Insurance giant LIC has announced a special window to revive old policies which have lapsed due to unpaid premiums. Policies that are in the premium paying term and are within five years of the last unpaid premium can be revived along with a concession on the late fees. The window for revival is open from February 7 to March 25, 2022.

LIC has regularly allowed such windows with the last such opportunity in August 2021 and November 2019. Policyholders should utilise such opportunities, especially now, considering the heightened need for a risk cover.

Reviving an existing policy with rates and terms of earlier periods can be beneficial, compared to investing in a new risk cover whose costs would have increased post the pandemic. The offer is not applicable for high-risk covers such as term insurance plans and multiple risk policies.

Details

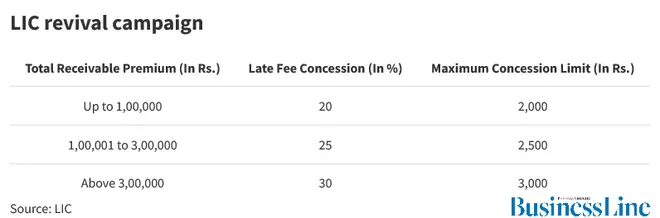

For a total receivable premium of up to ₹1,00,000 (cumulative unpaid premiums), a late fee concession of 20 per cent is applicable up to a maximum concession of ₹2,000 on the late fees. Similarly, for the receivable premium sum of ₹1,00,001 to ₹3,00,000, 25 per cent late fee concession up to a maximum of ₹2,500 and for premiums above ₹3,00,001 — 30 per cent late fee concession is allowed up to a maximum of ₹3,000.

Policies generally have a grace period of 15 days for monthly payments and one month for other payment frequencies such as quarterly, half-yearly and annual. After the grace period, the policy lapses. The revival of such policy is a fresh contract with the insurer having the right to impose fresh terms and conditions.

Outside of the policy revival campaign currently underway, revival schemes are available for making a return to the insured fold. In a special revival scheme, the date of commencement is shifted by a maximum of two years for policies that are less than six months in terms of non-payment. This can be utilised only once in the policy life, and terms will be the usual terms and conditions.

Under certain conditions, the revival amount can be serviced in installments as well or a loan is provided based on the policy being revived itself to cover for the arrears. To revive your lapsed LIC policy, policyholders can contact their nearest branch or agent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.