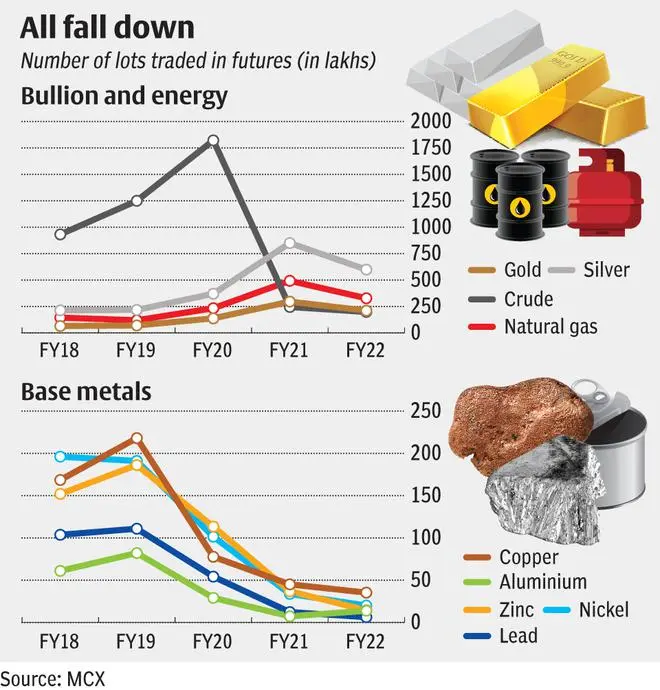

Commodity trading, based on the number of lots traded, declined across the board in FY22.

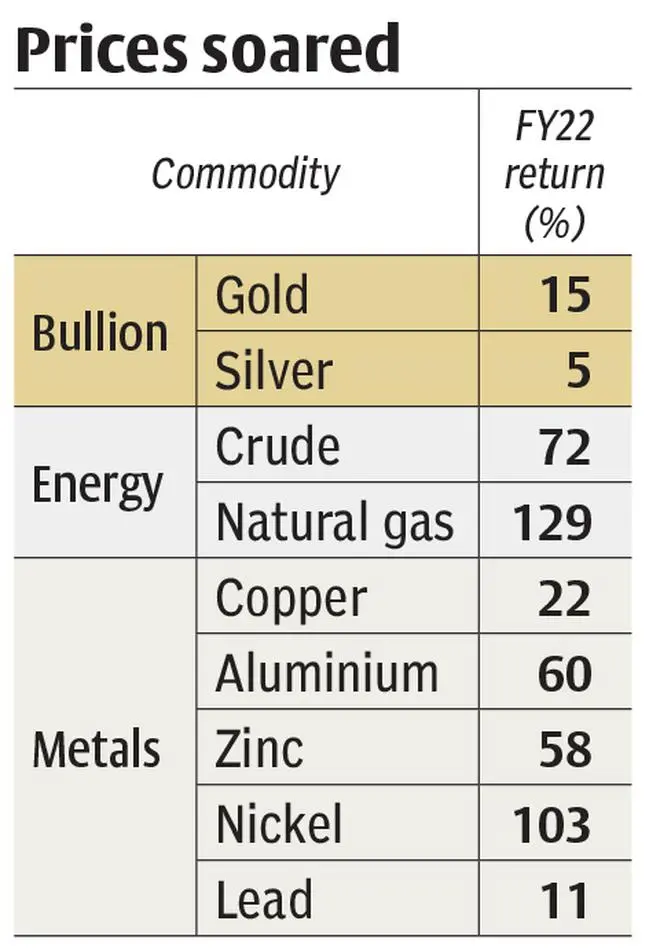

Bullion saw a drop in volume for the first time in the last four years with traded contracts in gold and silver falling 29-30 per cent. Cumulative number of traded lots in key base metals declined 33 per cent over FY21. This was despite the price of all actively traded commodities rallying, some more than double over last year.

“Peak margin reporting, higher contract value and change of settlement mechanism to compulsory delivery led to a fall in trading volume in commodity derivatives segment” says Navneet Damani, Head of Research, Commodities and Currencies, Motilal Oswal Financial Services.

After the new margin rules kicked in, traders require a margin of ₹2.3 lakh to initiate trade in silver futures — the most traded in FY22. Earlier, one could execute the same trade with a margin of ₹60,000 or less depending on the relationship with the broker. Of course, this is a burden for participants in equity derivatives market as well. However, the catch for commodities is the contract value.

In equity derivatives, the contract value goes through a revision every six months and the rules make sure that the value is maintained within the ₹5-10 lakh range. There is downward revision in the lot size if the value exceeds ₹10 lakh.

But such periodic revisions do not happen with commodity derivatives. The sharp rally in commodity prices has led to a significant increase in the contract value translating to higher upfront margin requirement. The contract value of zinc futures is currently about ₹17.5 lakh whereas it was approximately ₹11 lakh a year back. Correspondingly, the margin requirement has jumped to about ₹2.5 lakh from ₹1.5 lakh.

Compulsory delivery

Another factor weighing on commodity derivatives for a while is the change in the settlement mechanism. In April 2019, physical settlement of commodity derivative contracts was made mandatory. (energy commodities continue to be cash-settled). Thus, traders holding valid derivatives contracts on expiry must take/give delivery of the underlying commodity.

Outside of the actual users of commodities, this has become a significant contractual obligation involving considerable sums, discouraging hedgers and speculators.

Weakened arbitrage trading is playing its role too. “Metal contracts on MCX, which are deliverable, have diverged from LME prices quite widely in the recent years. This is because domestic fundamentals for metals have, at times, diverged from international realities. This is a healthy development for the country’s physical markets. But this has put away inter-exchange arbitragers, who are typically high-volume traders,” says Sandeep Daga of Regsus Consulting.

Aluminium defies trend

The drop in traded lots in gold was because for most part in FY22, prices were range-bound. Also, the contract value of gold (over ₹50 lakh) and silver (over ₹20 lakh) are higher than other commodities, requiring more upfront margins. Even having smaller contracts like gold and silver mini did not help.

Despite the headwinds, aluminium bucked the trend. The number of lots traded nearly doubled in FY22, that is, it shot up to 13.9 lakhs contracts compared to 7.3 lakhs in FY21. “Aluminium was not widely traded in the domestic market till recently. But this is changing with growing participation from physical traders as MCX warehouses provide an alternative venue to them.” added Daga. The share of aluminium trading within the base metals category went up to 15 per cent in FY22 against 5 per cent in FY21.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.