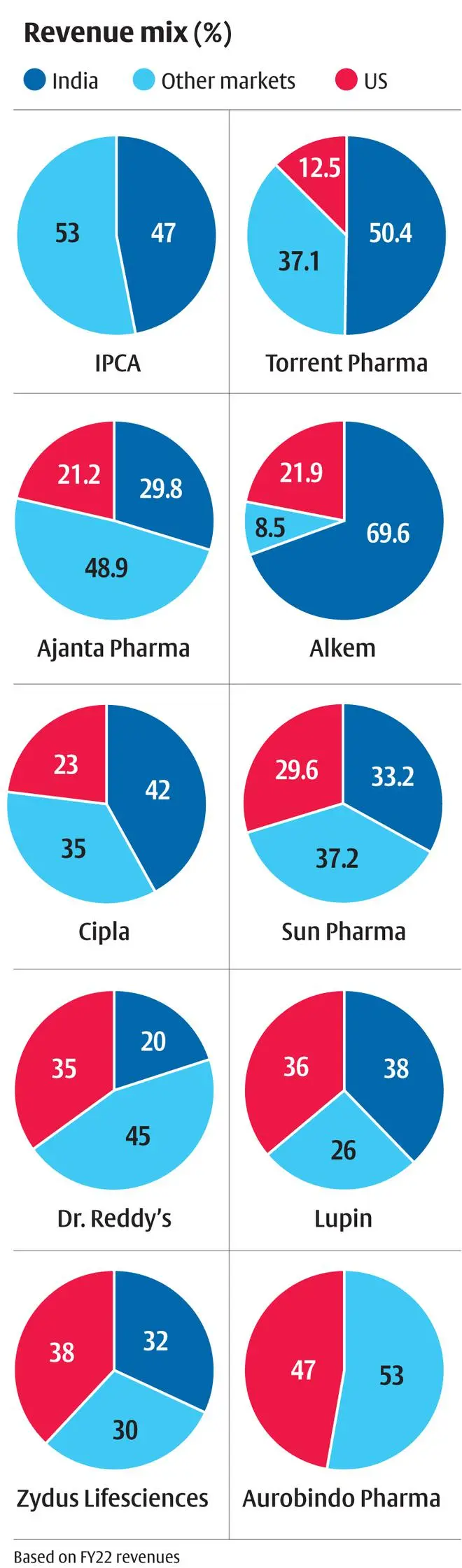

On further examination, it is the large-cap generics manufacturers led by Sun Pharma (3.6 per cent CAGR stock returns in the last five years), Lupin (-16 per cent), Zydus Lifesciences and Aurobindo (-5 per cent each) which has generated such flat returns in the period. Only Cipla and Dr Reddy’s are the exceptions with around 10 per cent CAGR stock returns. Segregating the top line performance of these companies shows that India and other emerging markets generated top line growth of average 11 per cent CAGR for these companies in the last five years (FY17-22). US revenues, on the other hand, generated 0.3 per cent CAGR in the same period, dragging the top line (average 30 per cent revenue contribution across these companies – see accompanying charts). This is in stark contrast to the performance in the five years prior (FY12-17) as well, where US revenue grew at 26 per cent CAGR.

Are the factors contributing to muted US growth permanent? How should investors approach pharma stocks in this context?

Why the slowdown in US generics

The primary reason for slowdown has been price competition, driven by accelerated ANDA approvals (Abbreviated New Drug Application) and buyer consolidation. Compared to 1,100 ANDA approvals in 2019, which, by itself, is more than double of 2014 approvals, the US FDA has approved 1,000-plus generics already by June 2022. This pressures older generics basket to erode further by a high 10-15 per cent in FY22 as evidenced by management commentary of companies post the recent quarterly results.

Regulatory hurdles stand in the way too. First, US FDA’s plant inspections have often resulted in negative observations in the recent periods. To enforce evolving manufacturing standards or to address impurities recorded in commercialised products, the number of inspections and the degree of standards required have been on the rise. Sun Pharma’s Halol facility got a much-awaited clearance in 2020 and again received 10 observations in May 2022. Similarly, Aurobindo, Lupin and Zydus Lifesciences need plant clearance.

The lack of plant clearance upsets new launches, which is critical to overcome price erosion. For instance, Torrent Pharma, with no new launches in the last two years (as two plants are under observation), reported 16 per cent YoY decline in US revenues in FY22 compared to Dr Reddy’s 6 per cent YoY growth as plant clearance is not a concern.

Second, complex generics approvals such as Ranexa, Welchol, Tamiflu, Suboxone, to name a few, which were frequent ‘revenue bumps’ for companies, also dried up owing to elongated review cycles with multiple rounds of product queries and accompanying plant inspections. Cipla launched Albuterol — a respiratory product, but launch of Advair, a follow-up in the respiratory segment, has been awaited for a few quarters now. The launch of Copaxone, another big-ticket product, is awaited by Biocon, Dr Reddy’s and others. Generic Revlimid though is the significant opportunity which almost all players have a shot at, in the next one year.

Third, regulatory risk also plays out in the form of anti-trust agreements, product recall expenses and even penalties for failure to supply. Sun Pharma had an exceptional cost of ₹4,500 crore each in FY21 and FY22 owing to anti-trust investigation on Taro, its subsidiary. Torrent Pharma incurred a ₹21-crore cost for failure to supply in Q4-FY22 and this is not an uncommon occurrence in the industry.

While product approval and regulatory risk are dependent on the abilities of the individual company to an extent, the main reason of price competition is entrenched and cannot be wished away. The best possible scenario would involve a return to mid-single-digit price erosion upon easing of channel stocking. But the pace of ANDA approvals from recent entrants may continue uninterruptedly consistently adding competition.

Sidestep measures

Though there is downward pressure on asset utilisation, revenues, margins, and return metrics for companies operating in the US now, they prefer continuing operations for certain reasons. US accounts for close to 40 per cent of the global market and India possesses the highest US FDA approved facilities outside the US. By leveraging the built-up infrastructure and dealing with one regulator and (unfortunately) few buyer groups, companies can generate economies of scale which can be leveraged for other markets as well.

Also, there is a need to utilise legacy assets as companies have already incurred product development costs of around ₹5-7 crore for a simple generic, have set up manufacturing plants meeting high standards and made front end investments.

Companies may also be adopting a wait-and-watch approach and may be looking to consolidate the seller’s power in the face of probable exit of weaker players.

Besides, the larger players including Sun Pharma, Cipla, Aurobindo, Dr Reddy’s and Zydus Lifesciences have started projects aimed at regaining pricing power. But the exercise will be long drawn, at a high capital outlay and involve significantly higher amount of risk.

Sun Pharma’s high-value innovator product strategy (around 65 per cent of US sales, excluding Taro in Q4-FY22) has got off to a good start with Ilumya (approved in the US for plaque psoriasis) generating close to half-a-billion dollars worldwide in FY22 and few more molecules in trial phase.

Cipla’s Advair, as a follow-up in respiratory, should be a big boost to its portfolio which may also add few complex injectables/peptides. Similarly, Aurobindo plans on increasing its sterile portfolio and opening complex filings to restart growth. These projects can offer better pricing power (due to exclusivities or limited competition) for a longer time compared to plain generics. But the platform (R&D capability, acquisitions, and partnerships) to repeatedly generate such assets is of critical importance.

Sun Pharma purchased and developed Ilumya from Merck ($80 million in 2014) but is now partnering a French biotech company for auto-immune molecule (Phase-II) and an Israeli company for non-opioid pain treatment (Phase-II) in its pipeline. Cipla leveraged its India/emerging market respiratory platform in the US and Europe, and is partnering on two products and developing two more on its own.

Biocon, on the other hand, has developed a proven platform for biosimilar assets (launched three in the US) and acquired the marketing capabilities (Viatris stake acquisition) recently to support the next phase of launches.

But complex product development from ground-up may cost ₹500-700 crore per product and would involve a five-six year timeline. Acquisition at an advanced level (Phase-II/III) will involve a similar cost outlay and also revenue/profit-sharing. The commercialising and marketing infrastructure cost are over and above this, once trials succeed. The probabilities for success start at less than 10 per cent in Phase I and reach 40-50 per cent by Phase-III. Companies will require a self-sustained innovator business model with five-six products commercialised to support such endeavours and this may be a few years away at the moment.

Way forward for investors

Thus, the weakness in US revenue growth may persist in the near to medium term. Hence, for investors, companies focused on emerging pharma markets, including India, may be a good bet as they offer better growth opportunities in today’s scenario without significant regulatory or product development risks. For the top 10 companies by market capitalisation with a sizeable generics portfolio in India, revenue growth stood at 11 per cent CAGR in FY17-22 with more than half of the growth coming from price increases. Emerging market exports for these companies have also grown similarly. Even with pricing control in various countries, companies have managed to generate double-digit growth.

Within India, the ability to develop a branded generics portfolio allows companies the much-needed pricing power. In the face of lower regulatory oversight compared to developed markets, the quality burden rests on branding which allows a more sticky product growth. Deploying a sizeable force of sales representatives at minimal cost allows last-mile reach to practising specialists. Patent challenge risk still exists, but the innovators’ resources and willingness to defend patents beyond the core exclusivity period may not be as high as developed markets given the lower market size.

India, being a low-cost operator with a highly developed API/contract manufacturing eco-system, finds strong demand from semi-regulated markets across the world. This allows companies to operate in zones where they establish themselves with low competition. Caplin Point has established a strong presence in specific Latin American markets, Cipla has a strong presence in South Africa, Dr Reddy’s in Russia, and Torrent in Brazil.

Thus, companies with lower reliance on US markets and higher reliance on India and other markets offer the ideal revenue concentration that allows the company to retain pricing power and sustain growth. In the near term, pricing power will be a prized possession for investors. Also, these companies trading at a slight 2-10 per cent discount (20-21x) to US exposure-heavy stocks (22-24x) should increase their attractiveness.

Our recommendations in the pharma space have also veered towards India-focussed stocks of late. Ajanta Pharma’s branded business, spanning across India, other Asian countries and Africa is poised for growth. Torrent Pharma can witness an immediate step up in margins in Q1-FY23 as the management trims unprofitable operations and optimises US production. But US FDA plant inspections expected in near term needs to be monitored for both stocks.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.