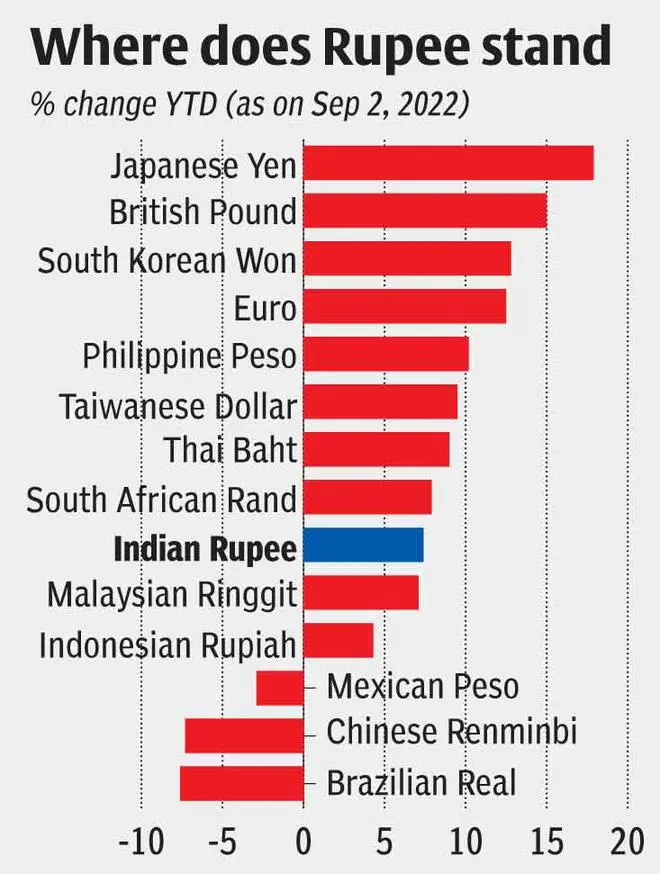

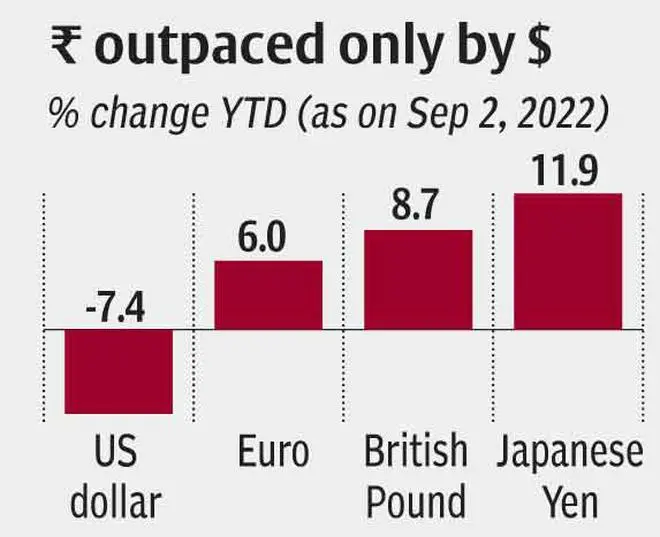

The rupee hit a record low of 80.13 against the dollar (USD) last week driven by the US Fed’s rate hikes this year. While it has lost 7.35 per cent against the dollar so far in 2022, the silver lining is that other major currencies such as the euro (EUR), the British pound (GBP) and the Japanese yen (JPY) have lost more and, consequently, the rupee has performed well against these currencies.

US rate hikes

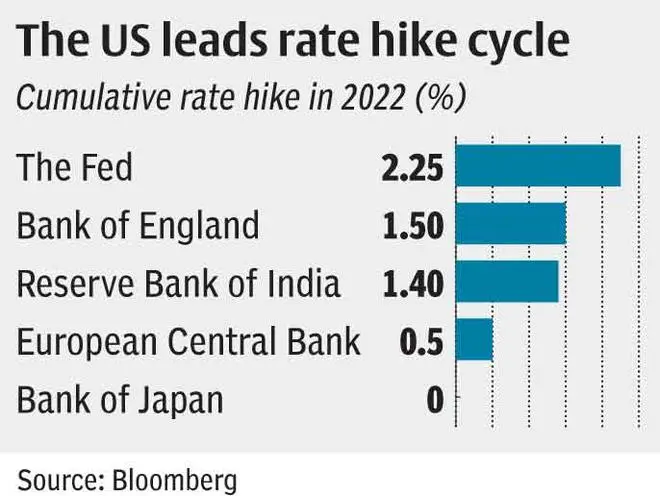

As inflation skyrocketed, the Fed decided to end the loose monetary policy and began raising interest rates in early 2022. The rates now stand at 2.5 per cent, up from 0.25 per cent in January. However, despite the inflation ballooning across the globe, other major central banks, including the Reserve Bank of India, have lagged the Fed on rate hikes.

With rate hikes by the Fed driving treasury yields higher, investors began to flock to the dollar, resulting in a sharp rally. “The USD’s rally against other major currencies led the dollar index appreciating by a significant 14 per cent year-to-date to 109.6. While the rupee depreciated, the relative performance of rupee compared to other major currencies led to it gaining against the EUR, JPY and GBP,” says Kunal Sodhani, Vice-President, Global Trading Centre, Shinhan Bank.

Why rupee fared better

“While the US does face high inflation and the risk of recession, Europe and the UK are under greater strain. But India is not facing high risk like these economies. Growth expectation is far better, and government reforms have helped foreign investment flows increase,” says Anindya Banerjee, Vice-President of Research in currency and interest rates, Kotak Securities.

Over-reliance of the European region on Russia for energy created the fear of an energy crisis in major economies in the region. For Britain, issues like disputes with Northern Ireland on post-Brexit trading agreement and the conundrum of Scottish independence, are also negatively impacting sentiment.

While inflation in Japan has not increased to alarming levels and the idea of raising interest rates has not gained traction, the dependence of Japan on imports for energy has begun threatening the trade surplus. This factor has been weighing on the currency.

Apart from economic resilience, India increased crude oil imports multifold from Russia at a considerable discount to the market price, limiting the pressure of high crude prices on the rupee to some extent.

Foreign flows, too, have turned favourable for the rupee. Foreign Portfolio Investor (FPI) investments, which was negative every month in the first half of this year, turned positive in June. Interestingly, in August, both the equity and debt segments saw net inflows. According to NSDL (National Securities Depository Limited) data, the net FPI inflows since July stands at $7.5 billion.

Finally, the RBI is tempering the excess volatility with the pile of foreign exchange reserves it is sitting on. “When compared to both emerging and Asian currencies, the rupee has not depreciated that much considering the RBI’s active intervention to curb excess volatility and any kind of sharp depreciation,” adds Shinhan Bank’s Sodhani. According to market watchers, the central bank even intervened in currency derivatives to prevent a sharp fall.

Outlook positive

Going ahead, the dollar is likely to strengthen further, and this can weigh on the rupee. Yet, the Indian currency is expected to depreciate at a slower rate compared to other major currencies. Charts indicate that the rupee could touch 82 by the end of the year.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.