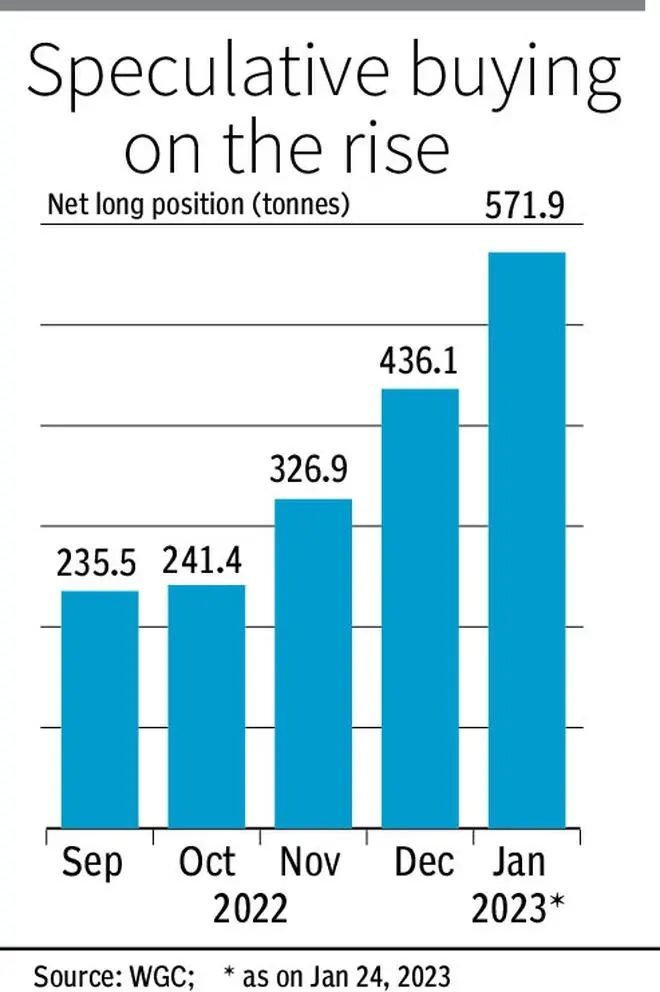

After remaining out of favour in 2022, gold seems to be back on global investors’ buy list in 2023. Gold, in dollar terms, went nowhere in 2022 on the back of a strong dollar and rising interest rates, with the 14 per cent gain for domestic investors coming mainly from a weaker rupee. Since the turn of the New Year though, gold prices are on the rise in terms of dollar as well as rupee.

Gold futures (continuous contract) in India recently hit an all-time high of ₹57,125 (per 10 grams) while spot gold in the international markets currently rules at a nine-month high of $1,949.2 per ounce. Year-to-date, the yellow metal in the international market has gained 5.7 per cent and is up 3.3 per cent in the domestic market.

Dollar down

The very factors that weighed on gold last year now seem to be supportive of a new rally. First and foremost is the rising global expectation that the US Fed and other central banks will hit the pause button on rate hikes some time this year. “With every rate increase, the capacity to increase the rate further comes down. That is one reason for the rise in gold prices,” says PR Somasundaram, Regional CEO India, World Gold Council.

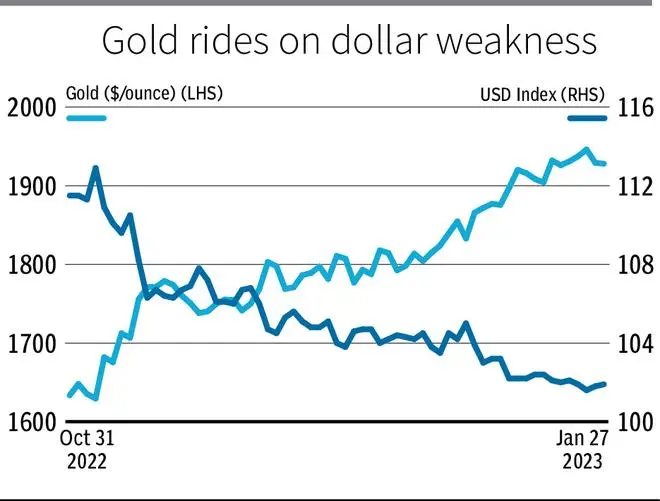

Rising rates boost returns on haven investments such as US treasuries, which act in direct competition to gold for global investors. Higher rates also support a stronger dollar that results in gold imports becoming costlier for emerging market consumers. So, a pause in rate hikes is seen as a positive for bullion. Over the past three months, as the dollar index dropped 8 per cent, the yellow metal gained by 17 per cent.

That apart, recession fears and heightened global uncertainties add to gold’s haven appeal. “There is still a fear of recession in the West and the Russia-Ukraine war is still on. All these create uncertainties in the minds of investors,” adds Somasundaram.

Recently, both equity and bonds have seen a spike in volatility as markets speculate on the direction of rates. But this has supported gold prices, as the precious metal is seen to protect investors against volatility in other assets.

Central banks have the largest above-ground stockpiles of gold apart from a ringside view of both equity and debt markets. They’ve been buying gold aggressively, adding 673 tonnes to their stockpile in the first three quarters of 2022 up from 416 tonnes in the corresponding period of the previous year. Notably, at nearly 400 tonnes, purchases in Q3 last year were the highest by central banks in over a decade.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.