It is key for senior citizens, post retirement, to have steady financial inflows that help them maintain their lifestyle. That’s precisely why they are advised to go increasingly for an investment portfolio that relies more on fixed income instruments and less on volatile assets. Facilitating this approach is the Pradhan Mantri Vaya Vandana Yojana, a pension scheme launched in 2020. This scheme gives returns at regular intervals as opted for by the policy subscriber.

Available till March 31, 2023, the scheme offers interest rate of 7.4 per cent. In the present scenario no other scheme or instrument holds out such a high rate for a tenure of 10 years. However, there are schemes of five-year tenure offering better rates — for instance, Senior Citizen’s Saving Scheme (interest rate of 8 per cent), and FDs in certain small finance banks, which feature rates of 7.5-7.75 per cent per annum.

Non-linked policy

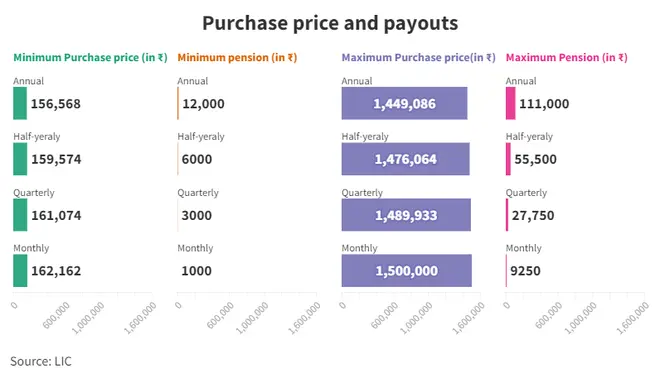

PM Vaya Vandana is a pension scheme for senior citizens (above 60 years) managed by LIC. It is a non-linked and non-participating policy. The tenure is 10 years, the payouts under this scheme are available in monthly, quarterly, half-yearly and annual options. The rate of interest provided is decided at the start of each year by the Ministry of Finance after review. The current rate for monthly payout is 7.4 per cent. If one opts for yearly payout then the pension rate offered is 7.66 per cent. The maximum purchase price under this scheme is ₹15 lakh.

Also read: LIC New Jeevan Shanti: Should you invest in the deferred annuity product?

The minimum payout possible in this scheme is ₹ 1,000 per month and maximum is ₹9,250 per month. The policy tenure is 10 years and therefore in this period the pension will be paid at the start of the period chosen (monthly, quarterly etc.) and at the end of 10 years, if the pensioner survives, then the purchase price, along with the last pension instalment, will be paid. However, on death of the pensioner during the policy term of 10 years, the Purchase Price shall be refunded to the beneficiary. The pension payment in this scheme will be through NEFT or Aadhaar-Enabled Payment System.

Loan facility

Although, the term of the scheme is 10 years premature exit from the scheme is allowed under special circumstances e.g., treatment of critical illness for self or spouse. In such cases, the surrender value payable will be 98 per cent of purchase price. In addition to this, the pensioner can avail loan against this scheme after the scheme has completed three years. The maximum loan will be 75 per cent of the purchase price.

Also read: Tax Query: Tax implications on gift towards investment

It must be noted that the proceeds from this scheme will be taxed at the applicable Income tax slab rate. The scheme also offers freelook period like any insurance policy. The freelook period for the scheme purchased offline is 15 days and 30 days for online purchase.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.