Choosing a debt fund for your goals can be a bit tough, if you aren’t too familiar with the categorisation or the underlying strategy of each of the schemes. The macroeconomic environment today is also challenging. Inflation and interest rates are on the rise amidst a global slowdown and second-guessing central bank actions globally is not easy from hereon. Thus, where to bet your money on, in the debt funds category, could be a question in your mind.

Now Kotak Mutual Fund is coming out with an ‘all-weather debt fund of fund’ that seeks to help investors by investing in a universe consisting of all of its own debt funds. Investments would be made from among Kotak Overnight, Kotak Liquid, Kotak Money Market, Kotak Savings, Kotak Low Duration, Kotak Floating Rate, Kotak Corporate Bond, Kotak Banking and PSU Debt, Kotak Bond Short Term, Kotak Credit Risk, Kotak Medium Term, Kotak Dynamic Bond, Kotak Bond and Kotak Gilt funds. The weightages for each of the funds or strategies that will be followed have not been specified, though.

The Kotak All-Weather Debt FoF will be open for subscription till November 10. Will incorporating funds with different mandates and multiple debt strategies within one scheme work for investors? Read on to understand debt fund dynamics before investing in the NFO.

Debt funds and interest rates

In general, when interest rates rise or are on an upward trajectory, debt funds that invest at the longer end of the yield curve (bonds maturing in seven years, 10 years or later) tend to experience losses as investors sell older bonds to buy newer securities with higher coupons — yields harden. Funds that invest in bonds at the shorter to medium end of the curve (a few weeks to a few years) tend to be somewhat immune.

The RBI started its rate tightening act from May this year and has increased the repo by 190 basis points.

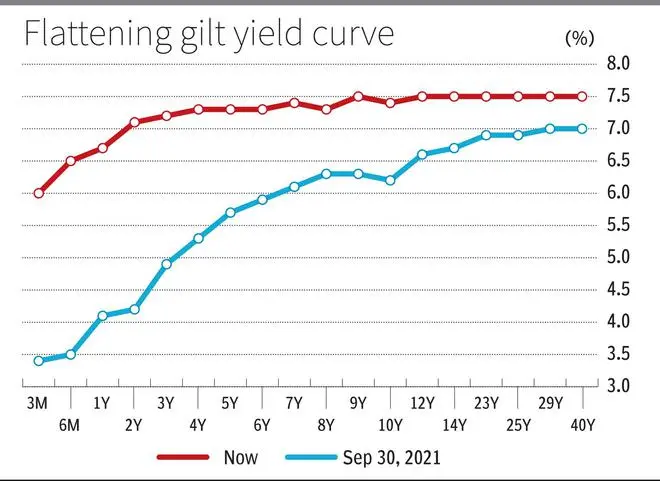

Between September 2021 and September 2022, data from Bloomberg and RBI indicate that the yields on gilts have increased the highest for shorter maturities of up to three years, by over 200 basis points (see graph). While the yields on five-year g-secs have moved up 166 bps, for the 10-year g-secs, the rise is limited to 119 bps.. Over longer-tenure gilts (beyond 10 years), the yields are similar at 7.5-7.6 per cent.

Some analysts and fund managers believe that interest rates may top out after the repo touches 6.25-6.5 per cent (it is at 5.9 per cent currently) by the end of the first quarter of CY2023. And they believe markets may have already factored this terminal repo rate.

Kotak Mutual Fund suggests that the two-five year zone may be appealing for investment, with attractive yields for the given holding period and opines that a good amount of future rate hikes have already been priced in, in this tenure range.

Various strategies

Debt fund NAVs move on two counts. One, due to the interest on coupons accrued periodically from the underlying securities. Secondly, there is also a price change depending on yield movements, inflation, interest rate outlook, anticipation of RBI action, liquidity conditions, time to maturity, global macro factors and so on. This price change can be an increase or decrease, thus creating marked-to-market gains or losses for investors.

There are many strategies that fund managers deploy — accrual, laddering, roll-down, barbell, active management of duration and credit risk — depending on the mandate.

Therefore, no one strategy can be all-encompassing enough to deliver well all the time. Hence, a case for this NFO is being made.

What should investors do?

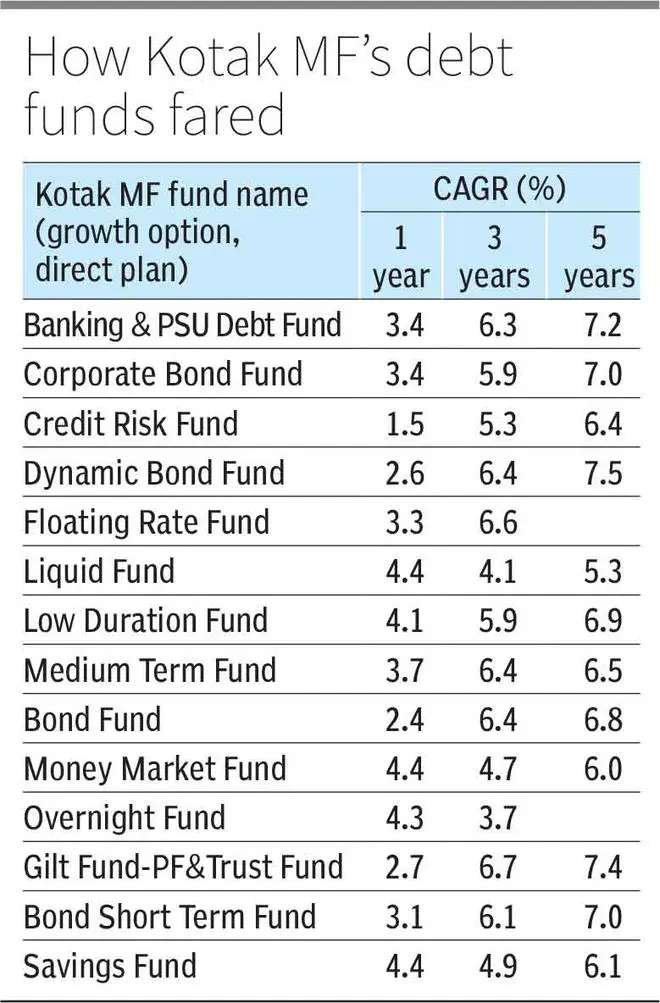

Usually, debt funds are selected based on the purpose for which investors deploy their money in them. Emergency funds are usually parked in liquid, overnight, money market or short-duration funds. For goals that are three-four years away, corporate bond, banking and PSU debt funds are reasonable choices. And for a bit more risk appetite, dynamic bond funds are suggested. In these schemes, duration management can be a key risk and getting it wrong can result in low returns, or even losses for investors. Indeed, liquid, overnight, money market or short-duration funds have done much better than most other categories over the past year or so.

For longer time-frames, there is a constant maturity gilt fund category that is attractive today.

In recent times, the emergence of target maturity passive index debt funds has resulted in low-risk, hold-till-maturity strategy with attractive coupons and yields. These are ideal for investments to reach goals with specific timelines. There are time-frames in the range of 4-15 years available in such funds. An investor can lock into the yields available and hope to maintain that, if she holds the target maturity fund till its expiry, and not sell it any time sooner. Tax incidence becomes minimal, as indexation benefit is available for gains made on holding periods in excess of three years.

Given the varied purposes and strategies of debt funds, it remains to be seen how Kotak All-Weather Debt Fund of Fund can combine all of these into one scheme cogently and deliver attractive returns. Besides, the costs may be higher (the scheme information document indicates 2 per cent for the regular plan), given that the costs of the underlying funds also erode returns.

Investors can wait and watch to see how the strategy plays out before attempting to take exposure in the new fund.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.