Investors with a two-to-three-year investment horizon can consider accumulating the stock of the Vadodara-based fertiliser and chemical manufacturer Gujarat State Fertilizers and Chemicals (GSFC). The company’s business constitutes two key segments — namely, fertilisers and industrial products (chemicals).

GSFC is a leading producer of phosphatic fertilisers and urea and is among the country’s leading producers of industrial products (chemicals) such as caprolactam and melamine. Moderation in crude and commodity prices globally from the June-July 2022 peak levels, will help the fertiliser segment by way of lower input costs.

GSFC’s investors will also benefit from the new rule mandating higher dividend pay-out for Gujarat PSUs.

At the current price of ₹175, the company trades at 5.2 times its trailing twelve-month earnings. . We had recommended accumulating the stock on dips in June 2022 and the total return (including dividends) since then has been 10 per cent.

We believe GSFC to be a good diversification bet and investors with moderate risk appetite can continue to accumulate the stock on declines, for three reasons.

First, the company’s fertiliser business, which accounts for about three-fourth of the revenue, continues to grow at a healthy pace. A moderation in global commodity prices and lower input costs should help GSFC’s working capital cycle as the dependence on government subsidy will reduce proportionately. For instance, phosphoric acid prices in Asia Pacific region has corrected from $1465 per metric tonne in early February 2023 to ₹1,320 per tonne by end March.

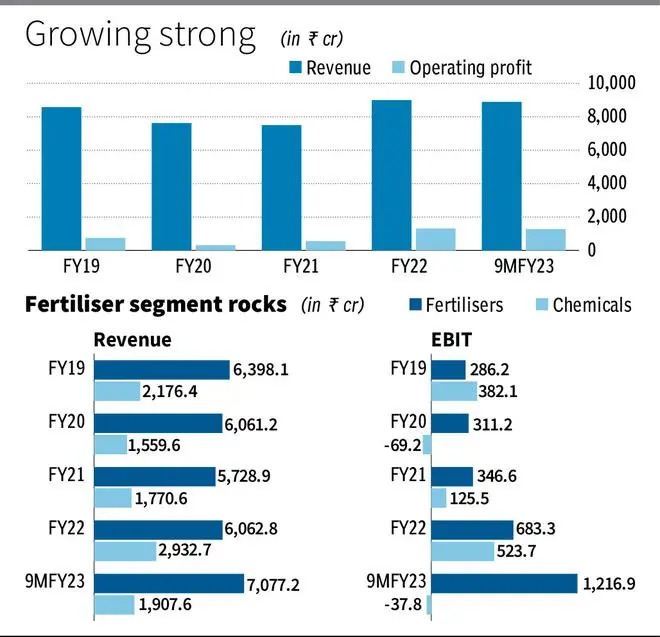

Likewise, the APM gas prices have moderated from $8.6 per mmbtu to $8.27 per mmbtu and those from nominated fields will now cost $6.5 per mmbtu and this will help fertiliser segment profits. For the 9MFY23 period, the fertiliser segment profits grew 3.5 times to ₹1,216 crore versus ₹348 crore same period last year. Over the last three years, the contribution of fertiliser business to the company’s overall profitability has increased significantly. From 43 per cent of the total operating profit in FY19, the fertiliser business contribution has increased to 73 per cent and 57 per cent in FY21 and FY22. For the 9MFY23 period, fertiliser segment accounted for the entire operating profit, while chemical segment recorded loss of ₹38 crore, due to falling prices and slack demand.

Second, the new minimum dividend and buyback policy announced by the Gujarat Government is favourable for investors in GSFC’s stock. With a minimum payout of 30 per cent under the new policy, the company will have to fork out more from profit as dividend. GSFC can see almost 7-fold increase in dividend, in FY24. This is thanks to the company’s strong profitability as well as robust net worth and its low pay-out ratio at 11 per cent of the net profit in FY23. For instance, in FY22, the company’s dividend outgo was about ₹87 crore, while the new rule will require the company to fork out as much as ₹580 crore as dividend.

Third, the company has planned capex of over ₹720 crore over the next two years. These should support the company’s growth in the medium term. The additional investment includes the spend on expanding its ammonium sulphate facility by adding another train with a capacity of 400 tonnes per day, increasing its phosphoric acid capacity by 600 tonnes per day and sulphuric acid capacity by 1,800 tonnes per day.

Finally, a strong balance sheet with negligible debt and cash reserves of about ₹374 crore as of September 2022 is positive, given that a meaningful portion of the revenue is recovered from the government as subsidy. Timely payment of subsidy by the Government has also helped GSFC manage its working capital well. From the peak of 197 days in FY16, the receivable days has reduced to 15 days in FY22. The company also boasts of a good investment book of ₹5,683 crore, which includes public investments such as GNFC, Gujarat Industries Power, Gujarat Alkalies, Gujarat Gas, Bandhan Bank, Gujarat State Financial Corporation, IDBI and Mangalore Chemicals and Fertilisers, among others.

The investment book value is significant, representing around 80 per cent of its current market cap. Although this value will get recognised in its stock price only when the company plans to unlock value, for now it can offer good downside support.

Risks

The fall in global energy prices and slowdown in demand from China continue to keep chemical prices, particularly in the Asia Pacific region, under check. Caprolactam price, for instance, continues to remain volatile and is headed southwards, due to weak demand from end users and lower input prices. This will likely limit GSFC’s chemical business performance. However, if crude stabilises at $70-80 a barrel levels, that should support end product prices and act as a cushion against further fall in chemical prices.

For the 9MFY23 period, the company reported 18 per cent growth in revenue to ₹8,887 crore, while operating profit rose 44 per cent to ₹1,275 crore. This was supported by the strong performance of GSFC’s fertiliser segment even as chemical margins were impacted in the 2HFY23 due to pricing pressure.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.