It is one of the youngest categories of equity funds to be rolled out, thanks to market regulator SEBI’s norms on investment proportion based on market capitalization in September 2020. The multi-cap category saw many older fund houses (Nippon India, ICICI Prudential, Sundaram, Invesco etc.) moving their existing scheme to the segment, with some launching new offers. LIC Mutual Fund is the latest entrant to the category and is rolling out a multi-cap new fund offer (NFO) that closes on October 20. The fund house has very few schemes in the equity category.

Here’s what you must know about the multi-cap segment and how LIC MFs’ equity schemes from other categories have fared, before investing.

Multi-cap category

SEBI rules on the multi-cap equity funds state that at least 25 per cent of the portfolio of such a scheme must be invested in each of large, mid and small-cap stocks. The balance 25 per cent can be invested according to the fund manager’s discretion.

Be that as it may, most of the funds in the category invest about 50 or more per cent of their portfolios in large-cap stocks. Given that the segment of funds has a limited track record of less than two years, it needs more watching before investors can consider funds from the segment. Of course, those that existed before the categorization norms have a longer track record. But with rigid allocation rules, it remains to be seen if they can deliver consistent returns.

For example, during volatile markets or when there is an environment where sticking to safer established bets may be prudent, the compulsory 25:25:25 (large, mid, small-cap) allocation will mean that such funds could face significant erosion in NAVs.

LIC MF NFO and other diversified schemes

The LIC Multi-cap fund will be expected to stick to the market cap allocation norms. It would invest based on a framework that is a blend of qualitative and quantitative factors – not unlike others in the industry. The fund house says the main differentiation about the scheme would be an in-house MVC (macro-based valuation check) framework. This framework would help the LIC MF Multicap Fund to avoid getting into traps of over-valued stocks or bubbles.

So, the model will have inputs in the form of G-sec rates (yields), a market risk premium and would derive the lower end and upper end of the price-earning multiple for the portfolio via a set of formulae. In other words, the scheme would first work towards deciding the justifiable PE multiple for the portfolio. Then, the growth-adjusted valuation or the desired PEG (price to earnings growth) band would be used for the overall holding to make allocation decisions.

It remains to be seen if this framework would help the fund deliver outperformance over the long term.

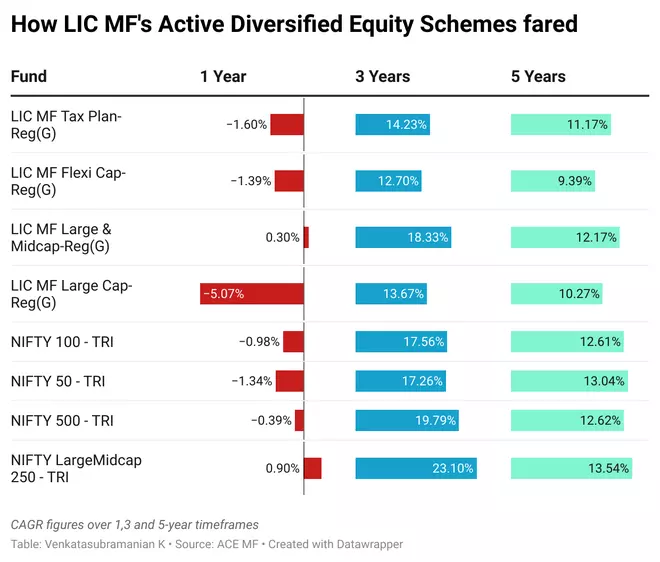

LIC Mutual Fund as such does not run too many active equity schemes. The fund house only runs large-cap, large & midcap, tax-saving and flexicap schemes in the active diversified equity segment. There are theme and index funds.

Active schemes from LIC MF have delivered lukewarm performances over the medium to long term. These funds have generally been in the bottom half in terms of returns in their respective categories across timeframes.

Being a new category, the returns from funds in the multi-cap category have been quite divergent in the last one year. The highest return is from Nippon Multicap, at 11.9 per cent, while the lowest is -6.7 per cent from ITI Multi-cap – these are for direct plans; returns from the regular option are lower.

Investors can safely step aside from taking any exposure to NFOs from the category till they weather multiple market cycles. If the systematic allocation pattern for the category seems attractive for those with an appetite for risk, going with names with strong performance records and those that have been around even before the categorization may be advisable. Even in such cases, waiting for a year or so – by which time many will complete three years in existence – before taking exposure would be a good idea.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.