It’s that time of the year when there’s flurry about what to do before the year end. Yes, we are talking about March 31.

It’s a rush hour not just for corporates wanting to close their books and ensuring that all that needs to be done within time is completed, but even for individuals like us who have some boxes to tick so that taxes can be kept under check on the D-day when the tax return must be filed.

Here’s a basic checklist one should always note. But depending upon your annual income and transactions during the year, the list could vary.

Pay advance tax

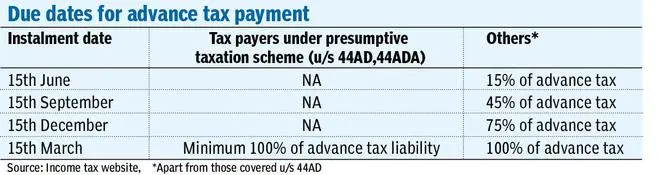

Pay as you earn. That’s what advance tax is all about especially when you estimate the annual income tax liability for the year (April to March) and it crosses ₹ 10,000 (net of TDS cuts). Advance tax is payable by any taxpayer including individuals who have sources of income other than salary. Since the employer deducts tax on salary the requirement for advance tax does not arise. But if you have earned capital gains, interest from deposits, lottery winnings, rental income or income from any other sources, the need to furnish advance tax arises. The tax is paid in installments throughout the year and falls due on or before March 15 which is the date of final installment (see table).

In case of any residual amount due and unpaid, the same can be furnished on or before March 31 to avoid penalty. While calculating the advance tax payable, remember to check for tax already deducted at source. Advance tax payable is net of TDS. What happens when advance tax is not paid properly? If you’ve missed the deadlines or paid less than 90 per cent of the assessed tax, expect to hear from the tax authorities and be prepared to pay a penalty for the lapse. Unpaid tax would attract interest at one per cent (charged monthly) per month or part of a month under section 234B of the Income Tax Act. Thankfully, the computation is only based on simple interest.

Missing the timelines

Individuals must file their tax returns on or before July 31. But what happens if you missed the date last year. Nothing is lost.

Section 139(4) of the IT Act allows you to file belated returns on or before March 31 of the next assessment year or before completion of assessment for the current year. In case you have missed furnishing some details or made some computation errors while filing the return, you can always file revised return with correct particulars. Once a revised return is filed, original return stands cancelled. A revised return can be filed on or before March 31 or before the completion of the assessment for the current year, whichever is earlier, just like belated returns. For previous year 2020-2021, there’s time till March 31 to file belated or revised returns, in case the tax department hasn’t assessed your income already. Do note, that while the law lets you file returns belatedly, its better not to skip the dates. For instance, if you have a loss return to file, you lose the chance to carry forward the loss. Only losses from house property is given exception, but otherwise you lose an opportunity to monetize the loss.

Additionally, there is interest and penalty to bear. If you fail to furnish return of income within due date be ready to pay ₹ 5000 if you are furnishing the same on or before December 31. The fine doubles to ₹ 10,000 if paid later. In addition to the fines mentioned above the delay in filing the return will also disallow exemption allowed for operating out of free trade zones or hundred percent export oriented undertaking.

Ready up the savings

Chapter VI-A is one that all taxpayers look up to. It allows for various deductions. Section 80C and some of its additions are tax payers favorites as they allow up to ₹1.5 lakh of deductions.

Some eligible instruments here include EPF (Employee Provident Fund), PPF (Public Provident Fund), National Savings Certificates, equity-linked savings scheme, repayment of principal component of housing loan, investment in Post Office Time Deposit Scheme, Senior Citizens Saving Scheme.

Plan your investments wisely and ensure that you make the best of this section. Investments have to be made on or before March 31 to avail this benefit.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.