With the stock market correcting by around 11 per cent from recent peak hit in December, long-term investors have an opportunity to enter equities. If you have a three-five year horizon and can take moderate risk via large-cap route, you can accumulate the units of Nifty 100 index based ETFs or stagger investments in Nifty 100 index funds via the SIP route. We recommend Nippon India ETF Nifty 100 and Bandhan Nifty 100 Index Fund .

The arguments for investing in these Nifty 100 passive product remains two-fold. One, compared with Nifty 50 and Nifty Next 50 indices, the Nifty 100 offers a more diversified substitute for investors considering broader market exposure. Two, Nippon India ETF Nifty 100 and Bandhan Nifty 100 Index Fund offer a cost-effective and liquid way to gain from the stock price movement of the top 100 companies based on full market capitalisation from the Nifty 500 universe.

Why Nifty 100 now

The across-the-board correction recently provide the opportunity to take exposure to a wider set of stocks. Nifty 100 Index gives the diversification of Nifty 50 plus Nifty Next 50, forming 100 stocks across broad sectors. It also gives exposure to higher free-float market capitalisation of NSE-listed stocks than the other two indices. From the recent December 2022 peak, Nifty 100 has corrected over 11 per cent and its price-to-earnings multiple has seen steeper correction of 17.5 per cent. In fact, Nifty 100 valuations today are about 20 per cent cheaper compared with pre-Covid peak.

While Nifty Next 50 has outperformed broad-based Nifty 50 over consistent periods, it is more volatile (five-year standard deviation is 19.44 vs Nifty’s 19.39). Nifty 100 offers a good way to get exposure to the Nifty Next 50 stocks, with lower volatility (Nifty 100 five-year standard deviation of 19.08).

For those with a long-term perspective, equities are a play on economic growth/revival prospects. Historically, economic growth/revival triggers growth in large-cap and larger mid-cap stocks initially, later trickling to mid- and small-caps. Hence Nifty 100 offers a clean play to leverage this progression.

Do note that Nifty 100 is not the same as making a 50:50 investment in both Nifty 50 and Nifty Next 50 indices. The weights of Nifty 50 and the Nifty Next 50 companies in the Nifty 100 combined index are different. Also, Nifty 100 is a market-cap weighted index, so significantly-larger Nifty 50 companies get a higher total weight in the index.

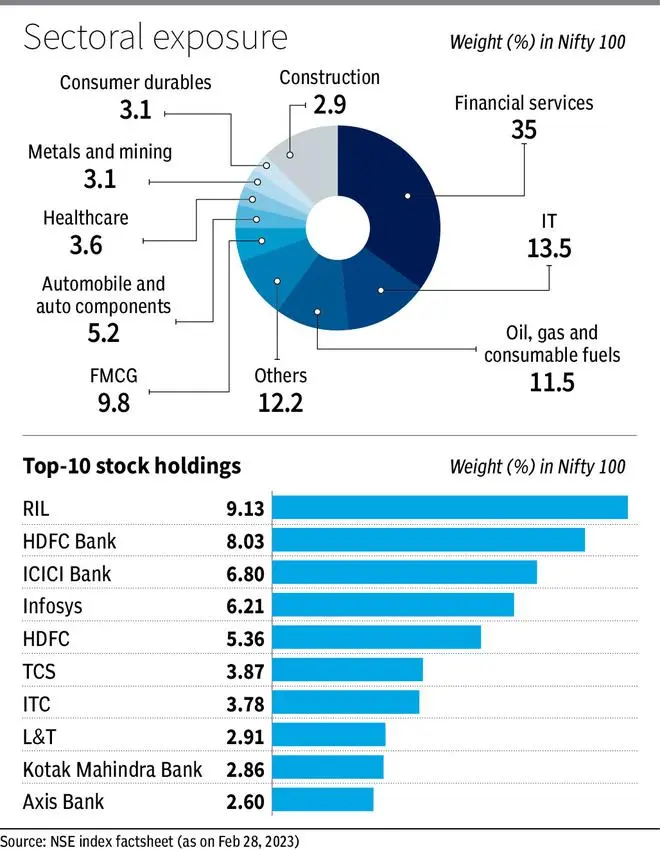

Sectorally, Financial Services (35 per cent), IT (13.5 per cent), Oil & Gas (11.54 per cent), FMCG (9.79 per cent) and Auto (5.22 per cent) are the top-5 weights for Nifty 100, as per February 2023 index fact-sheet. Top stock weights include RIL, HDFC Bank, ICICI Bank, Infosys, HDFC, TCS, ITC, L&T, Kotak Mahindra Bank and Axis Bank.

Preferred routes

Plain-vanilla Nifty 100 ETFs provide entry and exit facility during market hours usually five days a week, cost half as much than index fund counterparts and also have longer track records. Out of the four Nifty 100 ETFs, we prefer Nippon India ETF Nifty 100 on account of tight premium/discount over NAV over the last three years, reasonable impact cost (0.26 per cent), decent one-year annualised tracking error (0.04 per cent based on daily return), economical expense ratio (0.5 per cent), good trading volumes and a 10-year track record. You will need a demat account to trade in ETFs.

For those who want to take the Nifty 100 index fund route, consider Bandhan Nifty 100 Index Fund option on account of reasonable asset base (₹66 crore), decent expense ratio (0.62 per cent regular and 0.11 per cent direct) and decent one-year annualised tracking error (0.05 per cent). Index fund investments don’t require demat account and can be used to do SIPs.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.