As the season of hardening inflation and increasing interest rates plays out fully in the current environment, we have a non-convertible debenture (NCD) offering from a premier toll-road operator that comes with interesting features.

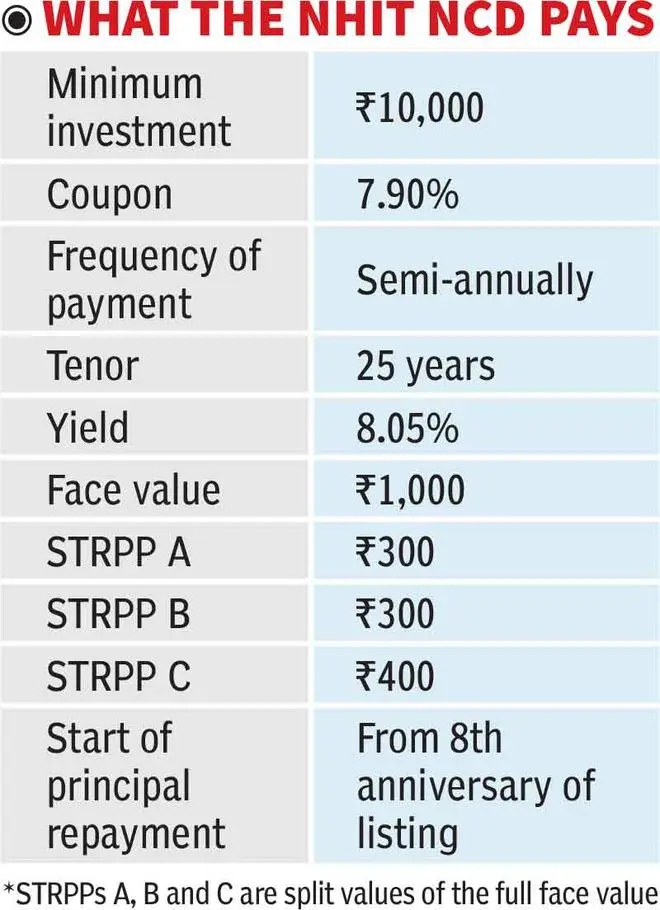

National Highways Infra Trust (NHIT) is an InvIT (infrastructure investment trust) with the NHAI (National Highways Authority of India) as the sponsor. Now, the InvIT is coming out with an NCD offer with a coupon of 7.9 per cent, payable semi-annually. The NCD comes with a total tenor of 25 years.

The entity is rated AAA by CARE Ratings and India Ratings. NHIT’s NCD offer opens on October 17 and closes on November 7 and is looking to raise up to ₹1,500 crore from the issue. Allotment will be on a ‘first come first served’ basis.

Given the high rating and relatively attractive coupon rate, should you go for these NCDs?

NHIT’s NCD structure

As indicated earlier, the NHIT NCD comes with a few interesting features.

Introduction of STRPPs: The full NCD will be split into three STRPPs (separately transferable and redeemable principal parts). NHIT NCD’s full face value is ₹1,000. But it will be split into three parts. STRPP A with 13 years tenor, STRPP B with 18 years tenure, and STRPP C with 25 years tenor. The face value of ₹1,000 will be split as ₹300, ₹300 and ₹400 for the three STRPPs. All will carry the same coupon rate.

Each of the STRPPs will trade separately on the exchanges when the NCD lists.

Periodic principal repayment: Unlike other NCDs that usually pay the principal at the end of the tenor, NHIT’s offer would start repaying the principal from the eighth anniversary — November 2030 — onwards. In November 2030, ₹50 of the face value would be repaid, in addition to the interest component. On each subsequent anniversary, ₹50 each would be repaid to the NCD investors till the 13th anniversary (2035) when STRPP A’s tenor comes to an end. In 2035, there would be ₹100 repayment as STRPP B’s repayment would start in the same year along with the interest portion. Subsequently, ₹50 each would be paid at the end of each anniversary till 2040, when STRPP B’s tenor ends. In 2040, again, there would be ₹100 paid as STRPP C would start repaying the principal even as STRPP B’s tenor ends. At the end of 25 years — November 2047 — there would be no principal outstanding to be repaid.

Coupon would be paid on reduced face value: With each payment of the principal as outlined above, the interest would be paid on the outstanding principal. So, at the end of the eighth year, interest would be paid on ₹950 face value. In the next year, 2031, the coupon would be paid on ₹900.

In 2036, the interest would be paid on ₹600 face value and so on.

What is the yield like? With regular interest payments along with periodic principal returns, the yield (XIRR based on cashflows) from the NCD over the 25-year tenure is 8.05 per cent, making it quite attractive, especially given the long tenor. Please note that you can realise the yield of 8.05 per cent only if you stay invested for the entire 25-year period. Exiting in between via the exchanges will alter the yields.

The minimum investment required is ₹10,000. STRPPs would be allotted based on the amount invested.

All coupon payments are taxed at the slab rate applicable to you. Capital gains made by selling NCDs after holding for one year would entail tax of 10 per cent on the profits.

Robust prospects

NHIT is an InvIT and owns full 100 per cent stake in a Project SPV (NHIPPL) that has a right to toll, operate and maintain a set of road assets. Currently it has five road assets running through States such as Rajasthan, Gujarat, Maharashtra, Karnataka, Telangana, and Andhra Pradesh. It will gain access to three more stretches soon, via roads running through Uttar Pradesh, Maharashtra, Madhya Pradesh and Telangana. The revenue model is TOT, or toll-operate-transfer. NHIT’s financials are reasonably strong and revenue growth prospects also appear to be robust.

- In FY22, NHIT reported revenue from operations of ₹139.6 crore and net profits of ₹68.4 crore (operations commenced only in December 2021). In the first quarter of FY23, the InvIT already has revenue from operations of ₹137.4 crore, while net profits came in at ₹62.8 crore. With the three other road assets likely to add to revenues, growth prospects look healthy. According to Ind-Ra, in 5MFY23, NHIT’s toll collections were ₹229.8 crore.

- Since these toll road arrangements run for very long periods of 20-30 years, there is sufficient revenue visibility as well.

- Periodic toll increases are assured. The rate of increase would be 40 per cent of the wholesale price index as of the December of the previous year, plus an assured 3 percentage points. With the WPI well into double-digits, toll hikes are likely to be robust for the Project SPV.

- Long-term debt to unitholder’s funds ratio is at a robust 0.24 currently. Post the NCD issue, it would increase to 0.39, which is still quite good. Debt coverage ratio (operating cash flow/(interest paid plus principal repaid)) is strong at 4.6 as of June 2022, as is interest coverage (EBITDA/Interest expense) at 4.47.

What should investors do?

Without doubt, NHIT’s NCDs are attractive for retail investors. The issue enjoys the highest rating and offers yields that are higher than comparable government securities as well.

For example, the 07.06 GS 2046 trades at a yield of 7.55 per cent (based on LTP). The 06.99 GS 2051 offers a yield of 7.61 per cent.

Investors or even those looking for a regular stream of income after retirement can consider parking a portion of their debt portfolio in these NCDs. As mentioned earlier, sticking on for the entire 25-year period is critical.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.