Long duration debt funds are enjoying their moment under the Sun. In the last three month period, debt long duration funds as a category are the best performing in the fixed income MF arena. As you may know, long duration funds invest in instruments such that the Macaulay Duration of the portfolio is greater than 7 years. Such products are of relatively low credit risk but at the same time are of a relatively high interest rate risk. The long duration fund category is a small with just five actively-managed schemes, making the HDFC offering the sixth one. Should you invest? Read on.

Understanding long duration funds

Typically, long duration debt funds operate on the primary investment objective that they will generate consisten returns with moderate levels of risk. The income may be complemented by capital appreciation of the portfolio. Depending on the fund positioning, they invest and hold onto long dated Government Securities (G-Secs). Long duration funds are also positioned as an avenue that can be used to build and structure a long-term income solution.

With long bond yields remaining largely stable and above inflation levels over the last 20 years, such funds aim to offer market linked returns above inflation. With rate hikes of 225 bps during 2022, large part of curve flattening has already happened; yield movement at the longer end has been very small. Now entire yield curve remains above RBI CPI inflation target range.

The biggest long duration debt fund is Nippon India Nivesh Lakshya, which has a over four-year history. The oldest fund is ICICI Prudentual Long Term Bond. ABSL Long Duration, SBI Long Duration and Axis Long Duration funds have been launched in the recent times (less than one year history).

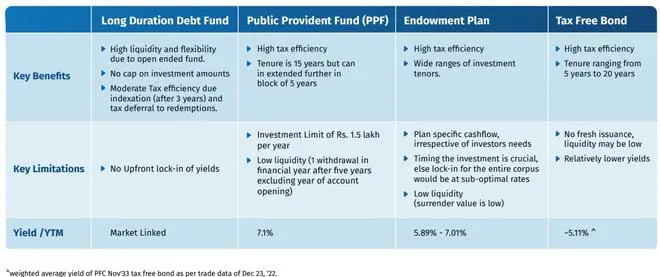

From a product perspective, long duration debt mutual funds offer high liquidity and flexibility basis open-ended structure. Unlike many traditional peers, long duration funds have no cap on investment amounts. These funds offer moderate tax efficiency on account of indexation (after 3 years) and tax deferral to redemptions. See below table for comparison with peers.

Fund positioning

HDFC Long Duration Debt Fund plans to invest in 30+ years residual maturity (2050-2055 maturing) Government Securities with roll down strategy. The fund manager will purchase security closer to the residual period, allowing the fund’s average maturity period to keep rolling down.

According to ACEMF data, the yield to maturity of existing long duration funds ranges between 7.37 per cent (Axis Long Duration) to 7.58 per cent (ICICI Pru LT Bond). In terms of modified duration, the lowest is ABSL Long Duration (6.75 years) while the highest is Nippon India Nivesh Lakshya (10.36 years).

Given the relatively longer duration of these type of schemes, there may be higher mark to market fluctuations during the investment period as compared to debt schemes with shorter duration.

The scheme is exposed to reinvestment risk, as the fund would invest coupons / inflows at prevailing market yields.

From an interest rate perspective, the key risk right now is that the debt market is pricing a premature end to the rate hiking cycle. Structurally, inflation could remain elevated in 2023, and this could be a problem for rate hike cycle proponents.

The fund manager is Shobhit Mehrotra. There is no exit load. The NFO period closes January 17.

Our take

Long duration funds, at least on paper, are expected to benefit from relatively low price sensitivity on interest rate movement since the underlying are long-term investments.

Unlike PPF, endowment or tax free bonds, long duration debt funds give you the flexibility to withdraw investments anytime, at prevailing market prices. Plus, you get benefit of indexation too.

These funds would be an ideal choice to meet long-term investment goals regardless of near-term interest rate movements. In the current macro environment, fixed income strategies have the potential to be an attractive option for investors, specially for those who in the middle of their career lifecycle and wish to plan for post-retirement. Such funds can also complement asset allocation approach for investors with existing long-term equity investments.

While most long duration funds invest almost all the money in sovereign debt, ICICI Pru LT Bond has about 9 per cent exposure to corporate debt. It remains to be seen how HDFC Long Duration Debt Fund plays with sovereign and corporate debt.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.