There is much to cheer about how mutual funds are raking it in.

With assets of ₹39.5-lakh crore and counting — as investors of all hues continue to deploy a portion of their savings in these instruments — there is little concern for the industry.

But get down to what is happening at the individual investor level and there are some noteworthy trends.

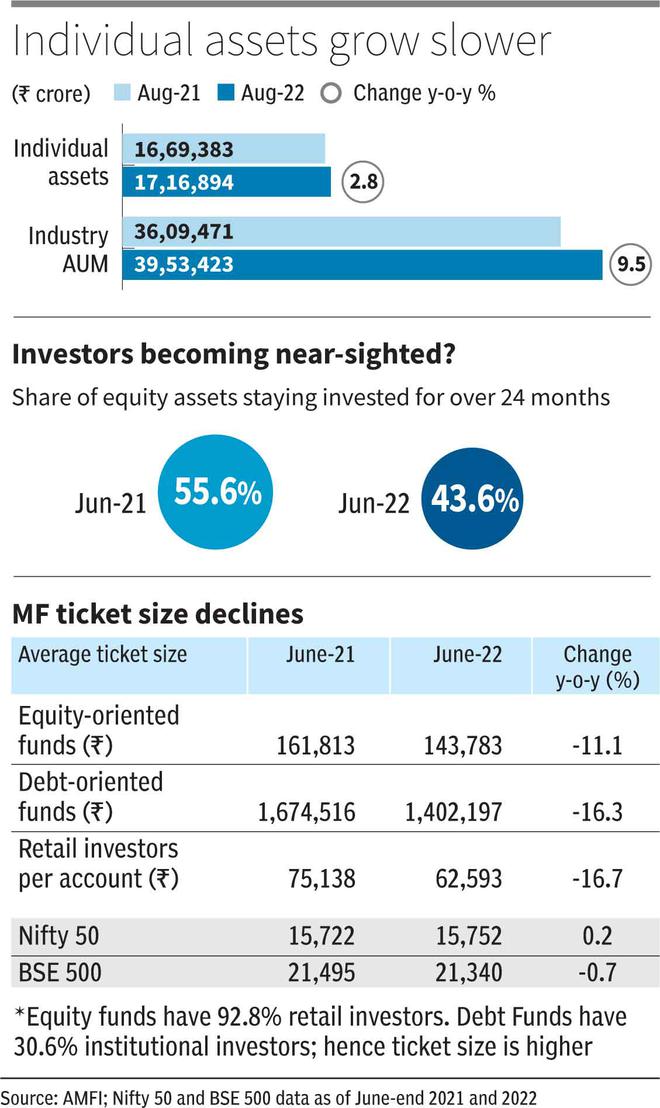

Data from industry body AMFI (Association of Mutual Funds in India) suggest that assets at the individual level are growing slower than the industry, that the average ticket size of retail portfolios has declined, and the holding period of equity-oriented schemes has shrunk in the last one year.

With all this happening when broader indices have remained flat over June 2021-June 2022, markets cannot be blamed.

Here is a lowdown on these trends.

As of August 2022, the mutual fund industry’s assets under management (AUM) totalled ₹39.5-lakh crore, representing an increase of 9.5 per cent over August 2021.

Dipping investments

But, over the same period, the assets of individual investors grew just 2.8 per cent to ₹17.2-lakh crore.

Break that down to the retail investor level and the figures drop further. These figures are made available as of June 2022.

The average ticket size for equity-oriented funds — a segment dominated by individual investors, who have a nearly 93 per cent share — has fallen 11.1 per cent in June 2022 to ₹1.43 lakh from ₹1.62 lakh in June 2021. Drilling it down further, at the ticket size on a per account basis, the fall is steeper. From ₹75,138 in June 2021 down 16.6 per cent to ₹62,593 in June 2022.

One may be tempted to link this fall to market gyrations. But between June 2021 and June 2022, the Nifty 50 and the broader market BSE 500 indices remained almost unchanged.

Short stay

One of the cornerstones of equity investing is that if the right choices are made, long-term investments pay off. But few retail investors seem to believe in this now.

In June 2021, 55.6 per cent of the mutual fund industry’s assets remained invested for a period of more than 24 months. But that proportion has come down to 43.6 per cent in June 2022.

A mix of newer mutual fund investors coming in with smaller amounts and many pulling out at the sign of market volatility or for personal requirements and shorter horizons may be at play here. The lure of direct stock investing may also be taking some investors away from equity mutual funds.

For reaching all their goals, retail investors must invest steadily for longer periods of 10-plus years, increasing the amounts periodically. With smaller amounts and shorter investment timeframes, investors would struggle to reach their financial targets and beat inflation.

Perhaps the next phase of investor education must focus on increasing the staying power and raising SIP amounts to make meaningful gains.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.