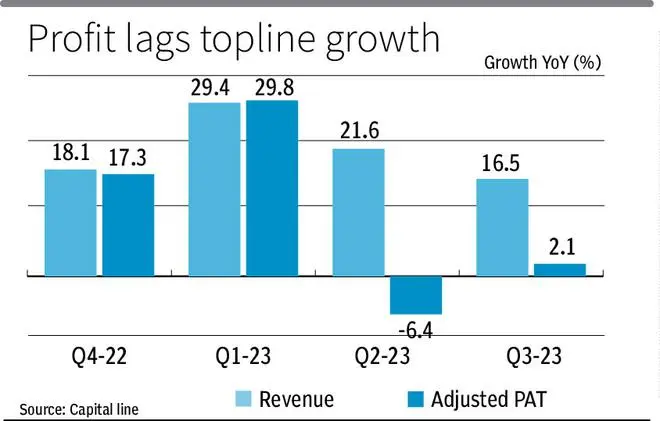

India Inc’s profits continue to lag revenue growth based on the Q3 report-card till date of 1,528 companies (excluding BFSI). While the cumulative y-o-y revenue rose a robust 16.5 per cent, EBITDA and net profit growth underwhelmed at -2 per cent and 2 per cent, respectively.

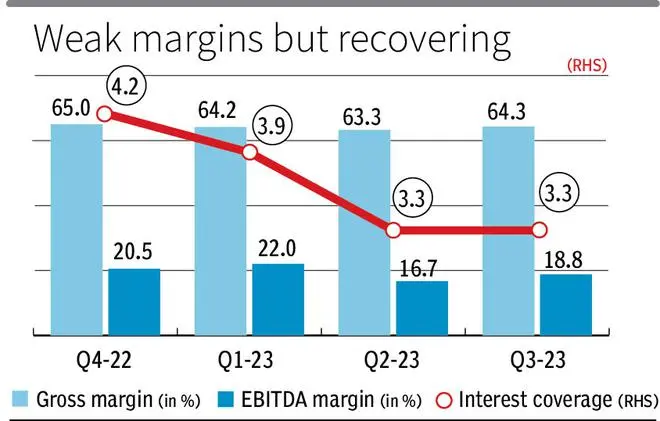

Q3 results indicate that the inflationary impact on raw materials may be waning with a 200bps sequential improvement in EBITDA margins to 18.8 per cent, but costs are still higher than previous years. The interest coverage ratio remains flat on a sequential basis at 3.3 times.

Overall revenue growth at 16.5 per cent y-o-y was lower compared to the average 23 per cent y-o-y in the previous three quarters that gained from the weak Covid base effect. Starting from Q3, the topline growth run rate may be without the aid of a Covid-impacted base.

Companies in sectors up the supply chain—refineries and power generation—reported 23/28 per cent y-o-y growth gaining from higher commodity costs. The IT-Software segment, too, continued to report strong growth at 20 per cent y-o-y despite speculation of developed market recession.

The automobile sector reported a 22 per cent y-o-y growth driven by premiumisation through SUV demand and higher ASPs, but companies reported lower volume growth as chip supplies are still not fully back. The two-wheelers segment is beginning to see a return of rural demand which had been weak the last two years.

The pharma sector reported 12 per cent revenue growth and cement 15 per cent. Both sectors were able to partially pass through the input cost inflation. The steel sector reported 3 per cent y-o-y growth as the full impact of the export duty hike (which has since been reversed since) played out on realisations, off-setting volume growth.

Operational costs

Raw material costs as a percentage of sales are still 140 basis points higher than the Q3 of FY22, but declined by 100 basis points sequentially.

Most sectors gained sequentially on the raw material front led by steel and automobiles where costs declined 340/160 bps, respectively. But steel margins are still 13 percentage points lower than that reported in Q3 of FY22.

Similarly, FMCG raw material costs have improved 100 bps sequentially but are still 170 bps higher y-o-y. ‘Other expenses’, including power and fuel, continue to remain high.

‘Other expenses’ as a percentage of sales have declined 120 bps sequentially but are still 220 bps higher than Q3FY22.

For energy intensive sectors like cement and steel, while there is q-o-q improvement, the cost is still higher by 450 and 30 bps y-o-y, respectively.

Overall, EBITDA margins at 18.8 per cent have improved from 16.7 per cent in Q2 but are still 360 bps lower than the 22.4 per cent reported in Q3 of FY22.

Only the auto sector has reported a 250 bps y-o-y improvement in EBITDA margin, owing to the current auto cycle.

Post multiple rate hikes, the absolute interest cost rose the highest y-o-y in Q3 at 22 per cent, compared to 18/2/1 per cent y-o-y in the previous three quarters.

Overall, the financial leverage health measured by the interest coverage ratio at 3.3 times in Q3 may be safer, but lower than the 3.9 times reported in Q3 of FY22. Going forward, revenue growth outlook will be on a higher base as Covid effect wanes, normalising the base effect.

Profit growth will be dependent on the disinflationary effect gaining further traction and providing relief in input costs from hereon.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.