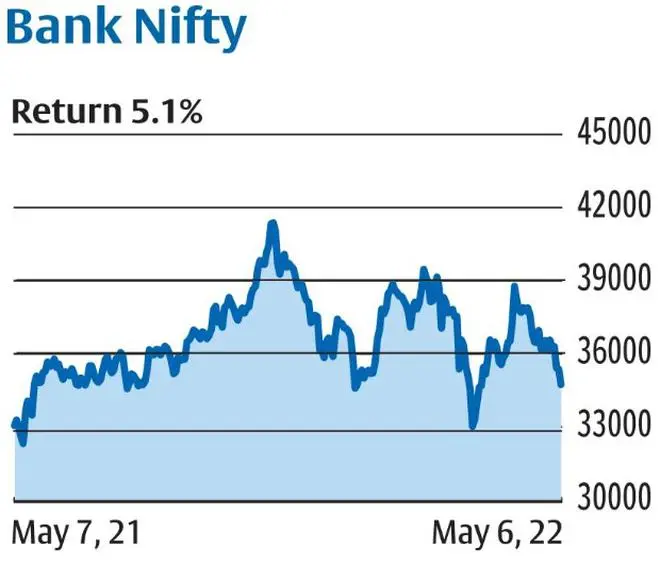

Bank Nifty (34,591.20) finds an immediate support at 34,027 and the next one at 33,298. The index finds a major support at 32,560 and a dip below this level could trigger a strong downfall that could take Bank Nifty to sub-30,000 level. On the other hand, Bank Nifty finds an immediate resistance at 35,631 and major one at 37,899.

We expect the index to display bearishness immediately and a violent bounce back in the near term.

F&O pointers: Bank Nifty May contracts witnessed a steady accumulation of open positions. The closing price of 34,632.35 commands a good premium over the spot price of 34,591.20. This indicates strong existence of longs, as traders are willing to bet on bullish side. Option trading indicates that Bank Nifty can move in a 32,500-37,000 range.

Strategy: Traders could consider calendar bull-call spread on Bank Nifty by selling 35,000-strike May call option and simultaneously buying the same strike July contracts. These options closed with a premium of ₹606.25 and ₹1,395.05 respectively. As the market lot is 25 units, this will cost traders ₹19,720, which will be the maximum loss. The maximum loss will happen if the index stays at or below 35,000 till the monthly expiry in July.

On the other hand, profit could be very high if the index slides immediately i.e., in May and rises sharply before July expiry.

A move above 35,606.25 approximately will start turning the position positive. Traders could exit the position if the loss mounts to ₹13,500. If Bank Nifty slides in immediately, traders could exit the short call (May contract) in profit and hold the long July contract.

Follow-up: As expected L&T Finance Holdings, slipped and the bear-put spread positions is in-the-money. We advise traders to book profit.

Note: The recommendations are based on technical analysis and F&O positions. There is a risk of loss in trading.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.