Despite delivering stellar performance in Q3 FY23, the stocks of many paper producers have remained under pressure on a year-to-date (y-t-d) basis.

Paper stocks have shed between 1 per cent and 8 per cent since this January, with the exception of Andhra Paper, which is majority-owned by West Coast Paper Mills.

Interestingly, paper stocks were among the outperformers in 2022, gaining between 47 per cent and 127 per cent.

So, what has changed in the last two months? We believe the muted stock response to robust performance, was on two counts.

Peaking realisations

First, paper companies reported strong performance in the December 2022 quarter on the back of strong performance in the writing and printing segment with a healthy growth in volumes and prices.

For instance, JK Paper reported 60 per cent growth in revenue, of which volume growth contributed about 30-32 per cent and the balance was driven by price realisation. While the writing paper segment’s demand continues to remain strong, the realisation, according to JK management’s commentary, appears to have peaked.

For JK Paper, the realisation for the quarter stood at over ₹84000 a tonne, which is 27 per cent higher than the same period last year. Thus, incremental upside in terms of price realisation may be limited. However, industry sources indicate that prices of writing and printing paper continue to remain stable and haven’t witnessed any pressure yet.

Second, while the demand for packaging boards has remained strong in Q3 FY23, the realisation has moderated. Similarly, the realisation for coated paper has moderated in the December quarter. Any further weakening of the price trend for coated paper and paper board can have a bearing on the operating margin.

Improved margins

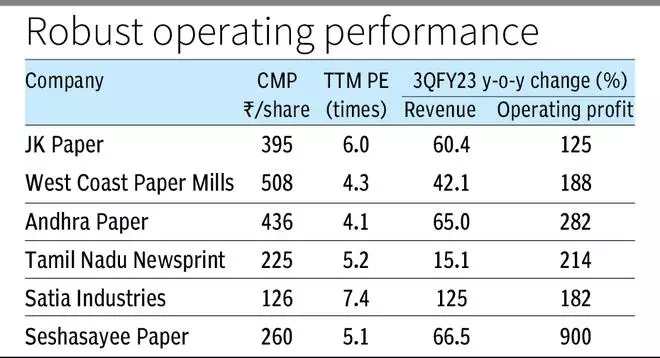

On a positive note, the moderation of fuel costs and reduction in input prices have led to improved margins for all companies in the December quarter (as shown in the above table).

For instance, Seshasayee Paper Board’s revenue grew 67 per cent in December quarter y-o-y, while operating profit zoomed 10 times from ₹15 crore last year to ₹150 core in Q3 FY23. Likewise, Andhra Paper grew its operating profit by 3.8 times to ₹237 crore, while revenue grew 65 per cent to ₹571 crore.

Although there may be some profit moderation on a sequential basis due to a decrease in packaging board and coated paper realisation, any decline in price can potentially be offset by volume growth, as we foresee stable demand.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.