My son proposes to give a gift of ₹10 lakh each to his wife and daughter (aged 20) for investment. Please let me know the tax implications on the gift, and earnings from out of the investment.

K Ramachandran

Gifts given by your son to his wife and daughter are not taxable in their hands under Section 56 of the Income Tax Act, 1961.

In case his wife invests the amount gifted to her and earns some income out of the same (interest, dividends, etc.), then such income would be taxable in your son’s hands, due to clubbing provisions. Appropriate disclosures also need to be made in the income tax return of your son along with reporting the income earned by his wife.

In respect of incomes earned by your son’s daughter out of the gift, there would be no clubbing of income as she is 20 years old. If the income earned by her is more than ₹2.5 lakh per annum, she would need to file income tax return.

Also read: Make cashless health insurance settlement smooth with these steps

I am a 70-year-old government pensioner getting a monthly pension of ₹27,127. I bought Maharashtra Scooter shares in the year 2008 and sold 400 shares at an average price of ₹5,010 in July-September 2022. The fair value of MSL is ₹2665.30.

I am living in an independent house over the last 25 years, with new construction taken up recently to the tune of 420 sq ft on the first floor. I also undertook major repairs about a month ago that involved expenses of ₹10-12 lakh.

Do I have to pay any ong-term capital gain tax? I have no other income except dividends of ₹90,000 to ₹1 lakh.

R. Sankar

Budget 2018 introduced Section 112A in order to tax long-term capital gains arising on sale of listed shares entailing payment of Securities Transaction Tax (STT). Under this Section, if listed shares acquired prior to January 31, 2018, are sold on or after April 1, 2018, then long-term capital gains arising on account of such sale is exempt up to ₹1 lakh (per financial year) and the balance is taxable at a special rate of 10 per cent, along with applicable surcharge and education cess. Further, indexation benefit is not available in such cases.

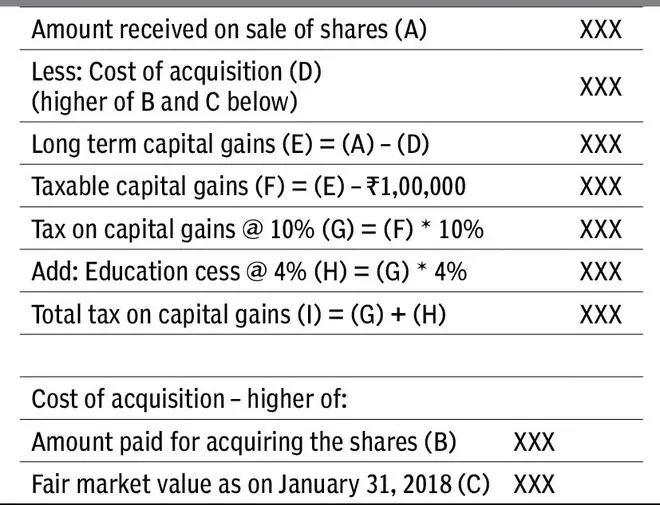

In your case, we understand that you had acquired shares of Maharashtra Scooters Ltd (MSL) in 2008 and sold them in 2022. Since MSL shares are listed, the sale of such shares would invite Securities Transaction Tax (STT). Hence, under Section 112A, the long-term capital gains on sale of MSL shares would need to be computed as follows:

Capital gains on sale of these shares exceeding ₹1 lakh is taxable at a special rate of 10 per cent plus 4 per cent of Education Cess.

Also read: How to secure the inheritance of your minor children

Details relating to capital gains would need to be appropriately disclosed in your income tax return form for the financial year 2022-23.

The writer is Partner, Deloitte India

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.