Investors looking for relatively safe debt funds that deliver above-average returns compared to many fixed-income instruments can consider schemes from the money market category. As funds that invest in only instruments with maturities of less than a year, the risks are lower. Money market funds invest in the safest of instruments – certificates of deposits, repo windows, treasury bills and corporate bonds with highest short-term ratings. These funds also beat fixed deposit returns on a post-tax basis, if held for more than three years.

You can use money market funds for parking your emergency corpus and may be even for medium-term goals that are three-four years away.

In this regard, SBI Savings Fund can be considered from the category in light of its consistent performance over the past nearly 19 years. The fund and indeed almost the entire category was immune to the debt market defaults and accidents that occurred between late-2018 and mid-2020.

Steady performer

SBI Savings has been among the best performers in the money market category over the years. It has delivered nearly 7 per cent annually since its launch in 2004.

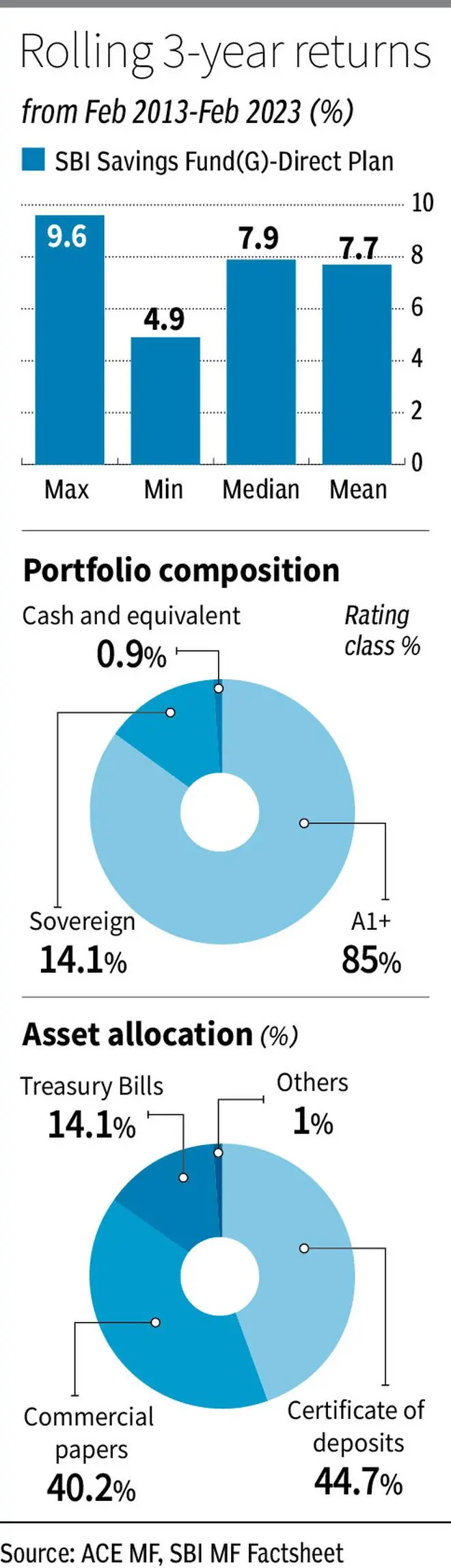

When we take the three-year rolling data over the past 10 years – Feb 2013 to Feb 2023, the fund’s average returns have been nearly 7.7 per cent. This is higher than the likes of Kotak Money Market and Tata Money Market. The rolling data also shows that the minimum return is 4.9 per cent, while the maximum return is a healthy 9.6 per cent. When five-year rolling returns are taken over the same 10-year period, the fund manages a robust 7.7 per cent on an average.

Barring 2021 and 2022, when the bond markets were rather tough to navigate, SBI Savings has generated 6.3-9.5 per cent returns in the previous seven calendar years. There has been no instance of the fund recording negative returns in any full year.

Given that gains from debt funds are taxed at 20 per cent with indexation if held for more than three years, these returns are better than those on offer from fixed deposits on a post-tax basis, especially for those in the higher slabs.

Safe portfolio

The portfolio that SBI Savings Fund holds is fairly low on risks. The average maturity of the portfolio has generally ranged between 0.2 and 0.6 years. In the recent January portfolio, the fund’s average maturity is 0.4 years, while the modified duration and Macaulay duration are 0.37 years and 0.4 years, respectively. The yield of the portfolio is quite attractive at 7.45 per cent.

There is minimal interest or duration risk in such funds most of the time, given their short maturity profile.

SBI Savings invests mostly in commercial papers and certificates of deposits of issuers who have the highest short-term credit rating of A1+. It rarely takes cash position and remains fully invested most of the time.

The commercial papers of LIC Housing Finance, Bharti Airtel and JM Financial are some key holdings, as are the certificates of deposits of HDFC Bank, Bank of Baroda, Axis Bank and Kotak Mahindra Bank. Apart from these, the 91-day and 183-day treasury bills are among the larger investments of the fund. It avoids taking any credit risk in its portfolio.

With an asset size of ₹18,776 crore, the fund is the largest in the category. Investors can consider parking lump-sums in the fund.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.