The multi-cap funds’ space is heating up with half a dozen launches just in the past year. Throwing its hat in the ring is Tata Asset Management which announced the launch of the Tata Multicap Fund, an open-ended equity scheme investing across large-cap, mid-cap, and small-cap stocks. The New Fund Offering (NFO) window for investing closes January 30 and thereafter the scheme re-opens for continuous sale and repurchase after allotment.

Often marketed as all-weather investment solutions, multi-cap funds are gaining popularity on account of the diversity of market cap allocations, which is thought to help a fund throughout various market cap cycles. Can Tata Multicap strike gold? Or, will it be a middle of the road performer? Let us understand the thinking behind this product.

Also read: How the active versus passive scorecard looks for PSU equity funds

Whole is greater than sum of parts

The defined allocation to m-cap segments i.e. minimum 25 per cent allocation each to large cap (top 100 stocks), mid-cap (101st to 250th stock), and small-cap stocks (beyond 250 stocks) means a minimum of 75 per cent of assets are always invested in multi-cap funds.

The balance of up to 25 per cent in multi-cap funds is to be invested dynamically in equity or debt/money market instruments, an area where a product can stand out. It appears Tata Multicap may invest in any of the three or a combination of the three. This may include debt and money market instruments, units issued by REITs & InvITs, ADR/GDR/foreign securities/overseas ETFs or mutual fund units as per the defined asset allocation.

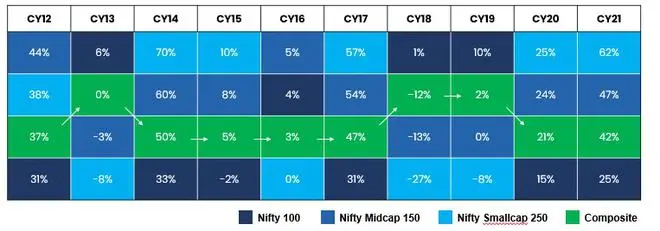

A multi-style investing framework does not necessarily give the best returns each year. But what it does is smoothen the investment journey, which is a big plus for many investors who want to be exposed to mid and small-caps but don’t want the pure-play volatility aspect of it.

Investment approach

Tata Multicap aims to have a combination of investment ideas (stable earnings, earnings upgrades potential and earnings turnaround scope) across the earnings cycle. In terms of portfolio construct, it will be flexible when it comes to m-cap. Each segment has a role to optimise risk-return trade-off and the fund wants to capture this fully by being diversified.

In terms of investing style with regard to valuation, Tata Multicap appears to be led by GARP i.e. Growth At Reasonable Price. GARP is typically associated with high perceived quality investing. In terms of stocks it buys, there needs to be growth potential but it wouldn’t totally disregard price for superb growth prospects. This concept is called value with triggers i.e. the stock may be at a multi-year valuation discount but it also has to be in the early stages of earnings outlook. This is just an example of the fund’s thinking.

Also read: Why you should buy Nippon India Nivesh Lakshya now

Rahul Singh will manage the equity portfolio. Tejas Gutka is the equity co-fund manager. The fund will be benchmarked to Nifty 500 Multicap 50:25:25 TRI.

Our take

Investors considering making investments in multi-cap funds need to understand a few things.

One, the multi-cap equity funds category is a relatively newly minted one. How and what kind of dynamic management of the portfolio will happen with regards to the mid and small-cap portion of the portfolio is key. This is where the extra risk and return come from. Well-run multi-cap equity funds have to proactively adapt to changes in market cycles, though they will be disciplined in allocation.

Two, given that a fixed portion of fund allocation is for mid and small-caps (25 + 25), this arrangement takes away the leeway compared to flexi-cap funds that do not have any mandate to remain invested in any cap segment. So, a solid rationale for remaining invested in mid and small-cap stocks chosen by the fund needs to be omnipresent.

Lastly, different studies have shown that multi-cap funds offer better risk-adjusted performance over many other schemes. However, risk-adjustment is constant endeavour.

Some of Tata MF’s equity have done well in terms of the respective category and are also in the top quartile. These include Tata Small Cap, various thematic/sectoral schemes (IT, natural resources, ethical etc.).

Investors can consider keeping this new fund on their watchlist and track performance.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.