There are very few diversified conglomerates in India with presence in financial services. Murugappa, Bajaj, Piramal and Aditya Birla are a few to name. Until the pandemic, the scant availability of such conglomerates with exposure to financial services helped these stocks stay in vogue. But with the pandemic cracking open their inherent strengths and weaknesses, only a few like Murugappa group’s Cholamandalam Investments and Financial Services, and Bajaj group’s Bajaj Finance have held on, thanks to their market-dominant position.

Others, including Aditya Birla group’s flagship financial services arm, Aditya Birla Capital Ltd (ABCL), which houses an NBFC, home loans business, life insurance, health insurance and asset management company, have not had it easy.

From that perspective, while valuations at 1.4x estimated FY23 book appear undemanding for ABCL, the lender’s slow progress in its retailisation efforts, persistent asset quality issues and lack of strong market positioning for its subsidiaries don’t support ABCL’s investment theme. We have a ‘sell’ recommendation on the stock.

Business fundamentals

Incorporated in 2007, ABCL was set up to pursue the financial services aspirations of Aditya Birla group. In its first 10 years of operations, ABCL was largely focused on big-ticket (or meaty) corporate loans. It was only post listing in 2017 that ABCL started focusing on retail lending too.

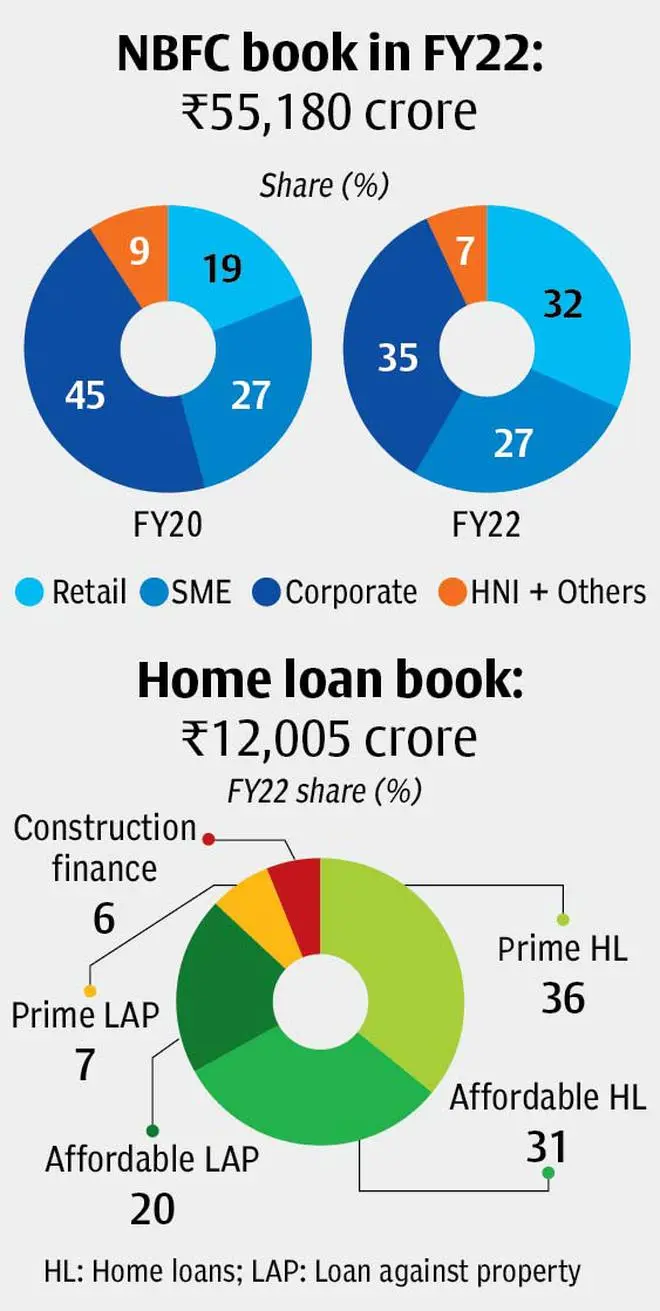

That said, retail loans (including SME and HNI loans) accounted for 46 per cent of total loan book in FY18 and were at 62 per cent in FY22. In absolute terms, the book has grown by just 10 per cent CAGR since FY18 and much of this growth has been accelerated since March FY21 quarter with the introduction of new products such as BNPL, checkout EMIs and other personal loans.

In the SME and corporate lending space, term loans, project loans and structured finance are the key products (see chart).

Slow progress

ABCL is often compared to Bajaj Finserv as both commenced operations in the same year. Fifteen years later, Bajaj Finance has emerged as the king of consumer finance, whereas ABCL is still scrounging to find a place in the league table. This pretty much reflects in their stock prices. ABCL listed at ₹250 a share in September 2017. Now trading at ₹99.85 apiece, the stock has been a value destroyer, while Bajaj Finance has been a multibagger during this period.

Where did ABCL lose the plot?

When the lender got listed, it had the lowest share of retail loans among the leading names of NBFCs. Since then, it has had aggressive plans to expand the retail portfolio. In the initial phase, ABCL tried spreading its wings through the branch model, but that didn’t yield the desired results. In FY21, the lender decided to focus on small-ticket loans and those that suited the digital distribution model, such as personal loans and BNPL products. ABCL’s average retail loans ticket size has reduced from ₹4.4 lakh in FY20 to ₹0.5 lakh in FY22, suggesting the company is increasingly focusing on volumes to grow its business rather than value proposition. Also, 52 per cent of ABCL’s retail book is unsecured.

Peers such as Piramal, Cholamandalam and Shriram have also upped their retail presence and, like ABCL, follow the fintech partnership channel. Mid-cap banks such as Federal Bank and IDFC First have also adopted this strategy as digital distribution helps in faster and deeper market penetration and is also cost-effective.

In short, the competition is heating up and ABCL’s strategy may not be sustainable in the long term, the reason being lack of brand relevance.

For the borrower or the user availing a loan from fintechs, all that matters is the rate of interest. The lender’s pedigree or identity isn’t of much consequence. Therefore, the lender’s say on the type of loans to focus on or the room to price risk is limited.

In short, the digital approach may best be a play on volumes but may not help lenders grow in the desired manner.

Home loans

At ₹12,000 crore of loan book in FY22, ABCL’s housing business hasn’t moved much since the pandemic. What’s encouraging, though, is an optimum mix of affordable housing and prime home loans, the share of which to total loans stood at 31 per cent and 36 per cent respectively in FY22. Also, the home loans business has held on to yields at 10.3 per cent in FY22 in comparison to other NBFC operations, where yields at 11.7 per cent have reduced by 40 basis points since FY20. But as the interest rates reverse and the overall slowdown in home loan demand deepens, there may not be much moat in this business.

Asset quality

While FY22’s asset quality has marginally improved, the overall situation isn’t very inspiring. Improvement has been quite patchy (see table). An increasing interest rate regime is usually unfavourable for asset quality. With ABCL’s books being relatively unseasoned and exposed to higher share of unsecured loans, and growth likely to come under pressure, the headroom for sharp betterment of asset quality may be restricted.

Play on monetisation

Life insurance, health insurance (which is heavily loss making) and asset management are the other subsidiaries of ABCL. None of them fit within the top 5 of the league table and operationally remain laggards to the sector leaders. Nonetheless, given its branched out businesses, ABCL is viewed as a play on asset monetisation by investors. But this strategy hasn’t materialised yet.

The AMC business got listed in October 2021. However, given its relatively-weak market positioning, the stock trades at undemanding valuations (25x FY23 P/E) and the upside potential of the AMC stock isn’t reflecting on ABCL stock. Unlike HDFC Ltd or Bajaj Finserv, which derive 40-50 per cent of valuations from their key subsidiaries – HDFC Bank and Bajaj Finance, ABCL does not have a strong play that can assure similar gains to investors. For lack of these triggers, ABCL stock may not be a good play on the holding company proposition. Also, given that the stock is already factoring 15 per cent holding company discount, there isn’t much upside on this aspect as well.

Way ahead

At ₹55,180 crore of NBFC’s loan book, ABCL is caught between RBI’s tight regulations and the intense price war in the retail loans space. The option to become a bank seems bleak considering ABCL’s complex shareholding and RBI’s hesitation to promote conglomerates. With the phase easy money and low interest rates behind, growth for NBFCs, including ABCL, may be exacting. Macro and internal factors aren’t favourable for the stock, though the Street believes that with a new CEO (ICICI Bank’s Vishakha Mulye) stepping in, that could change.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.