With the market off its peak it hit purple patch since it peaked last October, investors and traders seem to have shifted their focus to options from the cash segment. Incidentally, relatively lower margin requirements for options as compared to futures, after the final phase of the peak margin rules took effect kicked in in last September 2021, has also pushed market participants towards options.

Turnover shrinks

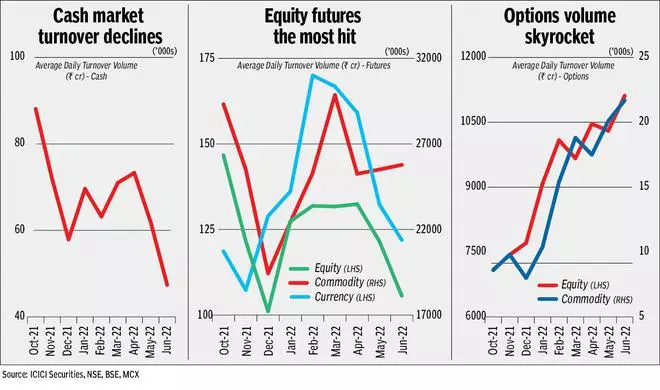

The average daily turnover volume (ADTV) in the cash market, (both NSE and BSE combined), declined to ₹47,500 crore 475 billion in June 2022 — the lowest monthly ADTV since February 2020, from ₹88,100 crore 881 billion in October 2021last year. This is because of the weak market conditions since October, when equities largely topped out. By the end of June, the benchmark indices, the Nifty 50 and the Sensex, had dropped 15 per cent each from their respective October 2021 peaks.

Moreover, experts opine that that the performance of mid and small-cap stocks is key for cash volumes. Says Deepak Jasani, Head, Retail Research, HDFC Securities: “Whenever mid- and small cap stocks underperform, volume in the equity cash segment tends to fall.” By the end of June, the Nifty Midcap 50 and the Nifty Smallcap 50 indices, for instance, had lost 21 and 35 per cent, respectively, from their October highs.

The peak margin rules did have an impact, too, especially with respect to intra-day cash trades, as the new framework meant no intra-day leverage. It also affected the futures segment. Thanks to the bull market, higher stock prices also resulted in higher contract value of futures, pushing up the margin requirements. Thus, the ADTV in equity futures dropped 28 per cent from ₹1,46,700 crore 1,467 billion in October last year.

Similarly, the ADTV in commodity futures declined to ₹2,57,75,800 crore 2,57,758 from ₹2,93,18,400 crore 2,93,184 billion in the corresponding period as commodities came into bear grip.

This is where options came in as a good alternative.

A good option

Options, with lower margin requirements and with the flexibility of taking positions on either side, scored over cash and futures segment. Thus, the turnover in options on both equities and commodities ballooned.

The monthly ADTV of equity options shot up to the highest ever at ₹1,11,13,900 crore 1,11,139 billion in June against 2022 compared to ₹70,92,000 crore 70,920 billion in October 2021. During this period, the ADTV of commodity options increased by 2.5 times d.Apart from lower margin requirement being an attractive proposition, participants could have turned to options to hedge their existing cash portfolios as well.

For commodity options, the ADTV going up wasue to heightened activity in energy complex commodities — i.e., crude oil and natural gas triggered by the Russia-Ukraine war. Note that options on natural gas were only launched in January this year but still managed to garner good amount of volume – the ADTV stood at nearly ₹4,700 crore billion in June. Interestingly, three-fourths of the commodity options volume came from crude oil, the ADTV of which more than doubled to ₹16,200 crore 162 billion in June this year as against ₹7,700 crore 77 billion in October last year.

Exception

In the currency segment though, the futures volume was largely steady. The Fed and RBI actions propped up the volatility in the currency market, opening the door for more participants. Since currency options are less liquid, futures were the natural choice for traders.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.