The outlook for the stock of Cholamandalam Investment & Finance Company (₹741.75) is bullish. While the stock finds an immediate support at ₹692, the next major one is placed at ₹666. A close below the latter will change short-term outlook negative. However, If the current trend sustains, the stock can climb to ₹913. We expect the stock to maintain the upward trend.

F&O pointers: As the price was hovering between ₹710 and ₹700 in the first five days of trading in April, the counter shed open interest marginally. However, a sharp rise on Friday triggered accumulation of open positions in April futures of the stock. This contract closed at ₹746.10, a good premium of ₹4.35 over the spot close of ₹741.75, signalling traders are willing to carry over their positions. Options trading indicates a movement in the range of ₹720-800.

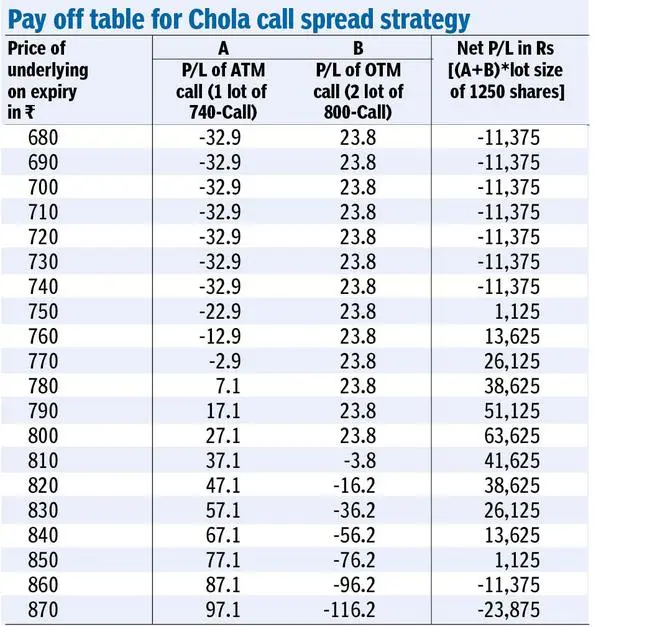

Strategy: We advise traders to sell two lots of 800-call option and simultaneously buy one lot of 740-strike call, which closed with a premium of ₹11.9 and ₹32.9, respectively. As the market lot is 1,250 shares, this strategy would cost traders ₹11,375 (i.e., ₹32.9 - ₹23.8). This strategy is for traders who can understand and take high risk.

While the loss would be limited to the premium paid (₹11,375) if the stock stays at or dips below current levels, losses will increase if it rallies above ₹860. The position will yield a profit between ₹1,125 and ₹63,625 depending on where it settles between ₹750 and ₹850 on expiry. The maximum profit will happen if Cholamandalam rules at ₹800. The position will hit a loss of ₹11,375 again if the stock rises to ₹860. Thereafter, for every ₹10 rise from there, the loss will increase by another ₹10,000. Simply put, if the stock hits ₹870, the loss would be ₹21,375 and so on, indicating higher risk. So, exit at a profit of ₹20,000 or exit if loss mounts to ₹11,500. Risk-averse traders can stay away.

Follow-up: Hold LIC Housing Finance bull-call spread strategy.

Note: The recommendations are based on technical analysis and F&O positions. There is a risk of loss in trading.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.