After a bout of weakness in February, precious metals regained their sheen in March. Both gold and silver managed to post the highest monthly gains since May 2021.

Concerns about the turmoil in the banking sector in the US and Europe played a key role in bolstering sentiment towards the precious metals. The weakness in the US dollar also played a role in helping precious metals close on a positive note last month.

As a result, Comex gold gained 8.1 per cent in March to end the month at $1,986.2 per ounce. The rally in the white metal was much more pronounced with Comex silver gaining 14.6 per cent to settle at $24.15 at the end of March.

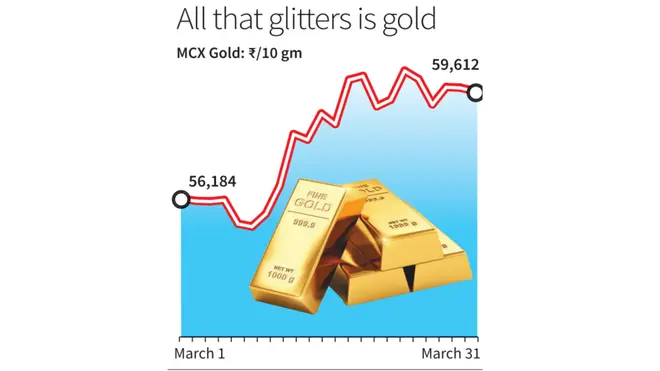

Mirroring the strength in the global markets, the prices of gold and silver closed on a strong note in the domestic markets as well. MCX gold gained 6.3 per cent to settle at ₹59,612 per 10 grams. MCX silver closed 11.7 per cent higher to end March at ₹72,218 per kilogram.

The strength in Comex gold pushed the price well beyond the target zone of $1,885-$1,890 mentioned in March. Comex gold also managed to move past the positive trigger level of $1,940 that was mentioned last month.

- Also read: Will gold and silver price fall?

As a result, the short-term outlook is positive and Comex gold is likely to rise to the immediate target of $2,025-2,030 range. This positive outlook would be invalidated if the price falls below the support level of $1,920. As long as the price sustains above $1,920, there would be a strong case for a rise to the above target zone.

Similar to gold, Comex silver, too, moved beyond the target zone of $22.20-$22.60 mentioned last month. After reaching a high of $23.7 on March 24, the price of Comex silver has been consolidating in a tight range in the past few days. The recent rise in silver is likely to continue and the price could head to the next target of $25.50-26.25.

This view would be invalidated if the price falls below $22.5.

Domestic market moves

In the domestic market, MCX gold moved well beyond the target zone of ₹56,500-57,500 mentioned in March. In the short term, the price could head higher to the immediate target of ₹60,800-61,500. A fall below ₹59,000 would invalidate the possibility of a short-term rise.

MCX silver, too, reached the target zone of ₹67,500-68,000 mentioned last month. The short-term outlook for silver is positive and the price could reach the next target of ₹74,500-75,000. A fall below ₹68,500 would negate the case for a rise to ₹74,500-75,000.

To summarise, the recent strength witnessed in precious metals is likely to spill over in April too. The positive outlook would be valid as long as the price sustains above the downside levels mentioned above.

(The author is a Chennai-based analyst/trader. The views and opinions featured in this column are based on the analysis of short-term price movement in gold and silver futures at COMEX & Multi Commodity Exchange of India. This is not meant to be a trading or investment advice.)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.