It is no strange fact that technology and its smart use is going to define the future of many businesses. And this ‘smartness’ has taken the form of Artificial Intelligence (AI) over the past several years and its application spans several industries. The growth of the technology applications – and AI in particular – has thrown up several investment opportunities with established global behemoths and newly minted unicorns jostling for a share of a seemingly ever-expanding pie.

Mirae Asset is looking to cash in on the investing opportunities in the space with the launch of Global X Artificial Intelligence & Technology ETF fund of fund. The underlying Global X Artificial Intelligence & Technology ETF invests in a mix of familiar global names from the software, hardware, e-commerce, and media segments. The NFO closes on August 30. Global X is a Mirae Asset company that has the global ETF.

How will the fund differentiate itself from any regular ETF that invests in the well-known tech-heavy Nasdaq 100? Here are the details.

AI and the growing opportunities

According to the definition given by IBM, “At its simplest form, artificial intelligence is a field, which combines computer science and robust datasets, to enable problem-solving.” Oracle’s website says: “artificial intelligence refers to systems or machines that mimic human intelligence to perform tasks and can iteratively improve themselves based on the information they collect.”

The use of AI spans several industries, including automotive, manufacturing, retail, financial services, transportation & logistics, energy, and technology, communication & entertainment. A PwC report states that the AI adoption rate over the next 3-7 years could range from 23-83 per cent depending on the industry.

AI is expected to contribute up to $15.7 trillion to the global economy by 2030. The global market size of AI offerings is expected to increase from $87 billion in 2021 to a staggering $1,591 billion by 2030, at a cumulative annual growth rate of 38 percent.

Smart assistants (Alexa, Siri, Google Assistant), chatbots, self-driven cars, facial and speech recognition, augmented reality, and unmanned drones are some examples of AI applications.

Is it any better than Nasdaq 100 ETFs?

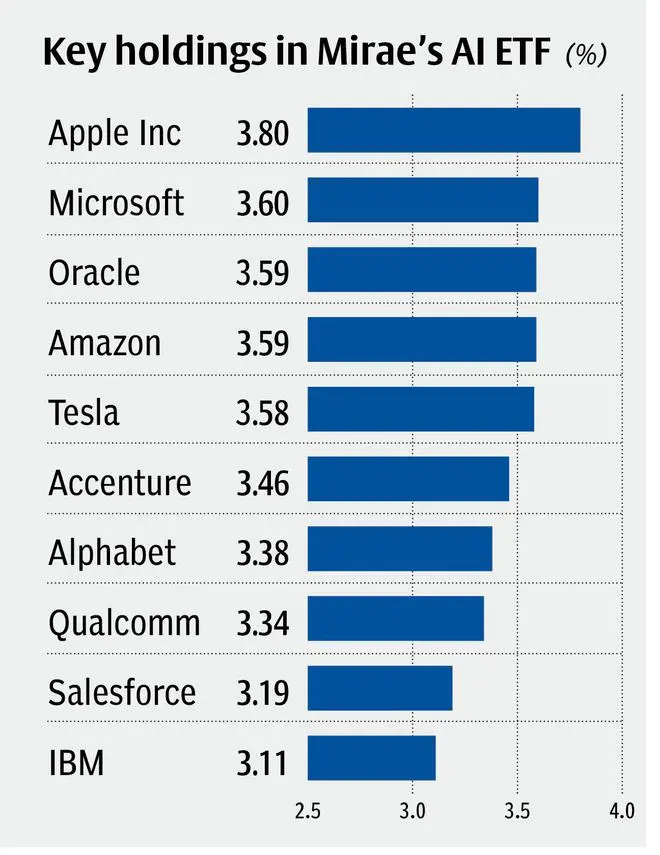

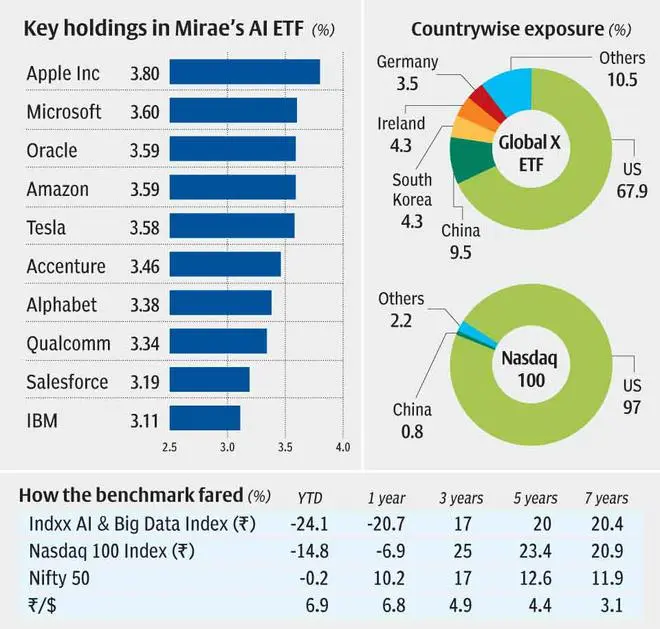

As indicated earlier, Mirae’s fund of fund will invest in the Global X Artificial Intelligence & Technology ETF, which will in turn take exposure to companies in the developed markets that benefit from the use of AI in their products and services. It will invest in the top 60 AI developers and top 25 AI hardware players. The benchmark will be the rupee denominated Indxx Artificial Intelligence & Big Data Index (TRI) (INR) – AIQ. The AI ETF has $153 million in assets, which is not very large by most global ETF standards.

Be that as it may, this AI ETF has several constituents that are similar to those that make up the Nasdaq 100 – Amazon, Microsoft, Alphabet, Nvidia, Qualcomm, IBM, Salesforce, Netflix, Tesla and the like. Of course, the weightages are different.

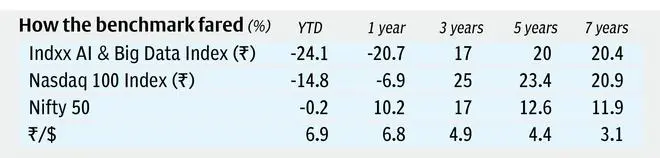

But the returns on a trailing basis have been lower than the Nasdaq 100 across timeframes. The Nasdaq 100 has done better than the AIQ index by 3-8 percentage points over three and five-year timeframes, in rupee terms. But AIQ has delivered much better returns than the S&P 500 and our own Nifty 50 over longer periods of 5-7 years.

With similar stocks, but better returns and liquidity, clearly Nasdaq 100 scores well.

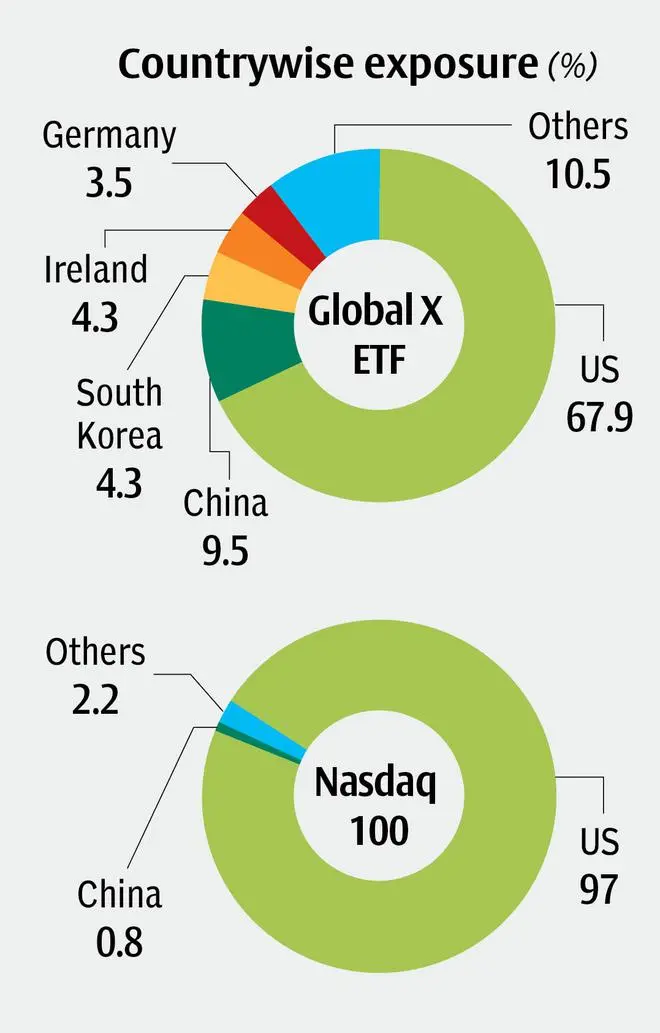

One key difference in the case of this ETF is that it is not US-centric, unlike the Nasdaq 100. The US accounts for only 67.9 per cent of the portfolio, while China has 9.5 per cent weightage. Other developed Asian economies and European countries find exposure too.

While this may be good in terms of diversification, Chinese investments present possible risks given the economic weakness in that country and also challenges of regulatory crackdown. Besides, the fund’s relatively small size and large number of stocks and segments could mean that the fund could be stretching itself too thin.

Also, most of Nasdaq 100’s constituents are global majors and derive their revenues from several countries, thus ensuring sufficient diversification anyways.

What should investors do?

The prospect of playing potentially rewarding technology revolution sounds exciting for investors. And Mirae’s fund of fund does seem promising. But as seen from a finer analysis, the constituents are not vastly different from the Nasdaq 100. The index’s constituents, too, would be beneficiaries of the AI uptick.

Returns are not better than the Nasdaq 100 either. Investors may also have to contend with tracking error and tracking difference. Then, there is the added risk of China exposure as well. With many economists predicting a recession in the US and also a possible slowdown in China, apart from rising rates, could mean that funding for unicorns/start-ups in the technology sector may not be easy to come by. Besides, even the established global tech majors have had a rough ride over the past year or so and there seems to be no immediate respite.

Investors wishing to take overseas exposure can do so via the Nasdaq 100 route or fund of funds tracking that index. The RBI has a $7 billion limit for investing in overseas stocks and funds for the industry and a separate $1 billion threshold for ETFs. Given the market correction in the US in the past one year, some fund houses accept SIPs and lumpsums for Nasdaq ETFs as well.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.