One among the few other fundamental factors built into the business models of Indian IT services companies for sustained profitability and growth is a depreciating rupee. In an ideal world scenario for Indian IT, ceteris paribus, a one per cent depreciation in the rupee translating into a 1 per cent increase in revenue, would end up having a greater than 1 per cent increase in profits. This is because the bottom line benefits from operating leverage.

While revenue increases due to currency benefits, and a good percentage of costs are fixed in rupees, a good chunk of the currency gain due to sales denominated in foreign currency like the US dollar, directly flows to the bottom line. For simplistic understanding, if revenue was entirely denominated in US dollars, and costs entirely in rupees, and the IT company had 20 per cent profit margins, a 1 per cent depreciation in the rupee against the US dollar with the entire gain flowing into the bottom line will increase profits by 5 per cent (21/20). However, this is not the way it actually works in the real world due to multiple factors (costs in other currencies, forex hedging costs) attached to the business model. However directionally this is how it typically plays out.

The twist in plot

During June quarter of 2022, the rupee depreciated against the USD by 4.2 per cent. In the one year up to June 30, 2022, the decline is around 6.5 per cent. This reflects sizable depreciation in just a single quarter and even on a yearly basis. But did the Indian IT services companies benefit from it? A simple analysis of the quarterly performance in constant currency revenue growth and rupee revenue growth (actual realised growth in domestic currency) will help give a perspective on this.

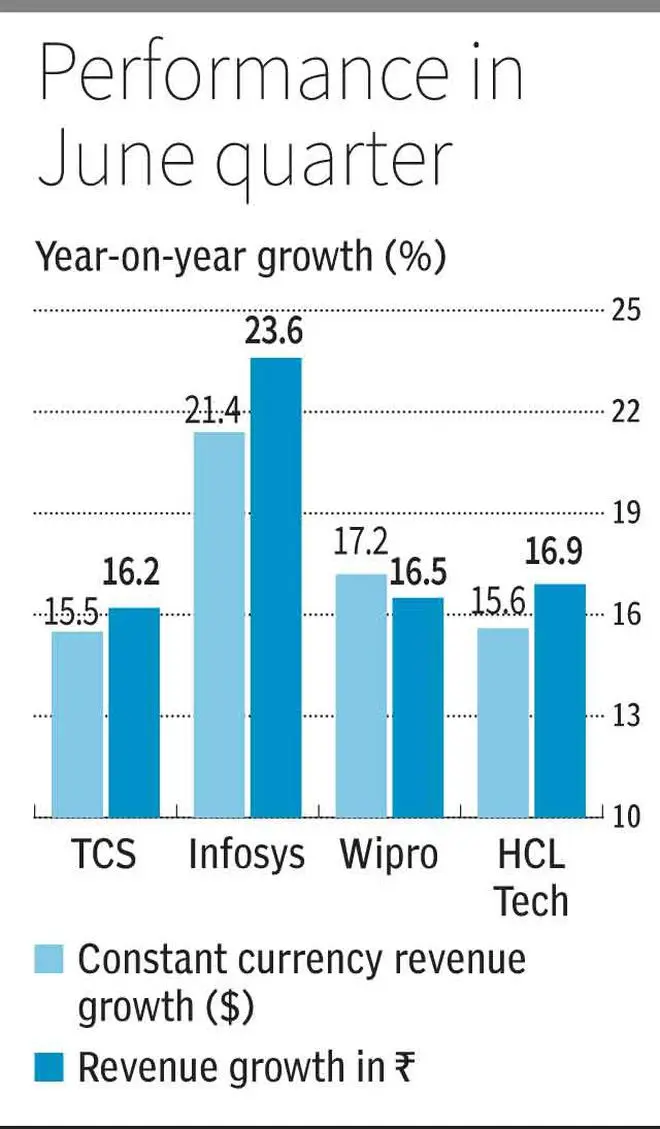

Constant currency revenue growth indicates how the performance would have been if currency/exchange rates had remained constant. It hence is primarily a reflection of business volume growth and leaves out exchange rate impact. Typically, the exchange rate prevailing in the period (for example: same quarter previous year) to which current performance is compared with, is used as the exchange rate. The table below compares the constant currency revenue growth of the top four Indian IT services companies versus the rupee revenue growth

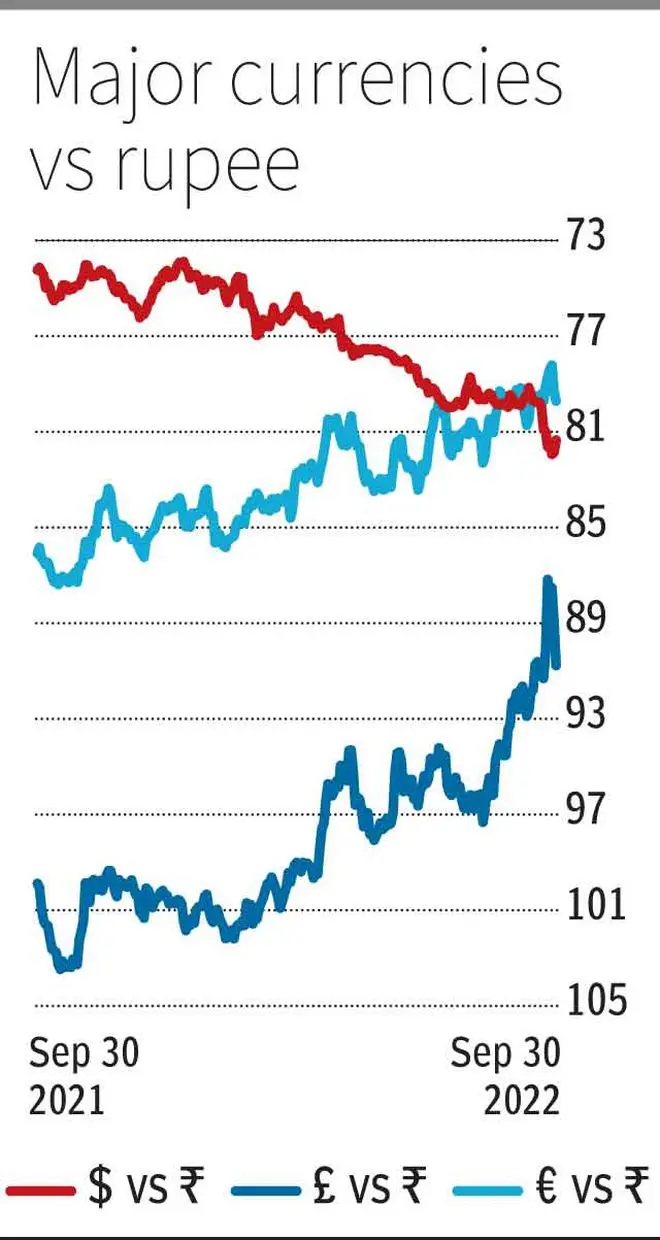

The data indicates the companies have not been beneficiaries of the outsized rupee depreciation versus the USD that was witnessed in the one year into June 2022. Ideally the realised growth in rupee should have been much better. The twist in plot here is due to what is called cross-currency headwinds. These headwinds emanate from the rupee’s outperformance over many other global currencies over the last year. Recent times have witnessed unprecedented volatility in many international currencies versus the USD, especially in the case of the British Pound (GBP) and Euro which have hit multi decade lows. The rupee’s outperformance against these currencies is turning this into a headwind offsetting the dollar strength.

For example, Wipro’sQ1 results presentation indicates that while 62 per cent of IT services revenue is in USD, 10 per cent is in GBP, 9 per cent in Euro and 5 per cent in AUD. In the one year into September 2022, the rupee had appreciated by 9 per cent against the GBP and by over 7 per cent against the Euro. Thus the impact of these headwinds will play out for IT companies across the board. Thus any optimistic view on the IT services companies due to dollar strength against the rupee will require a second look. The ultimate impact of these cross-currency movements will depend on each companies’ geographic exposure/ billing currency and also how their hedges play out. Investors must watch out for that In Q2 results.

Besides cross-currency headwinds, INR growth not being much higher than constant currency revenue growth amidst dollar strength can also happen in case benefits of the depreciation are passed on to clients. But that does not appear to be the case that played out in Q1 as managements have spoken of how they have pricing lever (ie improve billing rates) with clients that can help them deal with the cost pressures due to higher cost of talent/high attrition.

Overall the Q2 results for IT services is going to be an interesting watch with economic slowdown in key client geographies (US and Europe), margin pressures, and cross currency headwinds.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.