2022 concluded with a continuation of the relentless drop in venture dealmaking worldwide. As volatility in public equities surged and monetary regimes tightened, concerns around growth prospects and the level of valuations have cast a shadow. Here are 4 key charts that tell you the story.

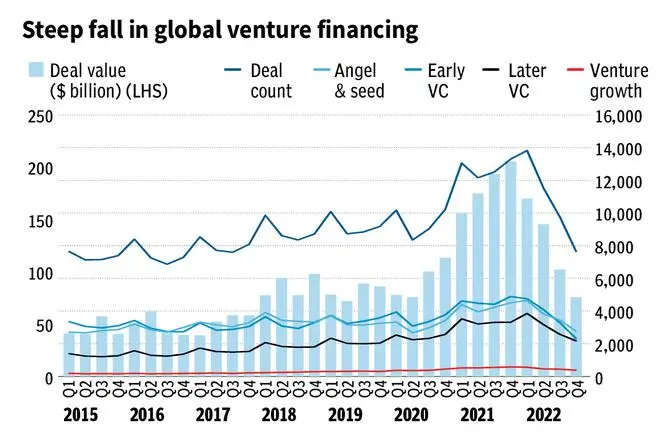

Sharp decline

It was a challenging 2022 for VC investment globally, despite globally, in addition to B2B solutions and healthcare and strong fundraising activity and a major amount of dry power biotech. available in the market. The ongoing conflict in the Ukraine, rapidly risinh interest rates, high levels of inflation and global growth concerns impacted VC landscape.

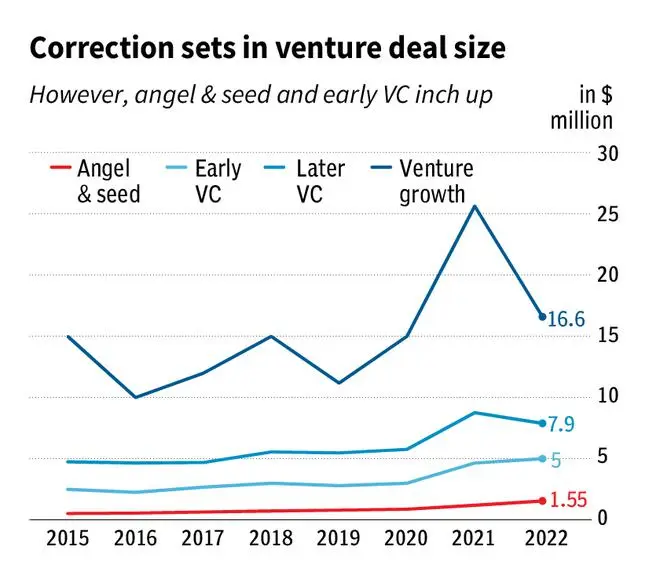

Long overdue?

There was a slight correction in venture deal size in 2022 compared to 2021.

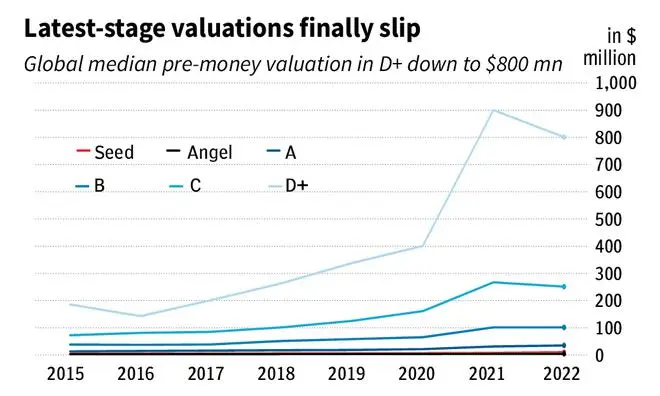

Valuations were hit

Given the subdued sentiments, venture valuations were affected in 2022. The biggest impact was seen in latest-stage companies.

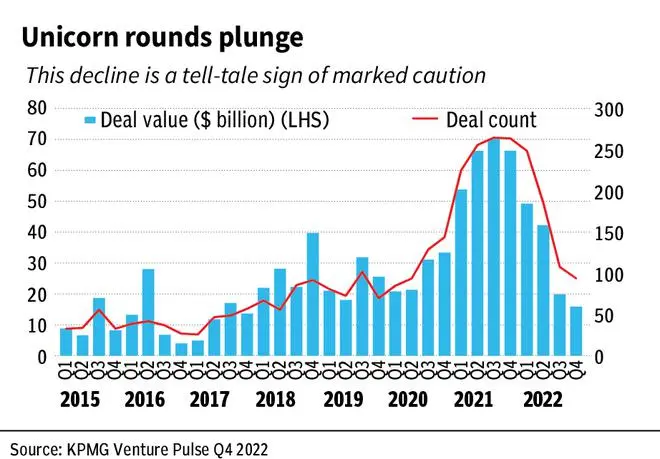

Lack of animal spirit?

The lack of IPO opportunities has caused many unicorn companies to struggle, particularly those that had been planning exits. Getting funding itself was a big challenge.

What happened in India

VC investment in India remained slow quarter-over-quarter as VC investors, primarily investors from the US, continued to take a wait-and-see approach given global macroeconomic uncertainties.

VC investment was soft in both fintech and edtech during Q4’22, likely accounting for the low VC investment total given these sectors typically account for most of India’s largest funding rounds. VC investment in the unified payments solutions dried up considerably; while VC investors continued to invest in fintech areas like microlending and B2B payments, deal sizes were much smaller.

VC investment in India is expected to remain soft in Q1’23, before starting to pick up in Q2’23 — in part due to India’s strong growth and consumption expectations. VC investment in agtech is expected to grow considerably over the next 12-24 months as startups in the space mature and attract larger funding rounds. Commenting on India’s trends, Nitish Poddar, Partner and National Leader, Private Equity, KPMG in India says, “ There’s so much entrepreneurship in India and investors see this. A lot have been betting on microfunds as a way to get their feet on the ground to identify diamonds early — and this has really worked well for some larger VC funds. Given the dollar values involved, microfunds are also easier to raise. Heading into 2023, there’s no doubt microfunds are here to stay. They’ll be what helps incubate very early stage companies and get them to that next level.”

Grim global prognosis

Looking ahead to Q1’23, the VC market globally is expected to remain challenged, with consumer- focused businesses expected to see the most strain. The IPO window, particularly in the US will likely remain closed well into 2023, with little to suggest it will reopen fully in the first half of the year.

As companies run out of cash, there will likely be an increasing number of down rounds and an in increase in M&A activity. Globally, there could also be a number of unicorn deaths over the next few quarters, according to the latest KPMG Private Enterprise Venture Pulse report.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.