Insurance giant LIC has announced a special window to revive old policies with concession in late fees. These policies are the ones which have lapsed due to unpaid premiums.

Policies that are in the premium paying term and are within five years of the last unpaid premium can be revived. The latest revival window is open until March 24, 2023.

LIC regularly allowed such windows open as recently as March 2022, August 2021 and November 2019. Policyholders should utilise such opportunities, especially now, considering the heightened need for a risk cover.

Reviving an existing policy with rates and terms of earlier periods can be beneficial, compared to investing in a new risk cover whose costs would have increased post the pandemic. The offer is not applicable for high-risk covers such as term insurance plans and multiple risk policies.

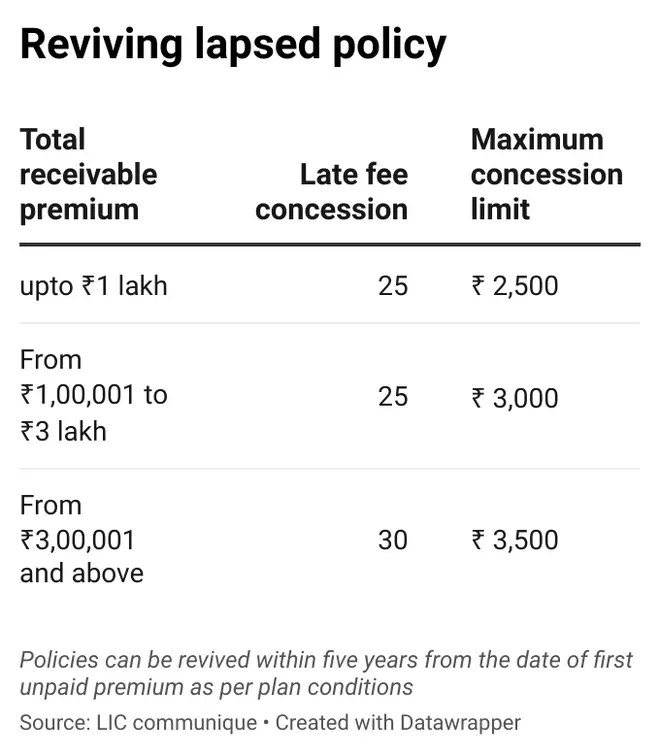

Policy revival concession details

For a total receivable premium of up to ₹1 lakh (cumulative unpaid premiums), a late fee concession of 25 per cent is applicable up to a maximum concession of ₹2,500 on the late fees. Similarly, for premium sum of ₹1,00,001 to ₹3 lakhs, 25 per cent late fee concession up to a maximum of ₹3,000. For premiums above ₹3,00,001 — 30 per cent late fee concession is allowed up to a maximum of ₹3,500.

Separately, late fee at the flat rate of just ₹5 (excluding GST) will be levied to all the eligible NACH and Bill Pay registered policies revived in this campaign, according to LIC communique to policyholders.

Policies typically carry a 15-day grace period for monthly payments and one month for other payment frequencies such as quarterly, half-yearly and annual. After the end of grace period, the policy lapses.

The revival of such a policy is a fresh contract, with the insurer having the right to impose fresh terms and conditions. According to LIC website, a lapsed policy has to be revived by payment of the accumulated premiums with interest as well as undergoing medical tests as required.

Outside of the policy revival campaign currently underway, revival schemes are available for making a return to the insured fold.

In a special revival scheme, the date of commencement is shifted by a maximum of two years for policies that are less than six months in terms of non-payment. This can be utilised only once in the policy life, and terms will be the usual terms and conditions.

Under certain conditions, the revival amount can be serviced in installments as well or a loan is provided based on the policy being revived itself to cover for the arrears. To revive your lapsed LIC policy, policyholders can contact their nearest branch or agent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.