Price is one of the important and inevitable determinants in decision-making for the purchase of a house. Most stakeholders anticipate a price increase and even developers are publicising this fact in order to close sales quickly and entice fence-sitters. To sustain the sales velocity and cash flow during the pandemic, developers refrained from raising prices. However, when the impact of the pandemic subsided, demand accelerated and developers increased prices to capitalise on the pent-up demand.

The sharp and unheard-of spike in the cost of input materials such as steel, aluminium, and cement has given the construction industry a serious jolt, with escalating project costs, and impairing cash flows and working capital for developers. Additionally, due to the geopolitical unrest between Russia and Ukraine, the world has seen a shortage of crude oil, which has pushed up the price of the commodity and affected a variety of industries, including real estate. Rising inflation has acted as a lubricant for the price rise of various commodity products and impacted the sector, especially in the past few months.

However, developers have so far resisted the urge to raise prices in 2022, choosing to absorb the consequences instead, including the most recent increases in the price of raw materials and other input costs. Strong sales in the residential sector has given them the ability to withstand the rising raw material costs. Due to pent-up demand, declining inventory, increased momentum post Covid-19, the market has seen a solid recovery and supported price stability in recent times. However, the situation was becoming more and more concerning during May and June, and any additional increases in input costs could have compelled developers to increase housing prices. Thanks to government efforts at reducing the price of raw materials, such as lowering of excise tax on petrol and diesel, State taxes, import duty on key raw materials, and measures to restrict exports, the price of major input cost reduced.

Residential price growth

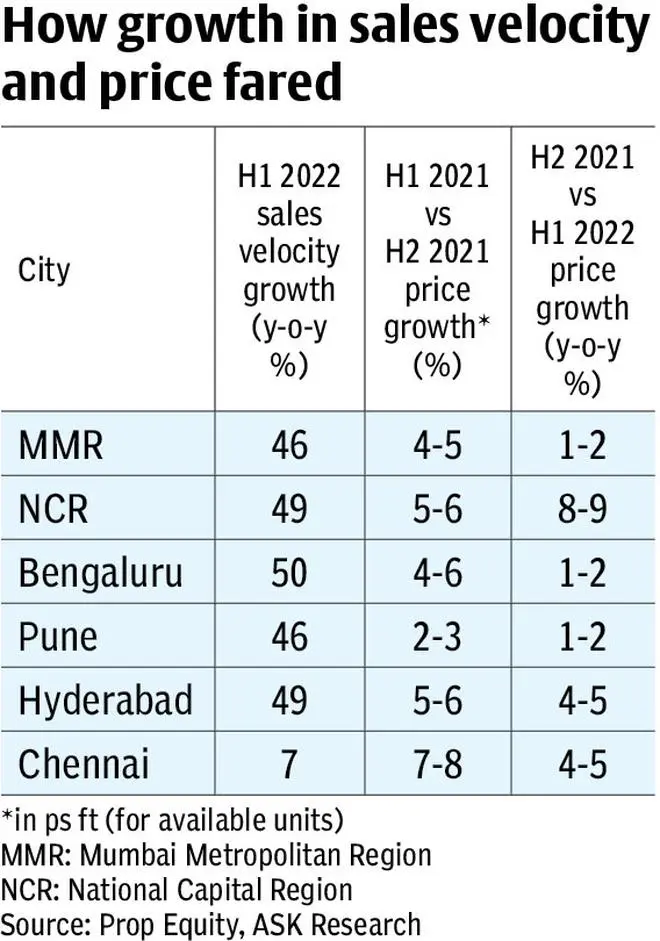

Overall sales velocity in H1 2022 increased about 40 per cent from a year ago on a pandemic-impacted lower base. The gradual improvement was noticeable from the last quarter of 2020 and continued in 2021. Moreover, the absorption reached its new peak in 2021, marking one of the best years in the decade. The market further improved and January-March quarter registered maximum sales in the last eight quarters.

As a result of the post-Covid revival and robust sales velocity, the weighted average home prices in the country increased between 5 and 6 per cent during June-December in 2021. NCR, Chennai and Hyderabad saw maximum year-on-year price rise in the range of 5-8 per cent, followed by Mumbai Metropolitan Region, Bengaluru and Pune. The market's affordability — high as a result of low mortgage rate and rising income levels in most industries, particularly IT/ITeS, BFSI and pharmaceuticals — supported demand post-pandemic.

Look beyond working capital cost

It was believed that input costs rose 15-20 per cent in the last six months due to various economic disruptions, before showing gradual declining trend.

However, recent corrections to input costs are a great respite for the developer. Additionally, factors such as the cost of the land, labour, approval cost, stamp duty, and registration cost contribute about 30-40 per cent of the total project cost. A marginal price change or, in some cases, reduction in these components, gave the flexibility to maintain stable pricing or survive with a modest increase, especially in 2022. In few cities, the government additionally backed by reducing approval/premium charges, which greatly helped reduce the cost of the project. While robust demand is backed by decline in quality supply, developers with better track record and efficient execution could hike prices more than the average price increase in the city. It is important to ensure the sales momentum is maintained notwithstanding market turbulence. Developers should focus on sustenance as opposed to raising prices in any specific market.

Cautious approach for stable sales

Any noteworthy price rise by the developer must be justified by income profile, buyer propensity to pay, competition landscape, and consumer behaviour. Adopting a marketing strategy that fits the business context affects sales velocity. In view of the shifting economic landscape, developers took a careful strategy rather than a hasty decision of rising price. Due to input cost increase, there was marginal increase in the housing cost which was compulsorily passed on to the customer.

Way forward

Although major developers have avoided slowing down construction so far, that could change if input costs rise more, delaying project completion. Recent government initiatives to restrict input price growth have given developers the room to maintain pricing. It will be interesting to see how long developers keep raising prices. We expect demand to remain high due to low financing rates, end-user demand, and government initiatives and policy support.

More developers will employ cutting-edge prop-tech tools aiding decision-making and sales. Significant technical advancements in construction processes are predicted to shorten lead times, improve quality, and strengthen the industry's resilience, which will alter developers' profitability and pricing strategies.

The writer is the Vice-President and Head - Research, ASK Property Fund

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.