Some corporates are walking the extra mile when it comes to corporate governance, but there is still a long way to go for top Indian companies, reveals the second edition of the ‘Survey on Corporate Governance and Business Responsibility Report’ released by Excellence Enablers. This is a study based on the annual reports and website disclosures of Nifty 100 companies.

Meetings become more participatory

There is enhanced participation in Board meetings, thanks to these meetings going virtual due to the pandemic. In FY21, 86 per cent of Board members had 100 per cent attendance, compared with only 63 per cent in FY20. More importantly, 89 per cent of the independent directors (IDs) had full attendance in FY21, as against 55-58 per cent in the previous three fiscals. Attendance of the Board in AGMs improved too. 72 companies saw 100 per cent attendance of the Board in 2020 AGMs, for example.

“Since the AGM is the one opportunity that a large number of shareholders get to interact with directors, it is necessary that all directors participate in AGMs. Not to do so would be to show scant regard to the shareholders and the company. In the interest of promoting good corporate governance, law and regulations should mandate that all the Directors should attend AGMs and EGMs,” says the report.

In the same breath, it points out the huge time lag between the finalisation of accounts and the holding of the AGM, keeping the shareholders waiting. It urges companies to advance the timeline as the pandemic settles. While there are companies that hold their AGMs within 45 days of finalisation, the time taken by the top 100 companies by market cap ranged 132-151 days in the last three fiscals (of which FY19 is pre-Covid), the study reveals.

Independent directors unrecognised

With only about one-fourth of the companies paying the maximum sitting fee of ₹1 lakh for directors to attend Board meetings, the survey bats for more companies to open up their purses on this front. Besides, it is also in favour of paying IDs better.

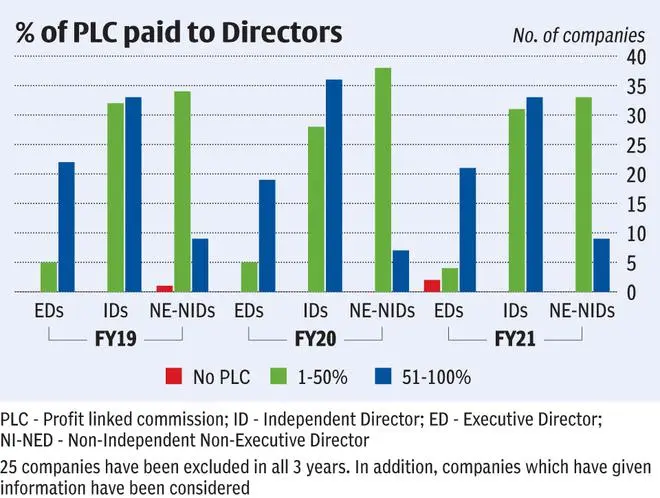

“While the statutory ceiling for the amount of profit-linked commissions to be paid to non-executive directors is 1 per cent of the net profits of the company, the actual amount paid, especially to IDs in some cases, falls woefully short of this prescribed limit. With stock options no longer available to IDs, companies need to revisit the amount of PLC paid so that Directors of acceptable quality are enthused to join Boards, and to stay on”, it adds. In the last three fiscals, only 14-15 companies in the Nifty 100 have paid 100 per cent of the PLC to IDs ; 2-3 companies have paid 0-3 per cent of PLC to IDs while paying 97-100 per cent to whole-time directors. It minces no words when it says, “Deciding on a number as the total amount of commission to be paid, and using only a part of that amount for compensating IDs, is an unacceptable proposition”.

Sustainability gaining attention

While in FY20, the top risks identified by companies was related financial, operational and Covid-related risks, in FY21, worry over ESG related risks climbed to the top. That companies are looking at sustainability more seriously is good news. Out of 85 companies that have expanded the ‘terms of reference’ for CSR (Corporate Social Responsibility), 7 companies have reference to ESG and 17 have reference to sustainability.

The statistics too looks good. In FY 21, all 100 companies published their Business Responsibility Report (BRR), which is mandated for top 1000 companies by market cap. 48 companies have Board or board/management level committees for oversight of responsibilities related to ESG. While SEBI has mandated Business Responsibility and Sustainability Reporting from FY2022-23 for top 1,000 companies by market cap, 72 companies are already publishing sustainability /ESG reports, in addition to BRR. 3 companies have been publishing a Sustainability report since FY 04.

The extra mile

Compliance and corporate governance are not synonyms, says the survey. “Good corporate governance is no more than doing the right things, without having the lawmakers or the regulators laying down what requires to be done,” it points out. In this regard, few companies have walked the extra mile in some aspects. For one, in FY21, 30 companies had only IDs as members of the audit committee (AC). 23 companies had only IDs as their AC members throughout FY19, 20 and 21.

Given that the role of the audit committee is to judge the legality and propriety of management actions, this can be considered a best practice. It is noteworthy that SEBI has mandated (wef January 1, 2022) that related party transactions would be cleared only by the IDs on the AC. Similarly, 17 companies had only IDs as members of the nominations and remunerations committee continuously in the last three fiscals. Secondly, about 15 companies of the Nifty 100 have been continuously complying with all the discretionary requirements under SEBI LODR Regulations, 2015, since FY18.

Finally, almost two-thirds of the entities had separated the post of Chairman and MD in FY21, though this number has remained almost stagnant over the last four fiscals. After recently being made voluntary, it needs to be seen how corporates fare on this front going forward.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.