I have been investing in the following MFs on SIP basis for the last four years: ₹5,000 each in Quantum Long-term Equity, HDFC Hybrid Equity, HDFC Midcap Opportunities and Franklin India Focused Equity. I invest ₹10,000 per month in HDFC Index Fund Nifty 50.

I want to increase my monthly SIP contribution by ₹20,000 (total ₹50,000 per month). In addition to the above, I am also looking for one-time investment option to accumulate money for my seven-year-old son’s higher education. Investment amount available is ₹25 lakh, time horizon in 10 years. My risk appetite is medium. Please advise suitable options.

Deepthi

Your ongoing SIPs somewhat reflect your moderate risk appetite, with 50 per cent of the corpus going into safer index fund (HDFC Nifty 50) and aggressive hybrid (HDFC Hybrid) categories. However, we are suggesting changing course due to two reasons. One, barring the index fund, which is not rated by bl.portfolio Star Track MF Ratings, the other funds are all middle-of-the road ones, rated 2- or 3-star; secondly, you also have too many funds from one fund house and some diversity can help, due to the different approaches and investing styles adopted by different fund houses.

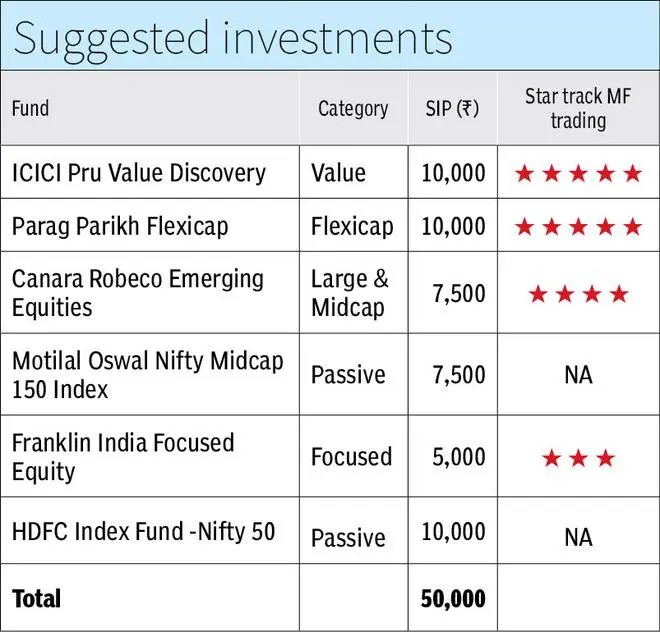

Considering the above aspects as well as the fact that you want to invest an additional ₹20,000, we suggest the following fund choices and allocations:

You can stop SIPs in the older funds and redirect it to the new funds suggested. We have added a new flexi-cap category fund. Considering your moderate risk appetite, we suggest taking exposure to mid-caps through two routes — one a passive fund and two, a large- and mid-cap fund. These choices will ensure that you don’t lose more than the broader market during a downturn. In the former, your loss will be limited to the index fall; in the latter, large-cap holdings will cushion the fall in mid-caps. While you can continue to invest in Franklin Focused Equity for now, keep an eye on its performance vs. peers and take a call a year or so later.

Lumpsum investment for child’s education:

You can split the ₹25 lakh across two funds — a passive debt fund either in Bharat Bond ETF April 2032 (Edelweiss) or in IDFC CRISIL IBX 90:10 SDL Plus Gilt - April 2032 Index fund (NFO opening November 14) and HDFC Children’s Gift, a solution-oriented fund.These choices suit your moderate risk appetite.

The April 2032 Bharat Bond ETF offers a yield to maturity (YTM) of 7.6 per cent now implying that if you invest today and stay till the maturity of the fund, you will realise this yield. The underlying index of the IDFC Target Maturity Fund has a YTM of 7.9 per cent now. The fund’s returns, if you invest in the NFO and hold till maturity, will be slightly lower post tracking error and expenses. Given that bond yields have been on the rise in the last year, the YTM on these funds are good to lock into now, as the RBI’s rate hike cycle is closer to topping out. Low cost and indexation benefit on long-term capital gains (resulting in lower tax payout) are an attraction for these funds. The maturity of this fund also coincides with your 10-year target.

HDFC Children’s Gift is an aggressive hybrid fund, which invests at least 65 per cent in equities and the remaining in debt. The fund has returned 15 per cent CAGR in the last 10 years on lump-sum investments. Points in favour of the fund is that it has a very low portfolio turnover ratio, suggesting that it adopts a buy and hold strategy and waits for its bets to play out. This is understandable since it has a lock-in of five years or until the child turns 18, whichever is earlier. The fund also has higher sortino ratio than peers showing that it contains market downsides risk, better. You can directly invest in the name of your child in this fund.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.