Amidst the flurry of new fund offers (NFOs) that this month has thrown up, we have a somewhat unique manufacturing sector index fund being rolled out by Navi. Called the Navi Nifty India Manufacturing Fund, it will be an index scheme replicating the Nifty India Manufacturing Index TRI.

To be sure, there are four other funds that invest mainly in the manufacturing theme – Aditya Birla Sun Life Manufacturing Equity, ICICI Prudential Manufacturing, Kotak Manufacture in India and Bank of India Manufacturing and Infrastructure – but these are actively managed. Except the Kotak fund, which was launched recently, the other three have been around for 3-12 years.

After being out of favour for many years leading up to 2020-21, the manufacturing as a broad segment is roaring back to life. So, sectors such as auto, auto components, capital goods and speciality chemicals are back in the reckoning. With lower taxation for corporates, government steps such as production-linked incentives (PLIs) and the thrust on making in India have finally helped turn the tide for manufacturing firms. Economic and business indicators such as the IIP, new order book of firms, manufacturing PMI and capacity utilization have been heading northward.

As manufacturing firms gain investor interest, will Navi’s Manufacturing fund gain significantly? Here is a lowdown on the NFO.

Playing a broad theme

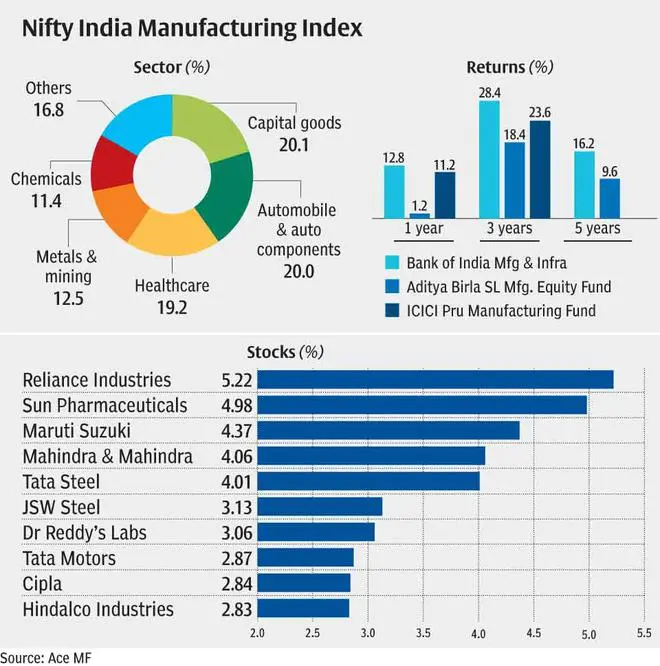

Navi’s Manufacturing fund, as mentioned earlier, will be a passive scheme. The underlying benchmark – Nifty India Manufacturing Index – has a fairly broad representation from across segments. Automobile & auto components, capital goods, healthcare, metals & mining and chemicals are among the top segments, accounting for over 83 per cent of the index. The index will maintain at least 20 per cent weightage for automobiles & components and capital goods.

Most of these sectors are among current market favourites as well, especially autos, capital goods and healthcare, given that stocks in these segments trade at reasonable valuation and have been lackadaisical for a few years now. The top 10 stocks in the manufacturing index are from the Nifty 50 index – Reliance Industries, Sun Pharma, Cipla, Maruti Suzuki, Mahindra & Mahindra and Tata Steel, among others. Most large-cap funds would hold the above stocks. But the weightage for the top 10 stocks is only 37 per cent. With 69 other stocks to play the theme across the balance 63 per cent, the index portfolio is fairly diversified.

The consensus among most analysts and industry observers is that manufacturing is set for strong run in India. The following are some of the positive factors playing out.

- An RBI OBICUS survey of 205 companies in April 2022 reveals that the average new order book has risen steadily over the past three quarters leading to Q3 2021-22 to Rs 224.4 crore from Rs 171 crore in Q1 2021-22.

- Inventory to sales ratio, which was at a high 80 per cent in Q1 of 2020-21 has fallen to 45 per cent in Q3 2021-22. This fall suggests improving demand and improvement in the sales of manufacturing companies.

- As many as 14 key sectors in the manufacturing theme would get PLIs worth Rs 1.97 lakh crore in the next five years

- FDI in manufacturing has increased from $9.7 billion in 2019 to $16.3 billion in 2021

- RBI data suggests that manufacturing capacity utilization has increased from 60% in Q1 2021-22 to 72 per cent in Q3 2021-22

- IIP manufacturing growth was 12 per cent for 2021-22, after years of low single digit growth and even declines over the previous two years

- India manufacturing PMI has risen from 48.1 in June 2021 to 56.9 in July 2022. A figure above 50 indicates growth, while a number less than 50 suggests contraction.

- Many global firms want to move some part of manufacturing away from China and are looking actively at India. China-plus-one strategy could work for India

How have other schemes fared?

As mentioned earlier there are four other active manufacturing themed funds. The Bank of India fund has 50:50 blend of manufacturing and infrastructure themes. The table indicates that the ICICI and Bank Of India funds have done quite well, with 23.6 per cent and 28.4 per cent returns, respectively over the past three years. Automobiles, metals & mining, capital goods and healthcare are some key segments held. There is also considerable mid-cap exposure of 38-65 per cent in their portfolios. The Aditya Birla Sun Life fund has not been able to deliver as well.

The Nifty India Manufacturing Index was launched only last year. Back-tested data as of June 30,2022 shows that the index delivered 17.2 per cent, 8.4 per cent 12.9 per cent annually over the past three, five and 10-year periods. Many diversified fund categories have delivered better returns, especially the actively managed ones, over the long term.

What should investors do?

Navi’s Manufacturing index fund comes with a charge of just 0.15 per cent for the direct plan. Costs are low. But past returns of the index have been underwhelming. Of course, things could play out well in the future, as many of the positive tailwinds take effect for the segment. But an actively managed strategy would be preferable for themes, given that stock entry and exit would be better-timed by the fund manager to gain the most from the opportunistic play. The Nifty Manufacturing Index has outpaced the Nifty 500 in seven of the past 10 calendar years. So, it cannot be written off. Investors can wait and watch to see how the passive style works before taking small exposures later, if at all.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.