Dreamfolks Services (Dreamfolks) is the country’s largest airport services aggregator. The company’s technology platform integrates customer engagement programmes of credit/debit card providers with lounge operators and other services in an airport. All of the country’s 54 lounges have tied up with Dreamfolks, which has tie-ups with 95-97 per cent of card issuer/network side offering lounge access to customers as part of loyalty programmes. With such entrenched presence, Dreamfolks can be a strong play on growth in air passenger traffic, airport infrastructure and card penetration. We recommend investors with a higher risk appetite and long-term view can subscribe to the issue. The IPO size of ₹562 crores is entirely an offer for sale from the promoters.

Differentiated business model

Prior to Dreamfolks, a large part of airport lounge use was driven by business- and first-class passengers. Dreamfolks’ first move with Mastercard in 2013 paved the way for card owners towards lounge usage, which now drives lounge operator volumes. Over the years, Dreamfolks has extended the client list to include nearly all card operators and lounges in the country.

Dreamfolks’ technology platform validates lounge access for a credit/debit card that is swiped at the lounge operator’s location on a company-issued point-of-sale machine. The validation checks the card being used against the number of lounge visits allowed for passengers who are customers of the clients. The clients here refer to the credit card issuers (banks) and card network operators (Mastercard, Visa and Rupay). Similarly, other corporate clients building customer engagement are on its network as well, but account for only 1 per cent of revenues. The customer accesses the lounge for a nominal charge of ₹2 (to check final validity of the card) and the client is charged per passenger (₹800 per passenger in FY22) for lounge access. The company retains 15-16 per cent of the same, and passes on the balance to the lounge operator for their services. This cost of service (amount paid to lounge operator) is the prominent cost for Dreamfolks, accounting for 90 per cent costs in FY22.

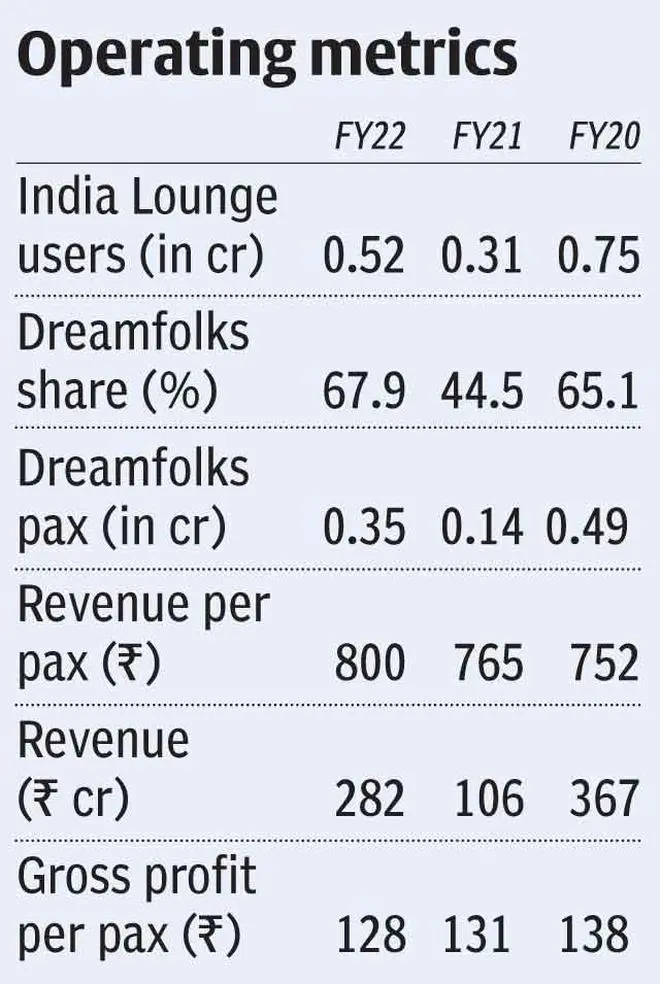

According to Frost & Sullivan estimates, 82 per cent of lounge access in FY22 was through credit/debit cards and the same report estimates that Dreamfolks has 95-97 per cent market share of the credit card business. The other 3-5 per cent is held by competitor Collinson Group, an international group that owns Priority Pass brand of airport lounge access cards. Overall, the company served 0.35/0.14/0.49 crore air travellers in the last three years, which accounted for 68 per cent/45 per cent/65 per cent of total lounge users. Business-class passengers, airline vouchers, and walk-ins accounted for the rest of lounge users.

Broad growth levers

Serving air travellers accessing lounges through credit cards, Dreamfolks faces growth prospects from increasing air traffic and credit card usage. The airport infrastructure extending into Tier-II/Tier-III cities, increasing domestic air travel, and increasing lounge area growth (both number of lounges and square footage) can benefit Dreamfolks. The increasing penetration of credit and debit card users and improving facilities being provided to counter modern payments facilities can act as incremental tailwinds to Dreamfolks as well. While the company has been adding clients driving its performance, in the pre-Covid period of FY15-20, the company’s 55 per cent top and bottom line CAGR (as informed by the management) was on account of such growth factors.

Financials and Valuation

The company’s revenue dipped in FY21 (71 per cent decline year on year to ₹105 crore) and recovered partially in FY22 (167 per cent increase year on year to ₹282 crore) similar to the fortunes of air travel traffic, but is yet to recover to FY20-levels (₹367 crore). The company recorded a loss at the EBITDA level itself in FY21 (0.4 per cent), but has reported EBITDA margins of 8 per cent in FY22.

The IPO prices the company at close to 110 times FY22 earnings, and on a steady-state base of FY20 (prior to Covid impact on air travel) the IPO pricing is at 54 times earnings. But given the lost years due to the pandemic, and good secular tailwinds the company has in its favour, the aggressive pricing may be justified. Apart from pricing, the other major risk is the promoter/management group’s compensation at close to 49 per cent of PAT in FY22 (36 per cent in FY20). According to the management, this should moderate as two of the three promoters have now taken up non-executive roles in the company.

Even considering the inflated valuation, the asset-light model of leveraging Dreamfolks’ operational base to growth in air traffic in India should be good value proposition to high-risk investors.

On the other hand, investors must also take note of the high-risk profile. Risks associated with small-cap companies are relevant to the issue. The operational track record is short and the financial track-record available in public domain even shorter, of which two years were lost to the pandemic. The business or the management operates in a peer-less environment making performance comparison difficult.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.