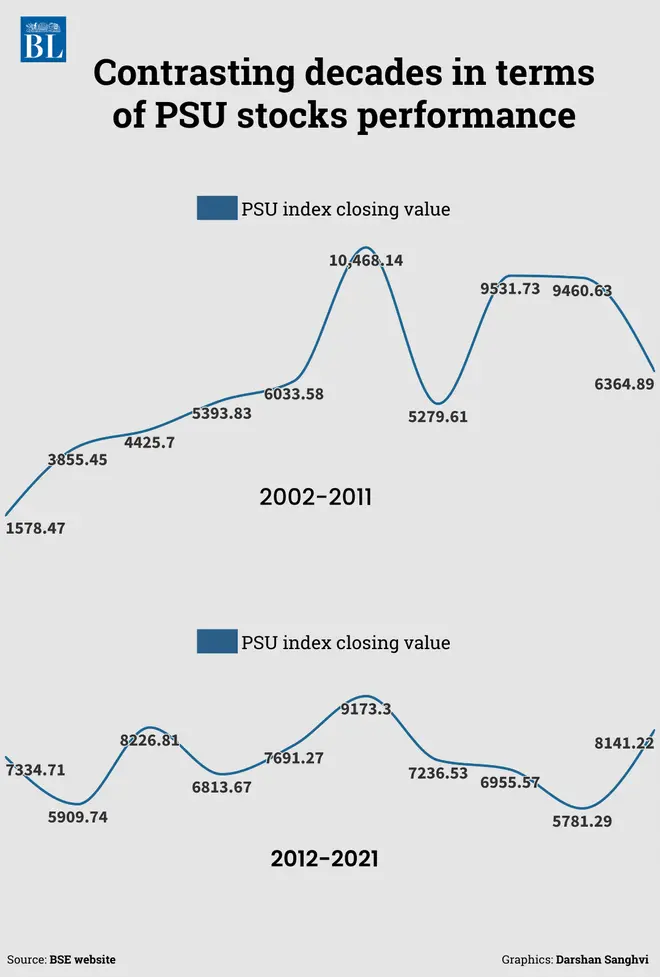

The PSU stocks have been old market favourites for various reasons such as attractive valuations, high dividend yields, sovereign support on account of government ownership and good return potential. Unfortunately, these reasons have been around for a long, and investors in PSU stocks were forced to play the waiting game, especially in the 2012-2021 decade. When the Sensex tripled, the PSU index basket inched by just 11 per cent (in absolute price return).

The PSU theme floundered quite a bit between 2018-2020. After a solid 2021, these stocks seem to have found some favour with investors since mid-June 2022 and have outpaced broader markets. At this time that ICICI Prudential MF has thrown its hat in the ring in the PSU thematic fund space with the launch of the ICICI Prudential PSU Equity Fund. Is it merely a tactical call going with the flow, or is there a fundamental shift in the PSU stock space that investors should note? We discuss this in this NFO review.

NFO details

ICICI Prudential PSU Equity Fund is an open-ended equity scheme to provide long-term capital appreciation by investing predominantly in equity and equity-related instruments of PSU companies. The mandate is to invest 80 per cent in the (PSU) stocks, like any other thematic fund.

The scheme may invest in sectors/stocks that form a part of the S&P BSE PSU index (57 constituents) across market cap i.e. large, mid or small cap, giving investment flexibility.

The fund-house appears to believe that sectors with PSU dominance are experiencing a turnaround, e.g. Public Sector Banks (PSBs), Defence, Energy, etc. It also thinks that since domestic markets have been volatile, the PSU theme is lucrative and can be a good vehicle to ride the volatility.

Mittul Kalawadia and Anand Sharma will be the fund managers.

The NFO ends on September 6, 2022.

PSU stocks as investment opportunity

The term 'PSU' refers to any undertaking where 51 per cent or more of the company is held by the Central Government, State Government, or jointly by the Central and one or more State Governments. The PSU space has three types of companies viz. CPSEs (central public sector enterprises), PSBs and SLPEs (state-level public enterprises).

The PSUs are an important constituent of capital markets and offer wide investment opportunities.

A typical PSU enjoys low-cost of borrowing (which could be beneficial during a rising interest rate scenario), relatively fewer Key Managerial Personnel (KMP), lower risk of diversification into unrelated business, and pay higher dividends. Also, PSU stocks offer their staple advantages of attractive valuation, balance sheet comfort and sovereign support factor.

For retail investors, PSU names such as SBI, PowerGrid, NTPC, ONGC, Coal India, BPCL, BEL, IOC, Gail India and Bank of Baroda do inspire confidence.

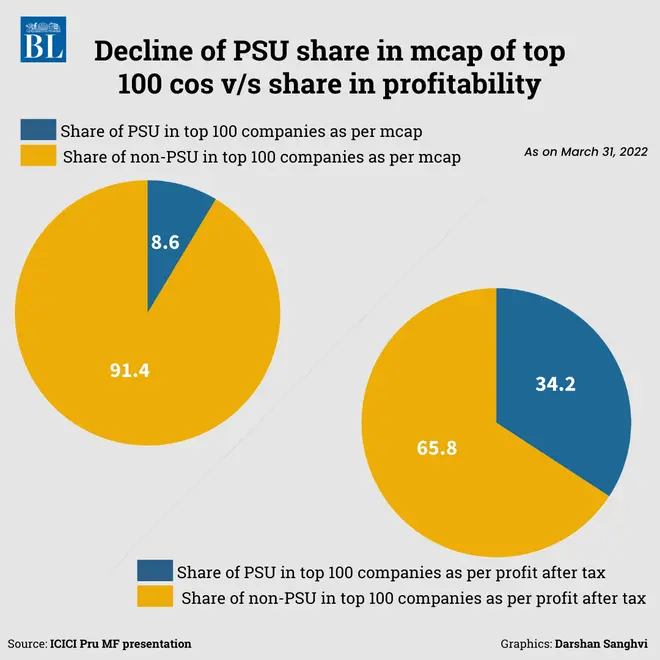

But despite all these advantages, the PSU stocks and companies have not done well. Their share in the m-cap pie has dropped to low levels, as market participants have looked at private sector players for growth.

Existing PSU funds

Thematic funds are not everyone's cup of tea. And given the extra effort to identify entry and exit points as well as the knowledge requirements to play a particular theme, there are just four PSU funds viz. CPSE ETF, ABSL PSU Eq., SBI PSU, and Invesco India PSU. The last two funds have been around for over 12 years, while CPSE ETF existed for over eight years. The ABSL product was launched close to three years ago.

From a return perspective, one-year returns of existing actively-managed PSU funds ranged between 13-21 per cent , which looks good but have lagged the PSU index. The longer-term track record is mixed.

What works, what doesn't

The years 2021 and 2022 have been good for PSU stocks witnessing an upward trend. This comes after nearly a decade of underperformance. However, its sustainability is not evident. ICICI Pru MF seems to think PSU stocks can continue to do well as historically, in the run-up to elections, PSUs performed well on optimism around reforms. Given that the next national elections are in 2024, there is hope that PSUs could do well in the pre-election period. The noise around reforms changing the PSU story have been around, but nothing on the ground suggests a real change.

The PSU sector doesn't have a real trigger that can lead to re-rating. The stocks appear cheap from a valuation perspective, but the earnings growth needs to be delivered ,too, as markets are a slave to earnings over the long term. Starting point i.e. valuations in PSU space, has been attractive for a while now. While this could indicate to some that these companies have a better margin of safety, they could also be a classical value trap.

The 'high dividend yield' factor for PSUs works. Yes, PSUs tend to offer better dividend yields than broader markets. The average dividend yield of the S&P BSE PSU Index (last 17 years) is 2.6 per cent, whereas that of the S&P BSE Sensex is 1.3 per cent. In a volatile environment, companies providing high dividend yields tend to have higher demand resulting in capital appreciation. But, the 2.6 per cent yield is nothing that will, on its own, move the needle on your portfolio gains.

ICICI Prudential PSU Equity Fund is coming out with a PSU thematic fund when the stocks have just experienced good times. The recent past performance can cloud investors' judgement. This product neither appears to be a differentiated offering nor does it approach PSUs in a brand new way. And given the lack of track record, investors may be better off siding with either the passively managed CPSE ETF fund or choosing one of the existing actively-managed PSU funds.

Given the heavy regulation in many spaces that the PSU firms operate, it is not sure that many stocks would indeed be able to unlock their actual value. Therefore, there is no water-tight case for immediate investments in the NFO.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.