With the RBI calling a sudden meeting of the Monetary Policy Committee (MPC), making worried noises about inflation and hiking the repo rate from 4 to 4.4 per cent last week, the interest rate upcycle in India has officially begun.

But ‘officially’ is the word to note, because the rate upcycle for bond market investors began much before. Markets usually shoot first and then ask questions. So Indian bond markets have been pre-empting this official rate hike for many months.

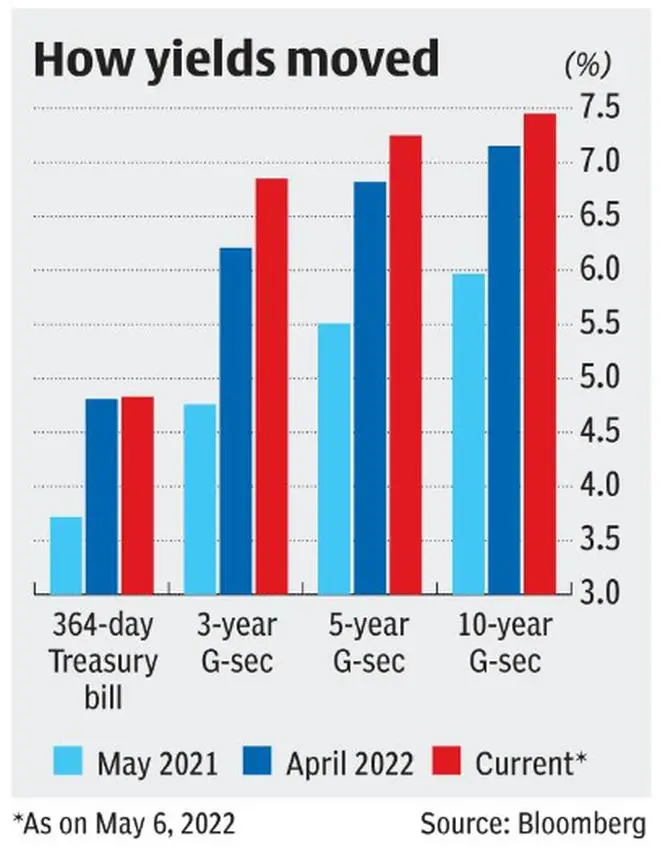

The table accompanying this article tells you that in the one year to April 30, 2022, before the RBI officially flagged off its rate hikes, market yields on the range of government securities had already risen by 110-145 basis points. The official rate hike has only taken market yields up a little further.

With the RBI just beginning to take note of inflation, market watchers expect MPC to continue with its official rate hikes for the rest of the year. Current expectations are for further 75-100 basis point hike in the repo rate over FY23, taking it to (or a little above) the pre-Covid level of 5.15 per cent. The trajectory of rates thereafter will depend on how inflation and economic growth play out.

The investor’s dilemma

This places investors in debt funds in a difficult spot.

If they can be sure that bond markets have already factored in all of RBI’s coming rate hikes, then they should be moving their money into long-term gilt funds, now trading at yields of 7-25-7.45 per cent. This would allow investors to lock into the safest bonds in the market for the next 5-10 years at 7.25-7.5 per cent, which is not at all a bad deal.

But this seemingly simple strategy carries a risk. If the RBI’s actual rate hikes go beyond current guesstimates of 5.15-5.40 per cent and market interest rates run ahead, 5 to 10-year bonds would face significant price declines over the next one or two years, leading to NAV losses in long-term gilt funds. This is not a very unlikely scenario. India’s repo rate ruled at 6.5 per cent in 2018-19 and went as high as 8 per cent in the rate upcycle of 2014.

Given that it would be risky to bet on any one of these outcomes, what can debt mutual fund investors do? Well, they can consider three strategies.

Short-term parking ground

Investors who aren’t sure when they’ll need to withdraw their money and those who are looking for short-term parking ground can consider investing in ultra-short debt funds and floating-rate debt funds. Ultra-short debt funds invest in Government of India treasury bills, commercial paper issued by corporates and certificates of deposit issued by banks. In a rate upcycle, the instruments they own quickly mature and are replaced by higher yield ones. Among ultra-short debt funds, it is best to choose ones which allocate more to safer avenues such as treasury bills and certificates of deposit, while being very choosy with corporate paper. HDFC Ultra Short and Kotak Savings are two funds to consider.

Floating-rate debt funds are mandated to invest in bonds which have flexible interest rates that move up when the yield on a benchmark index moves up. In a rising rate cycle, floating-rate debt funds not only give you a shot at earning higher returns from interest as rates move up, they also protect you from some of the downside that fixed-rate funds are subject to. While selecting floating-rate debt funds, it is important the check the portfolio for actual exposure to natural or synthetic floating rate instruments, given the paucity of such bonds in the Indian market. Aditya Birla Floating Rate Fund and ICICI Pru Floating Rate Fund can be considered here.

Medium-term investment options

If you are looking for medium-term investment options that can offer better returns than your bank or NBFC FD, then this is a good time to buy into passive funds investing in State Development Loans (SDLs). With yields on five-year bonds in the market rising quite sharply since the RBI’s rate hike, there’s only a 25-basis point differential between 5 and 10-year g-secs. SDLs can offer you better yields than g-secs because State governments borrow at a higher rate than the Centre. Kotak Nifty SDL 2027 Equal Weight Index Fund and Aditya Birla Sun Life Nifty SDL 2027 Fund are good options.

Long-term allocations

If you are looking for debt options for your 10-year goals or your retirement portfolio for 10 years plus, then this would also be the right time to start investing in 10-year constant maturity gilt funds. These are debt funds where the fund manager always holds g-secs with an average maturity of 10 years, irrespective of the rate cycle. The key risk in investing in such funds though, is the possibility of sharp short-term NAV losses as rates rise. A long holding period usually evens out such losses. But given that we may not yet be at the top of the rise in market yields, it would be good to deploy only part of your long-term money in such funds now, with the intention of investing more at higher yields. Ten-year constant maturity funds run by SBI and DSP are good bets.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.