Sometimes the best form of defence is an offence. Defence stocks have taken to this ‘literally’ over the last three months. Since the onset of the Russia-Ukraine war and concerns over war escalation, companies with a revenue share from the defence sector have seen their stock prices zoom. Also, the Indian Government’s endeavour to strengthen the country’s defence system with an enhanced focus on indigenisation has rekindled investment interest in companies that cater to the defence segment.

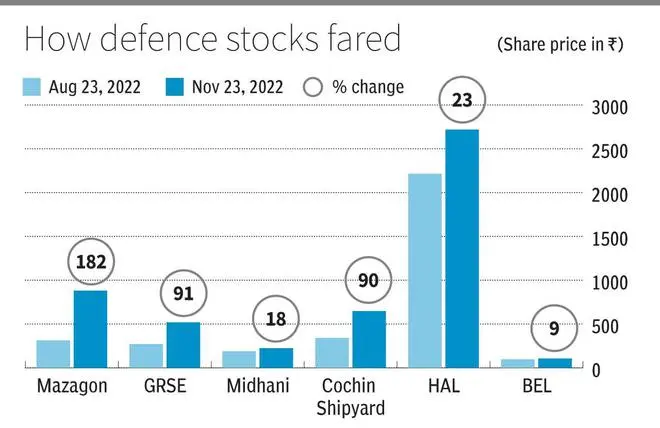

Prominent players in this space, such as Hindustan Aeronautics, Garden Reach Shipbuilders and Engineers (GRSE), Bharat Electronics (BEL), Mishra Dhatu Nigam Limited (Midhani), Cochin Shipyard and Mazagon Dock Shipbuilders, have seen their stock prices rally between 10 per cent and 177 per cent. While BEL was an underperformer, with a 10 per return on a three-month basis, Mazagon Dock Shipbuilders has been the star performer, with a whopping 182 per cent return over three months.

What has helped the investment interest in the stock of Min-Ratna company, Mazagon Dock Shipyard?

The company’s unique business model, with its niche as the country’s largest builder of warships and submarines, makes it a differentiated proposition. Being a defence PSU that comes under the Ministry of Defence, the company is 84 per cent owned by the Indian Government. Having started as a single unit, ship repair company, Mazagon has grown into a multi-product company, which builds offshore structures, cargo ships, passenger ships, multipurpose support vessels and water tankers besides submarines and warships.

Second, sound financials and a strong balance sheet, resulted from a robust business model, which has added to the company’s attractiveness and caught investor attention. Mazagon is a net cash company with ₹11,941 crore cash as of September 2022. Interestingly, the company’s market cap is about ₹17,481 crore. Borrowings as of September 2022 were barely ₹9 crore, implying net cash of ₹11,932 crore, translating into ₹591 per share. In a rising interest rate scenario, wherein leveraged companies see a significant earnings haircut due to rising interest cost and higher interest outgo, markets tend to reward net cash companies. Besides this, the return ratios have also been fairly good, with a return on capital employed of 25 per cent and return on equity of about 20 per cent. All of these have helped the stock’s upmove.

Third, revenue and profit growth visibility over the next two-to-three years continues to remain strong, thanks to the impressive order book totalling ₹43,343 crore. Given the Indian Navy’s plans to invest in asset acquisition in the near to medium term, we believe this will have positively impact the company’s financial performance. The company currently has a portfolio of seven Warships with two under construction - Destroyer P15B and Frigates P17A.

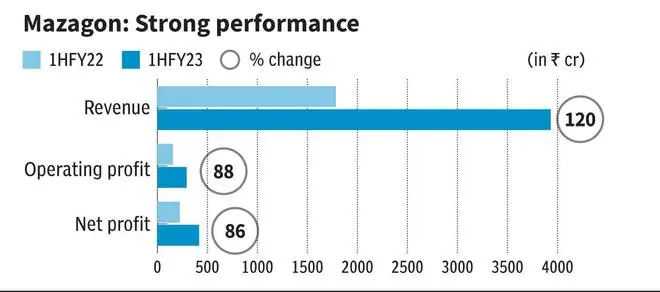

According to Bloomberg consensus estimates, earnings is expected to grow by 20 per cent and 37 per cent in FY23 and FY24, respectively. In the H1FY23, the company reported a 120 per cent growth in revenue to ₹3,932 crore. Operating profit has improved by 88 per cent to ₹292 crore, compared to last year’s period. Net profit in the first half of the fiscal grew 86 per cent to ₹417 crore, translating into earnings of ₹20.7 for the 1HFY23. Last fiscal - FY22, the company reported earnings of ₹29 a share. The company earns as much as its operating profit, in the form of other income, primarily interest on its investments, given the significant cash in the books.

The stock currently trades about 22.4 times its trailing twelve-month earnings. Foreign Institutional Investors (FII) have been buyers in the stock, increasing their stake from 2.47 per cent in June 2022 to 3.05 per cent in September 2022. In the last year, FII holding in the stock has trebled from 0.92 per cent last September.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.