Saral Credit, a fin-tech platform, has recently conducted a survey to understand the key behavioural factors fuelling personal loans in India. Personal loans provide individuals financial means to meet short-term fund requirements, without any obligation to specify the purpose for which the loan proceeds will be used.

The following four charts provide significant insights into the results of Saral Credit’s survey, which was conducted on 512 respondents.

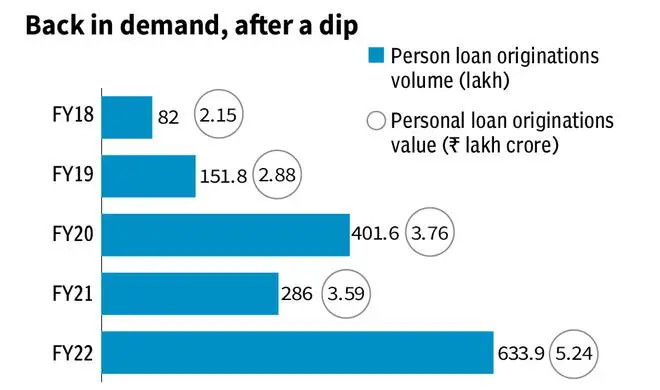

The rush for personal loans

Personal loans are most sought-after by individuals to meet short-term fund requirements in India. The following chart establishes this fact.

A 2.2x growth in originations by volume and 1.4x growth in originations by value in FY22 over FY21 show the growing popularity of personal loans.

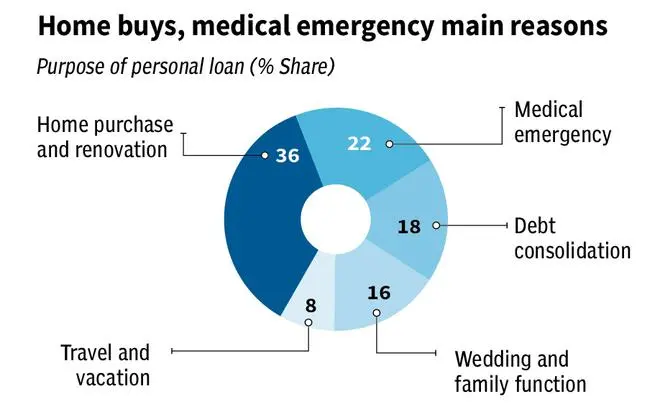

Why are personal loans taken

Since it is a cash transfer into the borrower’s account, one cannot ascertain the end use of loan proceeds. Borrowers take personal loans to meet fund requirements for various purposes.

Surprisingly, 36 per cent of respondents said that they are taking personal loans for home purchase or renovations.

The fact that nine per cent of respondents took personal loans for travel and vacation needs is a new insight. This trend indicates that today’s working class is ready to pay high interest rate for funds meant for gaining new experiences.

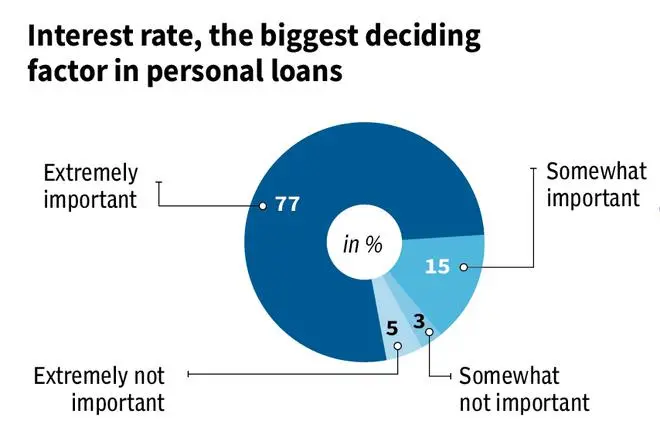

Is interest rate a major determinant

Indians in general are perceived to be cost sensitive. The following chart is testimony to this behavioural pattern.

Majority of loan seekers (77 per cent) mentioned that the rate of interest is extremely important for them. Another 15 per cent said the interest rate is ‘somewhat’ important.

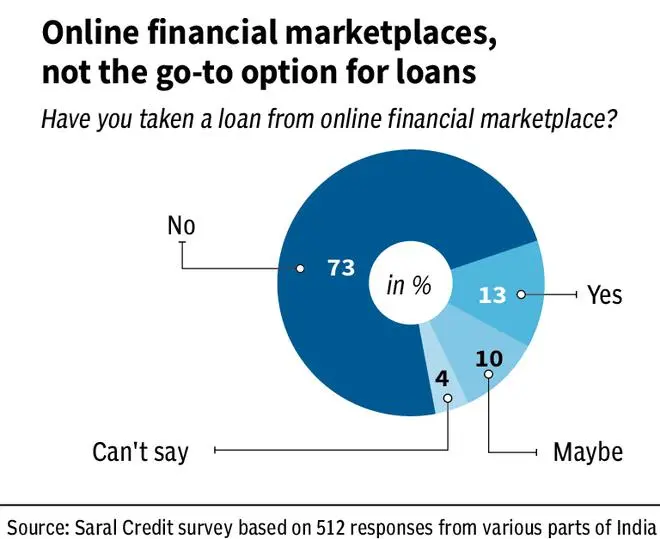

How popular are e-financial marketplaces for loans

Financial marketplaces have reported extraordinary growth over the past decade. It has been presumed that these platforms will become a go to place for comparison and applying for a loan. However, some interesting facts are confirmed in the following chart.

57 per cent of respondents have taken a loan from a channel other than the marketplace. Only 32 per cent of respondents have availed a loan using the marketplaces.

There still seems to be some ambiguity in understanding the difference between a marketplace and other direct lending platforms.

The popularity of personal loans will continue as those without any formal education are opting for this product.

It seems that borrowers are taking three elements into account—convenience, cost and trust—while deciding on the lender.

All lending institutions, barring the scheduled banks, have a long way to go before they could penetrate into this segment. The data on challenges faced by borrowers are indicative that there is a need for constant upgradation of online processes.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.