The global crude prices have witnessed sharp fall in the last few weeks, thanks to the slowdown concerns amid expectation of lower demand through the next 15 months or so. The price of benchmark Brent crude has corrected by 29 per cent since its June 2022 highs of $123 per barrel to $88 a barrel. Interestingly the commodity has shed over 11 per cent in the past month alone.

Good news for India

Falling crude oil prices is certainly good news for India, given that the country is a net importer of energy, with imports accounting for nearly 85 per cent of its oil requirement. This should help reduce the subsidy bill on oil imports for the exchequer. However, any further depreciation of rupee against US dollar may prove to be a spoilsport.

Over the last six months, as crude price globally was spiralling, India had to keep the retail prices unchanged, in order to tame inflation, which had already surged past the comfort zone. As a result, oil marketing companies (OMCs) which refine and supply crude for retail distribution had to bear the brunt of the unprecedented increase in the global prices of liquid gold. For instance, even as the price of crude soared past the $120 a barrel mark in June, the prices of motor fuels were kept at levels equivalent to $75-80 per barrel, resulting in severe losses for these companies.

Oil marketing companies such as Hindustan Petroleum Corporation (HPCL), Bharat Petroleum Corporation (BPCL) and Indian Oil Corporation (IOCL) suffered huge losses in the June 2022 quarter, due to flat retail sale prices. OMCs did not benefit from the record gross refining margins of over $20 per barrel from higher realisation for downstream products such as petrol, diesel, and aviation turbine fuel. The sharp depreciation of Indian Rupee against US dollar only added to their woes.

Related Stories

Q1 FY23: OMCs bleed due to marketing losses

Prices of motor fuels were kept at levels equivalent to $75-80 per barrel of crudeWhat the trend indicates

But now, with the crude prices having come off from their peaks, can there be some respite for oil refiners and marketing companies? Well, a look into the historical trend reveals that oil refining companies have benefited from upcycles in oil prices.

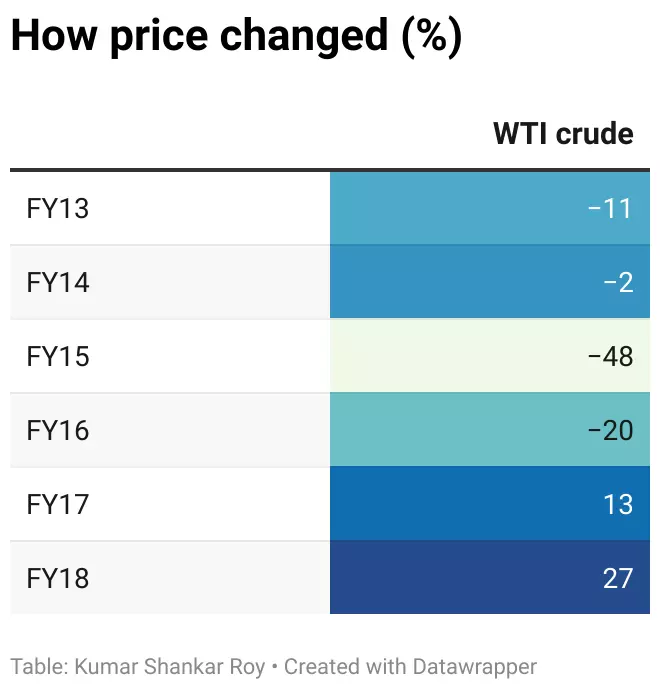

For instance, between FY16 and FY18, most refiners and marketing companies saw their operating margins expand compared to the previous period FY13-15, which saw a sharp correction in the global prices. Sample this, Indian Oil Corporation, which is the largest retainer in the country saw its operating profit margin expand from about 2-5 per cent during FY13-15 period to 6-10 per cent in FY16-18 per cent.

Brent crude price halved from $100 levels a barrel to about $50 levels during FY13-15 period and likewise more than doubled during the FY16-18 period from $40 levels a barrel to over $80 levels. For HPCL, the operating profit margin improved from about 2 per cent in FY13-15 to 5-6 per cent in FY16-18.

The reason upcycles in the past have been better is because of two reasons. One, inventory gains in a rising crude price scenario will provide a one-time benefit for companies. Second, higher realisation for downstream products, provided they can pass on the price increases to customers, can help increase gross refining margins. However, over the last two quarters while the first reason was valid, the second rationale did not pan out as expected, due to inability to pass on the price increases to retail and it had to be absorbed by oil marketing companies.

Rupee depreciation

Now, with the falling crude, one can expect one quarter of pain for OMCs as they will have to account for the inventory losses in the September 2022 quarter. Also, the new windfall tax on exports of petrol, diesel and aviation turbine fuel may have a bearing on the profits. Adding to this is the record depreciation in the Indian rupee against US dollar with a 10 per cent fall since the beginning of 2022 and with a 2 per cent depreciation just in the last two weeks. However, the only respite for OMCs can come from the Government deliberation to keep fuel rates unchanged even with the recent fall in global crude oil prices.

Also, any expectation of cut in retail prices unless global prices correct to $50-60 a barrel, may be unlikely. This should at least help OMCs recover a portion of the under recoveries incurred in the H1FY23.

As the above factors unwind, if crude corrects below $80, but not by too much like it did in FY13-15, the prospects may get better for OMCs. However the risk to be monitored is whether there can be any sudden spikes in crude prices due to escalation of geo-political issues.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.