Even as the Nifty keeps making fresh life-time highs in recent weeks, the score across the broader markets still remains a tad weak. In the rally from the June lows, and indeed for much of the year, small-caps have underperformed bluechip indices. Here are the details of how small-cap funds fared over the last one year.

Category-wide comparison

In the small-cap mutual fund (MF) category, there are 23 actively managed and four passive funds with more than one-year track record. In the last one year, the actively managed small-cap MFs have delivered 4.6 per cent on an average, which is nearly the same as that of large- and mid-cap funds’ return of close to 4.5 per cent. However, during the period, the small-cap index funds underperformed large and mid-cap funds significantly. Due to the fall in the underlying indices, small-cap index funds delivered negative returns compared with 6.5 per cent and 4.4 per cent for large- and mid-cap index funds respectively.

Performance within category

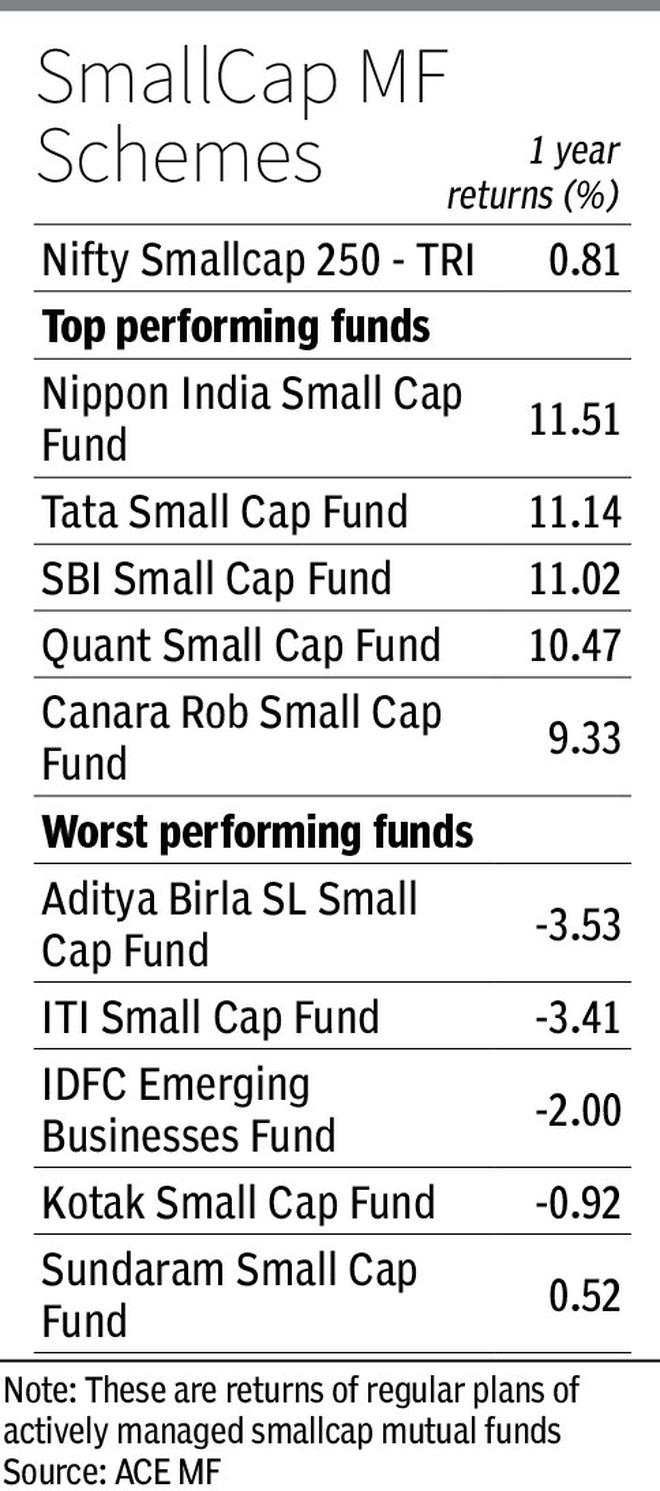

In the small-cap category, around 74 per cent of actively managed funds have been able to beat benchmark index Nifty Smallcap 250 which remained nearly flat during the year. Nippon India, Tata and SBI small cap funds have been the best performers in the category and have delivered about 11-12 per cent returns during the last year. Capital goods has been one of the major holdings for these top performing funds, while financials fetched a good share of holdings for Tata and Nippon India Smallcap funds. SBI and Tata funds have Services sector as one of their top holdings. Further, Nippon India and SBI funds have also invested more than 10 per cent of their corpus in Chemicals and Consumer discretionary sectors respectively.

The funds that performed poorly during the period are IDFC Emerging Businesses Fund, ABSL Small cap and ITI small cap funds giving investors negative return in the range of 2-5 per cent. All three funds have invested good portion of their corpus in Services sector stocks while ABSL and ITI have stocks of financials and capital goods as their other top holdings. Further, IDFC Small cap fund has materials and automobiles also as its major holdings.

Investing in small-cap funds

Of nearly two dozen small-cap actively managed funds, 15 have history of more than five years. One needs to understand that the way active management and comparison with benchmark or among funds work for small-cap funds is quite different from that of large- and mid-cap funds. For large- and mid-cap funds, the universe is 100 and 150 stocks respectively while the same for small caps is nearly 5,000 stocks and hence the scope for active management increases for small-cap funds on account of very less overlap.

Small-cap indices couldn’t participate in the rally enjoyed by large-cap indices since June. In recent months, as FIIs turn buyers, their preference has tended to be with large-caps. However, small-cap MFs have shown impressive returns over longer periods of time. The funds have consistently beaten the benchmark index Nifty 250 small-cap and large-cap funds and hence delivered category-average CAGR of around 19 per cent compared with 13 per cent and 15 per cent for large-cap MFs and benchmark index respectively in the last 10 years. One can argue that things might have changed post-2018 categorisation rules. However even in the last three years, these funds have beaten the benchmark and outperformed large-cap funds.

Despite being seen as a vehicle for high growth and looking attractive currently, small-cap funds come with high volatility and low liquidity, a risk generally borne by funds with higher AUMs (assets under management). One should invest in small-cap funds only if he/she has long-term investment horizon (more than seven years) and the ability to take heavy volatility and drawdowns. Investments might have been done in relatively under-researched stocks and hence the strategies here might have a long gestation period. After you explore flexi-cap, multi-cap, and equity-oriented hybrid funds, you can consider small-cap schemes over the years.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.